Record loss for PI Coin in the last week, which saw its price plummet by 20.2% in seven days, the worst performance among the top 100 cryptocurrencies according to CoinGecko.

Summary

What happened to Pi Coin in the last week?

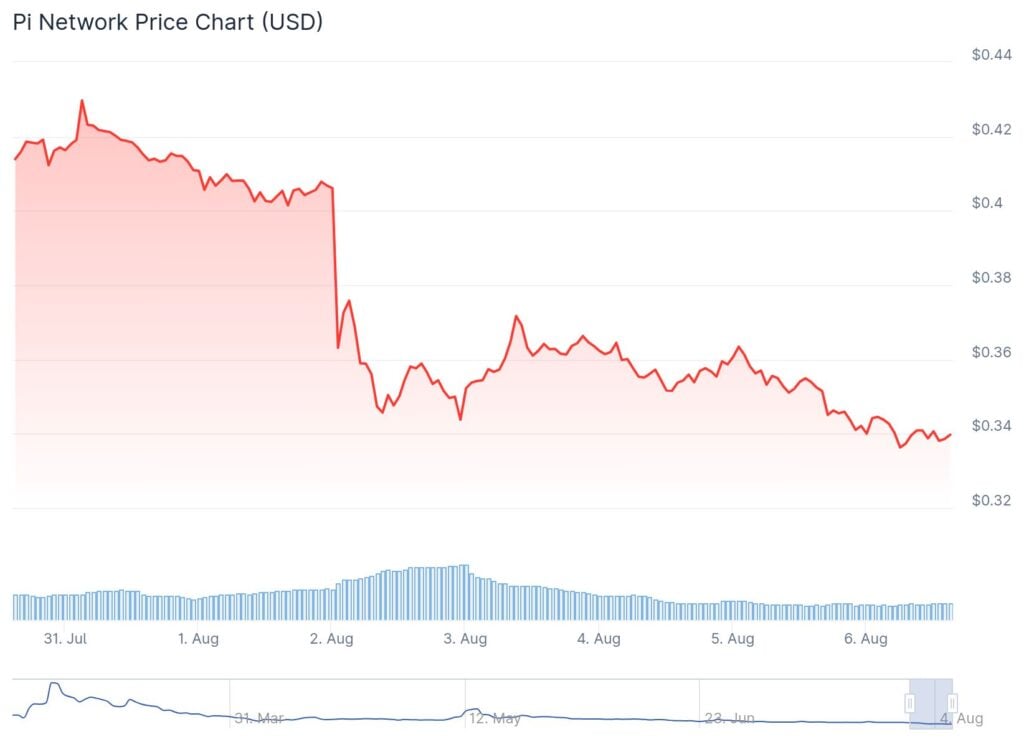

The price of PI has experienced one of the worst weeks of 2025. The asset has dropped by 4.5% in the last 24 hours, losing a total of 20.2% in seven days, with a loss of 28.7% in the previous two weeks and a monthly decline close to 27%. This negative trend has been confirmed by CoinGecko data, which positions PI as the cryptocurrency with the largest decline among the top 100 projects by market capitalization.

The downward trend is part of a general correction context of the entire crypto market. While many assets have experienced slight setbacks, the fall of PI has been more pronounced and symptomatic of a growing distrust among investors towards projects considered “high risk”.

Why is Pi Coin crashing more than other cryptocurrencies?

The recent moves of the US monetary policy have contributed to this heavy downturn. In particular, during the last FOMC meeting on July 30, the president of the Fed Jerome Powell halted the interest rate cuts, but the cost of money remains high. Consequently, many market operators have shifted towards assets considered safer, such as gold and government bonds, penalizing emerging assets like PI.

“When credit tightens, the flight from risk is inevitable”,

some analysts comment on X.

CoinGecko reports that sensitivity to macro announcements and limited liquidity make cryptocurrencies like PI even more vulnerable.

Complicating the picture for Pi Coin is also the climate of uncertainty fueled by the recent commercial tariffs imposed by the Trump administration. These measures have contributed to triggering a broader sell-off in the US stock market, scaring both institutional and retail investors who are trying to limit their exposure to risk.

What are the consequences for those who own Pi Coin?

The price of PI had reached an all-time high (ATH) of 2.99 dollars at the end of February, coinciding with the mainnet launch and a peak of interest around the project. However, after the bull rally, the value progressively fell, recording a total loss of 88.6% compared to the record levels by mid-June.

In the face of this volatility, investors are confronted with a high-risk scenario:

- Slow and uncertain recovery: in the absence of new catalysts, the return to previous levels seems difficult

- Increase in selling pressure: those who record significant losses might liquidate, further weighing on the price

- Climate of growing distrust: the strong corrections reduce the propensity to hold PI in the short-medium term

What happens now: risks and possible scenarios for Pi Coin

The current correction phase could continue if both the macroeconomic uncertainty and the wait-and-see attitude of the Federal Reserve persist. Additionally, the renewed trade tensions generated by Trump’s tariffs risk fueling a risk aversion trend that penalizes even more the non-established cryptocurrencies like PI.

In the short term, without significant news on the development of the Pi Network project or new viral trends (as happened with some memecoins), it is likely that the price will remain under pressure from sellers. On the other hand, new users or partnership announcements could offer some insight, even in a context of high volatility and little clarity on the real utility of PI as an asset.

Can Pi Coin recover from the current crisis?

The future of PI will depend on the team’s ability to relaunch the project and regain trust. In the weeks following its all-time high, the community had shown signs of enthusiasm thanks to the developments of the mainnet. However, the loss of momentum and the market correction have dampened these drives, making a clear relaunch plan a priority.

The experience of PI demonstrates once again that, without solid foundations and real growth in demand, even the most popular cryptocurrencies can be overwhelmed by volatility and investor fear.

What impact does the crash of Pi Coin have on the rest of the cryptocurrencies?

The PI case fits into a framework of widespread sales: after Trump’s tariffs and the Fed rate freeze, even Bitcoin experienced a decline, while maintaining greater stability compared to emerging assets. The flight from risk particularly affects projects with less clear prospects or that are perceived as “bets”.

Observing the behavior of investors, it becomes evident that during phases of economic turbulence confidence focuses on main assets, while secondary projects suffer the most severe consequences.

Conclusions: what to expect and how to navigate

The collapse of Pi Coin represents a warning signal for the entire high-risk crypto sector. The combination of a cautious Fed and Trump tariffs has put pressure on PI and similar assets, leading to double-digit losses in just a few days. Recovery in the short term is not guaranteed, but the evolution of the crypto market remains unpredictable.

For those holding PI, it remains essential to monitor news from the team, any updates, and macro dynamics.