Bitcoin is back in the spotlight as major market moves, large-scale institutional purchases, and speculation about its long-term future drive investor attention.

Today’s update covers Trump’s mining company debuting on the Nasdaq, significant Bitcoin buys by institutions, and discussions on whether Bitcoin could hit $1 million by 2030.

Plus, with Bitcoin struggling to maintain the $112K level, this article highlights the best altcoin to buy right now.

Source – Cryptonews YouTube Channel

Summary

Bullish Bitcoin News Sparks $1M Price Prediction for 2030

This week brought big developments in the crypto market, highlighting a new Nasdaq listing and key movements in Bitcoin’s price and adoption.

The headline news is American Bitcoin’s debut on the Nasdaq stock exchange. The mining company, backed by Donald Trump Jr. and Eric Trump, holds more than $260 million worth of Bitcoin. This shows a bullish signal for the market.

Every time a company adds Bitcoin to its balance sheet, it takes coins off exchanges and locks them up for the long term. With less supply in circulation and demand staying strong, scarcity pushes prices higher.

Moves like this also show how deeply crypto is gaining acceptance in mainstream finance and among public figures.

Bitcoin’s daily update shows the coin briefly touched $112,000 today, a strong performance in a month that usually challenges Bitcoin. While September is down 3% so far, institutional adoption and large-scale purchases could outweigh that trend.

Crypto Caesar noted that Bitcoin is facing resistance at the $112K level and remains cautious, stating that optimism is limited as long as Bitcoin trades below this zone.

Meanwhile, institutional buying continues to lead this bullish momentum. Spot Bitcoin ETFs bought $300 million worth of $BTC, extending a steady wave of corporate and institutional investment.

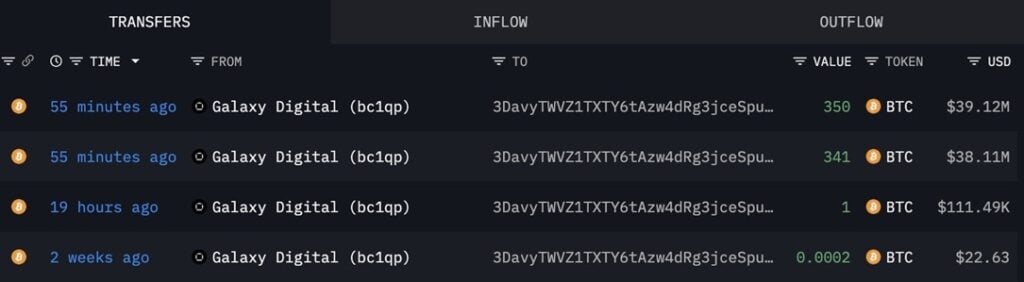

Galaxy Digital also grabbed attention when one buyer picked up $77 million worth of Bitcoin, proving that major players are still accumulating and signaling long-term confidence.

Beyond crypto, gold also hit an all-time high of $3,565. The historic link between gold and Bitcoin as safe-haven assets suggests a wider wave of bullish sentiment across global markets.

In another key development, the Winklevoss brothers launched a Bitcoin treasury firm called Treasury BV, which already acquired 1,000 $BTC. Moves like this show how top investors are creating new vehicles to hold and manage Bitcoin for clients, adding both liquidity and legitimacy to the ecosystem.

With so much institutional interest building up, the big question is whether Bitcoin could hit $1 million by 2030. This path would likely need a financial reset, falling faith in fiat, more money printing, and lower interest rates.

While ambitious, the surge in institutional capital and the shrinking supply make the target more realistic than it seemed just a few years ago.

Investors Flock to Altcoins as Bitcoin Struggles

Bitcoin (BTC) has struggled with losses over the past month, while altcoins continue to attract investors looking for creative utility projects. One standout is Bitcoin Hyper, a new presale project aiming to turn Bitcoin into a hub for innovation.

Bitcoin Hyper focuses on solving Bitcoin’s speed and scalability problems. Today, Bitcoin’s mainnet handles only about seven transactions per second and often charges high fees during busy times.

Bitcoin Hyper introduces a Layer 2 solution that acts like a fast lane, bundling transactions off-chain with rollups before committing them back to the mainnet. This approach could push Bitcoin’s transaction speed into the thousands while keeping security intact.

To make the upgrade seamless, Bitcoin Hyper is also releasing a Canonical Bridge, which makes moving $BTC between the mainnet and the new Layer 2 simple. The network periodically records Layer 2 activity on Bitcoin’s mainnet, ensuring a secure audit trail while still improving performance.

Bitcoin Hyper’s vision goes beyond microtransactions. By integrating Solana Virtual Machine (SVM) technology, it will allow developers to launch scalable smart contracts and easily bring Solana-based projects into Bitcoin’s ecosystem.

This could open the door for new DeFi protocols, dApps, and even meme coins to thrive on Bitcoin. The project’s utility token, $HYPER, powers the ecosystem. Users will need it for gas fees, staking, and other actions.

Interest in $HYPER is growing quickly, with approximately $13.8 million raised in the presale. Tokens are currently priced at $0.012855. Crypto Tech Gaming featured the presale and named $HYPER the best altcoin to buy.

Investors can also stake $HYPER during the presale with dynamic APYs of around 79%, allowing them to grow their holdings. After the presale, the team plans to launch $HYPER on Uniswap and pursue CEX listings.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.