Vitalik Buterin thinks Ethereum developers should start focussing on other non-financial applications of the blockchain rather than just aping, yield farming, and you know all that DeFi stuff.

So beyond being gifted half of SHIB supply, the meme coin that is now out to rival other top DEXs like Uniswap, PlasmaSwap or even SushiSwap, Vitalik says that:

“Being defined by DeFi is better than being defined by nothing. But it needs to go further.”

Undoubtedly, Ethereum is powering many other use cases of blockchain technology noticeable around supply chain, identity verification and even decentralised social media.

So while Vitalik, a Polymath, may be quickly bored with the Degens, orangutans and the apes like he referred to ardent DeFi natives using the esoteric language of DeFi, Ethereum has actually seen massive growth within the last one year thanks to DeFi.

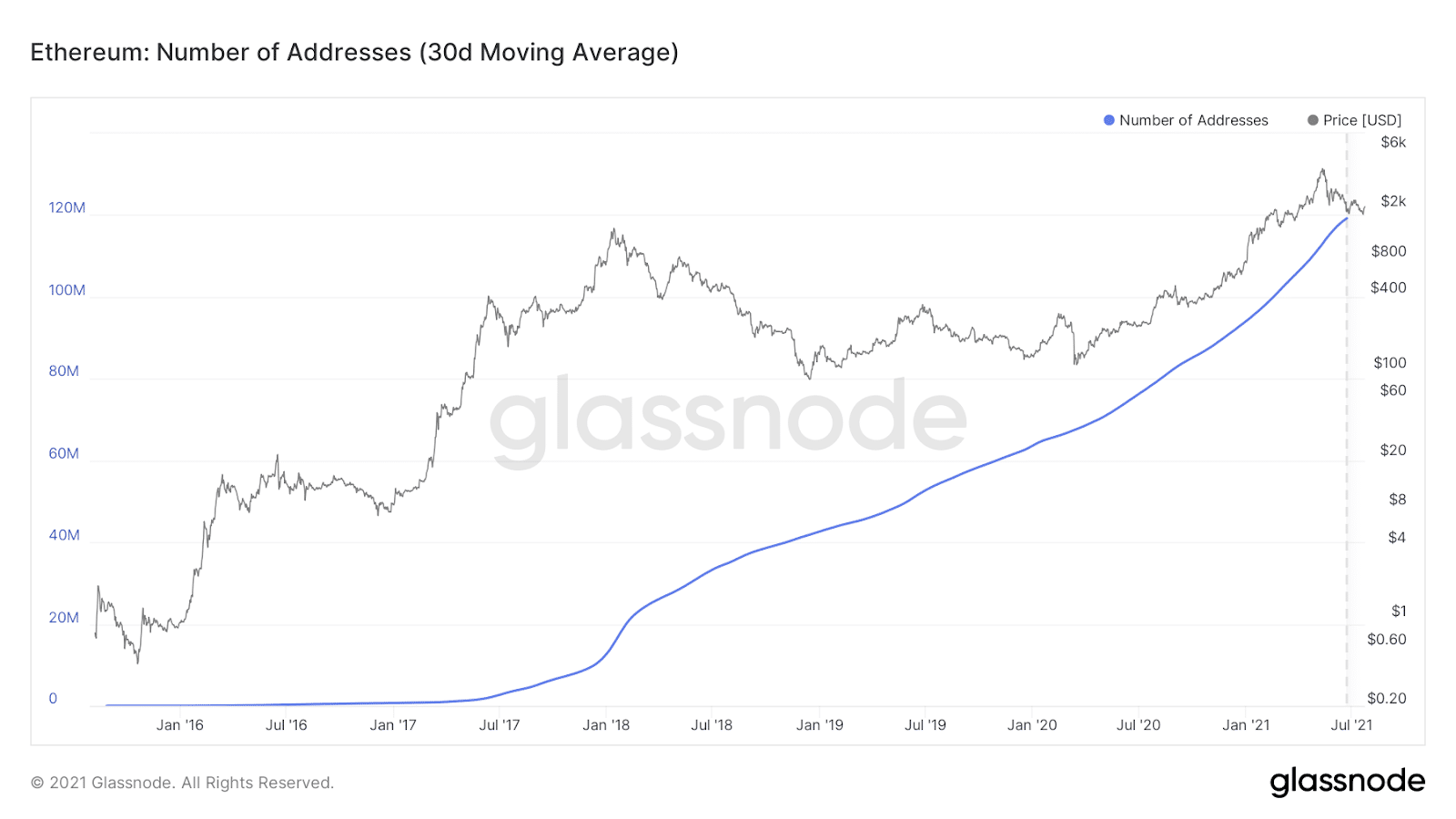

For instance, Ethereum wallet creation surged from 50.2 million addresses in June to last year to 119 million as of July 21, 2021. That would represent about 60 percent growth year to date.

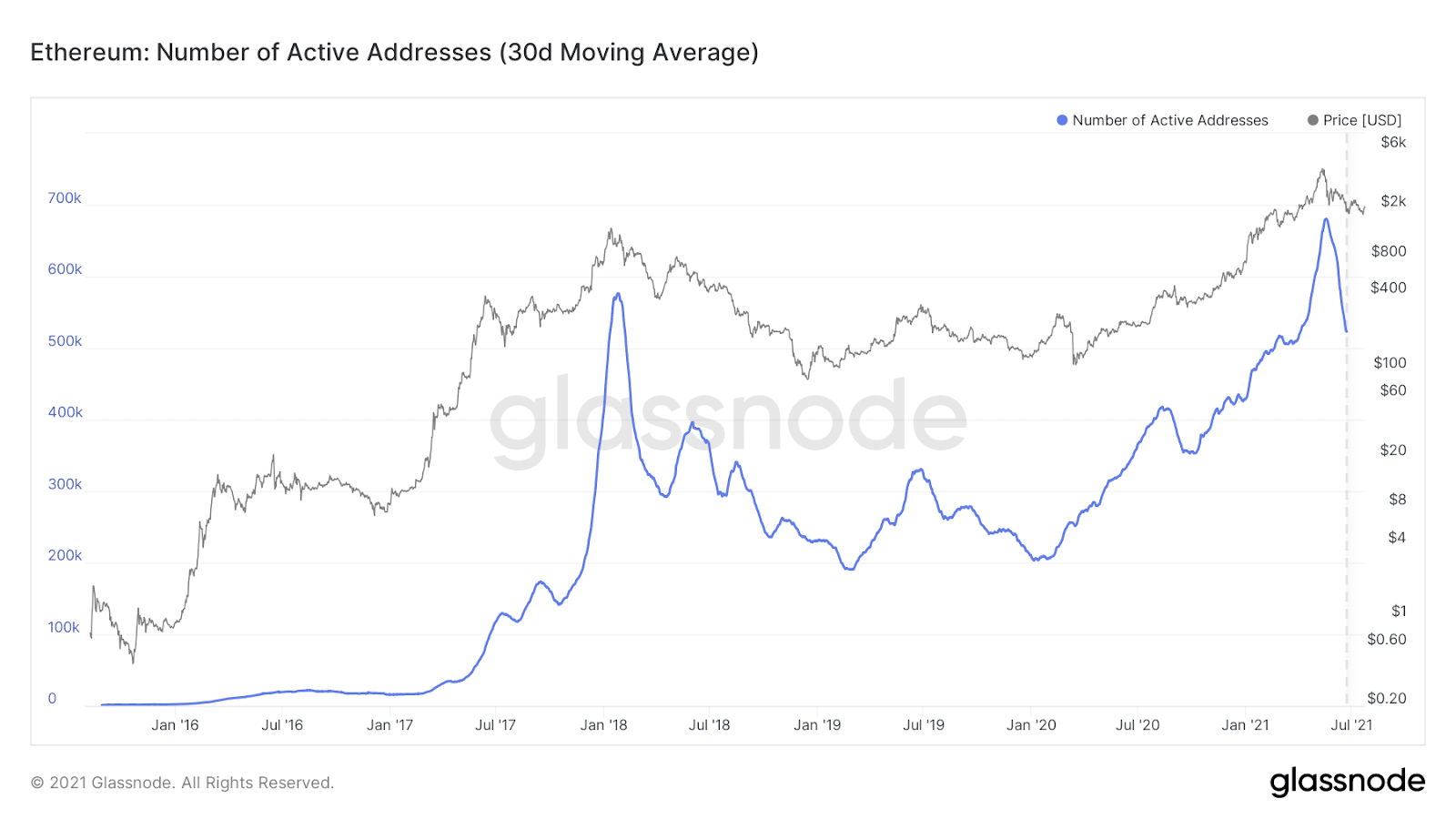

While that may not represent total network usage, active ETH addresses, which suggest DeFi users interacting with protocols, reached the highest ever for a single day at 678,000 in May this year.

As of today, the active ETH address sits around 522,000. A historical look at active ETH addresses shows even the ICO craze of 2017 that climaxed before plummeting in 2018 didn’t see daily Ethereum usage at its current level today. Active ETH addresses during the ICO mania peaked at 574,522 in January.

Ethereum in the DeFi sector

So beyond the noise of the next high paying yield farming protocol, the Ethereum network has actually been growing. Moreso, even while it looks like challenger networks like Binance Smart Chain, Avalanche, Polkadot, or even Solana have been eating away at Ethereum’s market dominance as the largest smart contract network, Ethereum still shows iron-clad network effect. For instance, in a bid to connect their community to some of the highly liquid protocols on Ethereum, either these challenger chains are EVM compatible or employ cross-chain bridges. That in itself is a network effect no one can take away from Ethereum, and constant developments in DeFi accentuate all these.

So one part that Vitalik placed his lens on was the perennial gas issue that never seems to go away whenever the network load skyrockets rendering the Ethereum network almost unusable to DeFi users. Understandably, many of these are retail investors and deserves utmost consideration if Ethereum is not to become an arena for only whale gladiators. Vitalik says

“The degens can pay for it, the apes can pay for it, the orangutans can pay for it,” Buterin said, using niche DeFi jargon that refers to wealthy traders and DeFi obsessives. But a holistic Ethereum ecosystem won’t work, he said, if gas fees cripple the average user.”

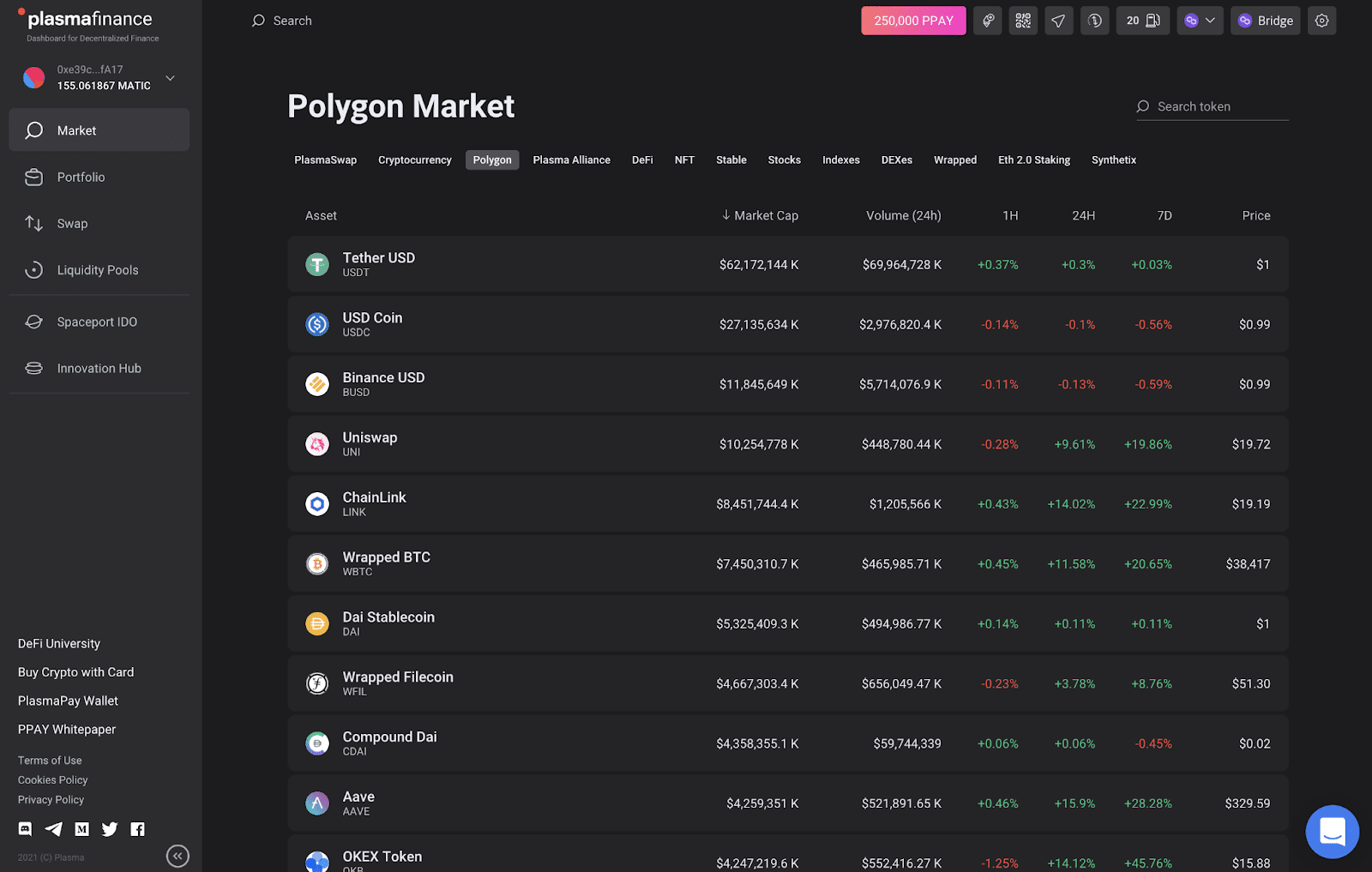

Recent advancements in Layer 2 are making that stale news already. For instance, PlasmaSwap, which is now Polygon chain’s most advanced DEX right now facilitates swaps and other regular transactions with as little as $0.005. I wouldn’t consider it expensive at all. This means that DeFi users can benefit from a suite of advanced trading tools using PlasmaSwap. E.g. Limit Order for compact control on their trading activities and stop-loss usage on a DEX and other extensive portfolio management tools. DEX users enjoy these value-added services by trading on PlasmaSwap asides from the cheaper and faster trade execution. Thanks to Polygon.

Indeed, other areas beyond DeFi like decentralised social media, identity verification and attestation, and retroactive public goods funding are worth considering by innovators powering the network’s usage. Still, I think it should not be at the expense of DeFi. I mean, why step your foot away from the DeFi pedal, which is giving you the network’s largest growth currently, to face other areas when these actions are not mutually exclusive?

Author

Ilia Maksimenka, CEO & Founder PlasmaFinance