World Liberty Financial starts with 27 billion WLFI in circulation and an immediate release of 20% for user allocations. Such a large float at debut reshapes liquidity, volatility, and expectations for potential listings on Binance, Gate.io, and MEXC. In this context, opening with an already substantial offering can immediately influence both the book depth and price formation in the very first hours.

According to public data collected by CoinMarketCap and market analysts’ observations, as of September 1, 2025, the confirmed circulating supply is 27 billion WLFI. Industry experts indicate that this corresponds to 27% of the declared maximum supply (27 billion out of 100 billion), a significant percentage that redefines the trade-off between immediate liquidity and potential selling pressure.

In the monitoring conducted during the initial phases of listing, some operators also recorded rapid changes in the depth of order books on the main markets. For an analysis on the impact of liquidity on crypto markets, also see our in-depth article on liquidity and volatility in digital markets.

Summary

WLFI: Official data before the spot listing

The official page of CoinMarketCap indicates an initial circulation of 27 billion WLFI out of a maximum supply of 100 billion. This figure, higher than previous estimates, has been picked up by industry publications and confirmed in a statement reported by Cointelegraph. An interesting aspect is the timing: the signal comes just before the debut, with a direct impact on the market metrics observed by the most active operators.

Circulating Supply — Source and Context

- Initial circulating supply: 27,000,000,000 WLFI.

- Confirmation: data “repeatedly confirmed” by the WLFI team.

- Impact: such a high supply right at the debut can ensure greater trading depth, but it also involves a different price trajectory in the initial phases.

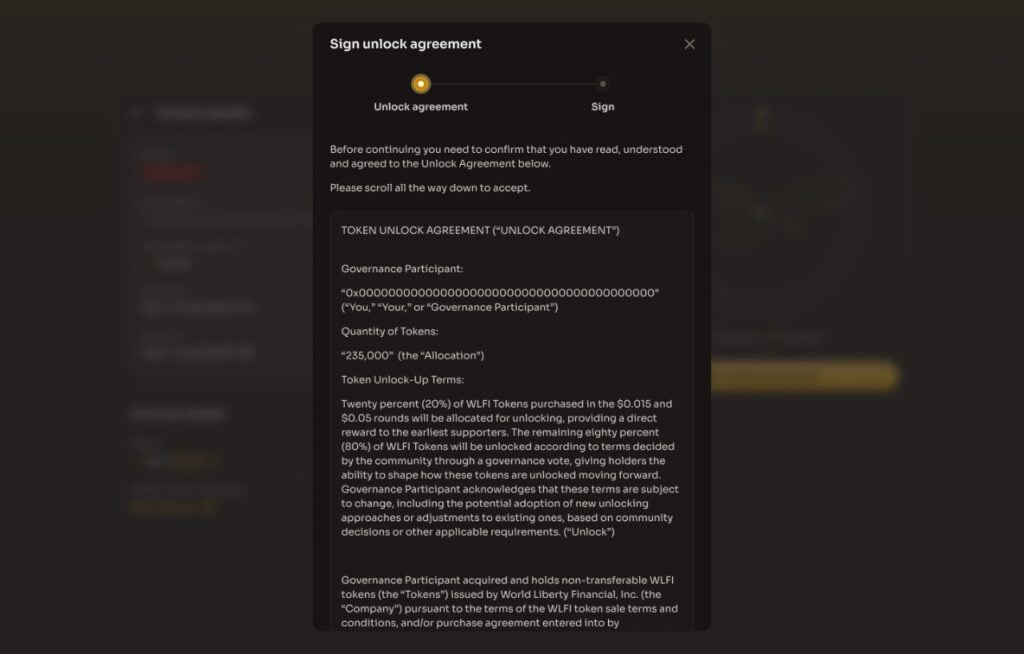

How the Unlocking Works: 20% Immediately, 80% Under Governance

The project adopts a modular vesting that includes direct release and on‑chain decisions for the remaining portion. It should be noted that the combination of immediate tranche and locked portion aims to balance access to liquidity and control of issuance over time.

Vesting — main conditions

- Immediate release (20%) for those who participated in sales at $0.015 and $0.05.

🚀 The $WLFI Lockbox is LIVE.

— WLFI (@worldlibertyfi) August 25, 2025

You can now move your $WLFI into the Lockbox to begin the unlock process.

🔗 Unlock here: https://t.co/QXA44NAffg

⏰ Claiming begins: September 1 @ 8:00 AM ET (20% of your initial allocation).

Thread below with step-by-step screenshots. Only use…

- Lockbox for the remaining 80%, unlockable progressively according to the governance decisions.

- The parameters and timing can be modified through on‑chain voting, which are currently reported as having achieved an “overwhelming” consensus (over 99% of votes in favor).

Those who were fortunate enough to participate in the whitelist presale can visit the official page to unlock their WLFI tokens before the start of trading.

On-chain Governance: What Has Been Voted

The community has supported a proposal to make the tokens transferable and tradable already in the early stages. On‑chain deliberations could influence the acceleration or deceleration of future unlocks. In this context, governance takes on an operational role: collective choices can establish pace and priorities, with significant effects on liquidity and volatility. For more information on how on‑chain voting works and its implications, see our guide on on‑chain governance.

Timelines and Adjustment Margins

- The unlocking conditions are not final and can be updated through new proposals.

- Any changes could reflect operational or regulatory requirements.

Listing and Liquidity: The State of the Art

Several leading exchanges, including Binance,

Binance will list World Liberty Financial (WLFI) with Seed Tag Appliedhttps://t.co/0EmyBMBsX4 pic.twitter.com/YA3V1vjLbq

— Binance (@binance) September 1, 2025

Gate.io

Gate US New Listing: $WLFI @worldlibertyfi

— Gate US (@GateUS_Official) September 1, 2025

🔹 Trading Pair: $WLFI / $USDT

🔹 Trading Starts: 9:00 AM, September 1st (ET)

Trade: https://t.co/R9hZctV71p

Details: https://t.co/rXBvymRngJ pic.twitter.com/3UHQZ9gfJc

and MEXC,

MEXC proudly presents the WLFI Launchpad! @worldlibertyfi

— MEXC (@MEXC_Official) August 27, 2025

📌 Subscription Price: $0.1

📌 Total Rewards: 880,000 $WLFI + 10,000 $USDT

Be early. Be first. Be ahead.

👇 Join today

have been indicated as potential locations for the opening of spot trading on WLFI. The announcement has increased market attention, especially regarding the order book depth in the initial sessions. An interesting aspect is the possible difference between markets: listing conditions and liquidity could vary between locations, at least in the early stages. For an overview of the best exchanges for new listings, see our article on how to choose an exchange for listing.

Market Data — What to Watch

- Open interest derivatives: reported a peak close to $950 million, then dropped to $887 million in the following 24 hours (data not independently verified, [data to be verified]).

- Float effect: a larger number of tokens on the market can improve liquidity, but it might also increase initial selling pressure.

Key Figures at a Glance

- Initial circulation: 27 billion WLFI (27% of the maximum supply).

- Maximum supply: 100 billion WLFI.

- Vesting: 20% immediate; 80% in lockbox, unlocking via governance.

- Quoted selling prices: $0.015 and $0.05.

I promised to Make America Great Again, this time with crypto. @WorldLibertyFi is planning to help make America the crypto capital of the world! The whitelist for eligible persons is officially open – this is your chance to be part of this historic moment. Join:…

— Donald J. Trump (@realDonaldTrump) September 30, 2024

- Listing indications: Binance, Gate.io, MEXC.

Implications for WLFI Holders

An initial float this large can help maintain tighter spreads and facilitate larger order sizes; however, it also leads to increased volatility and rapid turnover in the early hours of trading.

The presence of the lockbox and the on‑chain voting system introduce variables that could influence the actual supply in the short to medium term. It should be noted that the balance between the unloading of initial positions and organic demand will determine the price stability, while any signals on listings could adjust the sentiment within a few sessions.

In summary

The WLFI unlock with 27 billion tokens in circulation and an immediate release of 20% immediately impacts price and liquidity. The structure based on on‑chain governance and the lockbox system will keep the effective supply in constant evolution. The next steps will depend on the community’s resolutions and future confirmations on the listings of the reference exchanges.

In this context, the initial trajectory might be more gradual than expected or, conversely, accelerate in the presence of unexpected flows: much will depend on how future unlocks are managed and the potential opening of spot trading.