Investors took advantage of the favourable situation to increase their exposure to gold, according to data from Spectrum Market.

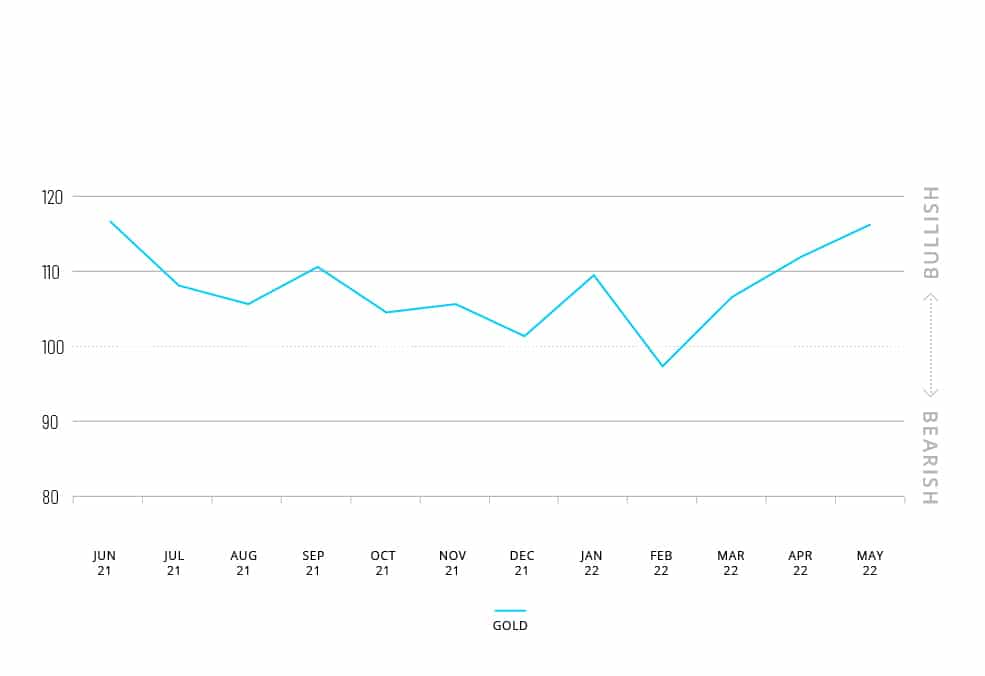

The SERIX, or the Spectrum European Retail Investor Index, is a 100-based instrument that can be used to gauge whether sentiment is bullish or not on a particular asset, security, etc.

Summary

Spectrum Market data shows an increase in gold investments

Based on trading data from the Pan-European stock exchanges, the SERIX is concerned with determining the direction taken by the markets and is also a valuable tool for shedding light on the month of May that has just passed.

The index, which is calculated on a monthly basis, for the month of May indicates a veritable boom in buying the precious metal in a hedging perspective by investors, who noticed the slight downturn and took full advantage of it to rightfully buy the yellow metal.

Indeed, since mid-month, gold is in the grip of a full bullish trend after its brief setback.

Suggesting a rosy future for the safe-haven asset are a multitude of events.

The dollar as well as the euro are not in the best of health and the respective central banks (Fed and ECB) are grappling with an aggressive monetary policy aimed at fighting inflation. In the meantime, new Chinese lockdowns, the emerging crisis in Taiwan, the war between Ukraine and Russia and, last but not least, the difficulty in supplying raw materials are paving the way for a rise in the value of Gold.

Michael Hall, Head of Distribution at Spectrum Markets, said:

“After a period of decline in May that saw the price of gold drop below USD 1,800 on the 16th, the price of gold began what looked like a new rally in the last few days of the month, supported by both the dollar and the dollar. euro in a phase of weakness”.

Hall then added:

“Given the macroeconomic environment, it is not surprising to see investors looking to take advantage of a drop in the price of gold to make safe-haven allocations”.

Record also for securitized derivatives

A record $138.7 million of securitized derivatives were traded last month, of which 41.5% traded outside normal trading hours (17:30-09:00 CET). This represents the highest monthly figure in the last two years.

Of the $138.7 million traded, as much as 90.3% were on indices while the rest were on commodities, currencies, equities and crypto.

The Frankfurt am Main-based company sheds new light on the gold rush, which apparently does not stop its run, indeed it is still galloping towards $2000.