The US Congress is currently looking into how much influence Binance had in the collapse of FTX.

FTX was a US exchange. Actually, it was two exchanges, one international, FTX.com, and one dedicated exclusively to the US market, FTX.US.

Binance is also an exchange, although not a US one, and Binance also has a second exchange dedicated to US customers: Binance.US.

Therefore, Binance is for all intents and purposes a direct non-US competitor of a major US exchange.

However, it is worth mentioning that the company that operated FTX is based in the Bahamas, even though FTX held all the permissions and licenses to operate in the US. Moreover, the collapse affected the international exchange FTX.com, and not the US exchange FTX.US.

Summary

Binance’s role in the collapse of FTX

The collapse of FTX was due to the fact that the company that ran it did not have enough reserves to be able to execute all the withdrawal requests that came to it after it became known that something in Alameda Research’s financial statements did not add up.

Alameda Research was a kind of subsidiary of the FTX group, with very close relations with the exchange.

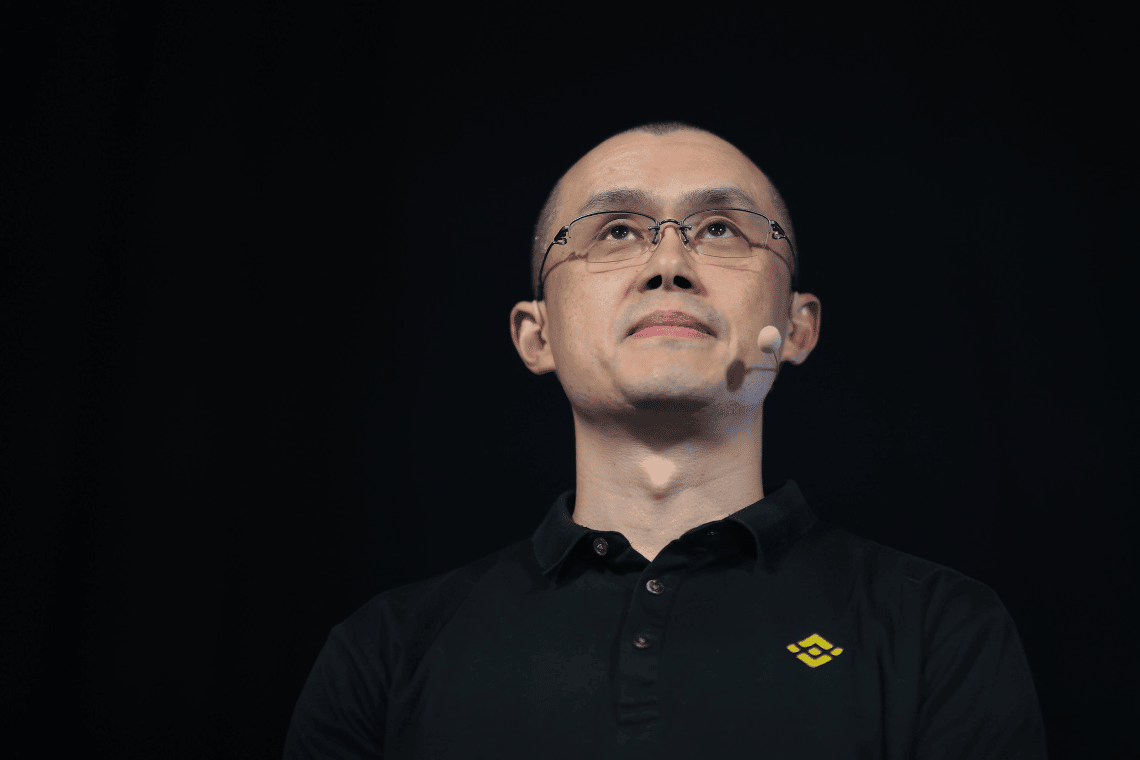

However, an important role in generating this “bank run” was played by Binance, and in particular its CEO Changpeng CZ Zhao.

As a matter of fact, on 6 November he wrote on Twitter that, because of the revelations that had emerged, Binance had decided to sell all the FTT tokens it still possessed.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 BNB (@cz_binance) November 6, 2022

By no coincidence that same day, the price of the FTX token (FTT) on the crypto markets fell from $25 the previous day to $22 the following day.

It is also no coincidence that the drop had stopped at $22, as the then CEO of Alameda Research, Caroline Ellison, responded to CZ saying that they were willing to buy all of Binance’s FTT tokens at a price of $22.

Two days later, while FTX was already having serious problems executing all withdrawal requests and the price of FTT had collapsed to $4, CZ again wrote on Twitter that FTX had asked Binance for help and they had decided to offer to take over the US exchange to “help cover the liquidity crunch.”

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 BNB (@cz_binance) November 8, 2022

This did not happen, because in the following days, after doing due diligence on FTX’s accounts, Binance announced that it no longer intended to buy it.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

US Congress examines Binance’s influence in the collapse of FTX

After the midterm elections, the revamped US Congress seems intent on delving into what role Binance really played in FTX’s collapse.

Republican Congressman Patrick McHenry of North Carolina said that Binance’s role in the sudden collapse of FTX will be one of the focal points of the December hearing of the House Financial Services Committee, of which McHenry is a candidate for chair.

On the one hand, it is possible that these statements by him are part of the ongoing propaganda to try to get elected chairman of that committee, since FTX co-founder and CEO Sam Bankman-Fried (SBF) is very close mostly to the Democratic Party, and it sounds rather odd that a newly elected Republican seems to want to take his side.

However, CZ is originally from China, although with Canadian nationality, and FTX was a US exchange. Republicans care a lot about domestic companies, and they have a bad relationship with Chinese competitors, so these statements of his that seem to go in favor of the SBF Democrat have so much the flavor of political propaganda.

It is worth noting, however, that although FTX has filed for Chapter 11 status under US bankruptcy law, it is headquartered in the Bahamas, so much so that Bahamian authorities have refused to let US authorities handle the bankruptcy.

This creates an additional problem.

Indeed, the congressional investigation should begin with a hearing of SBF itself, but the latter is based in the Bahamas. The problem is that the Bahamian authorities do not seem at all happy to let SBF move to the US in order to be heard by the House Financial Services Committee.

Apparently, there are negotiations going on between the US and Bahamian authorities to seek an agreement that would allow the latter to accept SBF moving to the US.

Thus, the House Financial Services Committee intends to investigate both the behavior of SBF, who is a US citizen, and the role played by Binance in this matter.

FTX employees

Meanwhile, it was discovered that FTX was encouraging its employees to invest their savings on the same exchange, and to even use the platform as if it were a bank.

From this indiscretion, and from some of SBF’s statements in recent days, it could be inferred that the company’s strategy was to keep only a portion of customers’ deposits in cash, using the other for its own purposes without customers’ authorization, and that they were looking for other income to cover these shortfalls.

Thus, it is not at all surprising that when faced with about $9 billion in deposits they had only $1 billion cash on hand to execute withdrawal requests. The rest of the reserves were either illiquid, difficult to liquidate, or even no longer existed because they had been spent.

At this point, it is not even surprising that they were looking for new revenue to cover the hole, even at the cost of convincing their own employees to become spending customers.