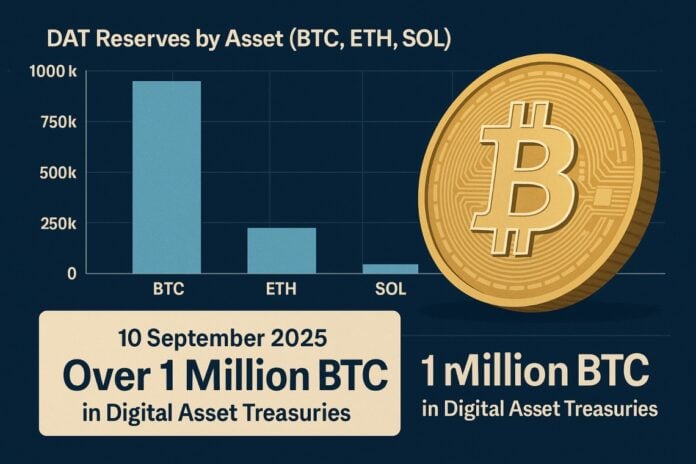

As of September 10, 2025, over 1 million BTC – equivalent to approximately $110 billion Financial Times – are parked in the so-called Digital Asset Treasuries (DAT), a record level that, along with improving macro liquidity and clearer regulatory signals, positions Bitcoin strongly at the start of the 4th quarter.

According to data aggregated by our editorial team, based on corporate filings and official communications as of 09/10/2025, over 1M BTC are held by DAT.

Direct verifications reveal that this figure is equivalent to just over 5% of the circulating supply of Bitcoin in September 2025, a fact that confirms the systemic relevance of these vehicles. Market analysts consulted also note that the concentration in DAT has increased compared to 2024, strengthening the “sticky” component of demand.

DAT refers to corporate vehicles, listed funds, and company balance sheets that hold crypto-assets as part of the treasury. The current “PvP” (player-vs-player) phase describes a market where execution, governance, and cost of capital become distinguishing factors. In this context, investor selectivity increases.

Chart 1 — DAT Reserves per asset (BTC, ETH, SOL) in 2025. Source: aggregation of corporate filings and official communications.

Summary

1) Macro outlook: windows on rates and key calendar

The central outlook for crypto markets remains constructive at the start of the 4th quarter, supported by cooling inflation and rates that might decrease, favoring the search for yield and appetite for risky assets.

That said, attention remains focused on the FOMC meetings expected on September 17, 2025, and October 29, 2025, where guidance and dot plot could provide indications on the timing and extent of cuts Bitcoin down after the FOMC rally, but the probability of returning to $100,000 increases.

- Europe: the focus remains on ECB decisions and financing spreads, where potential coordinated easing could amplify flows towards growth assets ECB interest rate reduction and impact on the cryptocurrency market.

- Liquidity: following potential cuts, the rebalancing of Money Market Funds towards riskier assets could increase the market “beta” – as indicated by data from the Investment Company Institute and explored in our analysis on Bitcoin’s funding rate.

2) DAT: state of the art and where demand is concentrated

A crucial technical factor is the growing institutional demand coming from the DATs, which are distinguished by increasingly disciplined allocation criteria. As of September 10, 2025, the DATs boast:

- Holdings: over 1M BTC (≈ $110B), 4.9M ETH (≈ $21.3B) and 8.9M SOL (≈ $1.8B) Financial Times and report by Architect Partners.

- Share of circulating supply: vehicles focused on Bitcoin hold about 5% of the circulating supply, while the main DATs on ETH exceed 4% BitMine raises the bar: 1,866,974 ETH in treasury.

- 2025 Fundraising: 154 US-listed companies raised around $98.4 billion for crypto initiatives Financial Times and according to data from Architect Partners [data to be verified].

These numbers indicate a structural demand that acts as a floor for the price during phases of volatility, accelerating movements in conjunction with an improvement in macro liquidity. In fact, the combined effect of stable flows and more relaxed financial conditions acts as a catalyst.

3) Why Bitcoin May Outperform in 2025

Bitcoin benefits from numerous favorable macro factors: its scarcity profile, market depth, and the improvement of microstructure (in terms of spot and derivatives flows) are elements that play to its advantage. It should be noted that the “programmatic” demand component further consolidates the thesis.

- Money Market Funds: approximately $7.4 trillion are parked in short-term instruments and, following a decline in risk-free yields, could be rebalanced towards riskier assets, as highlighted by data from ICI.

- “Sticky” demand: DAT and spot ETFs promote a demand less susceptible to short-term fluctuations Coinbase: the CEO fires employees who have not used AI.

- Network effect: the growth of active addresses and hashrate strengthens the narrative of Bitcoin’s resilience Bitcoin eagerly awaits the Fed.

The expected outcome is an outperformance of Bitcoin during risk-on phases, with the possibility of new highs in the second half of 2025, given favorable macroeconomic conditions.

4) September, between myth and statistics: what the data says

The narrative of Bitcoin’s “September weakness” has been repeated on several occasions, but data analysis suggests caution in relying solely on seasonality as a decision-making driver. In other words, seasonality alone provides weak signals.

Synthetic Methodology

- Sample: monthly returns of Bitcoin from 2013 to September 2025 (log-returns on consolidated spot data).

- Test: analysis with monthly averages and confidence intervals (Wilson 95% for positive months), logistic regressions with binary variables (up/down), out-of-sample rolling validations and placebo tests through permutations.

Main Results

- Uncertainty: wide confidence intervals for each month, without robust significance.

- Odds ratio: values close to 1, with intervals that cross it.

- The “month-of-year” models often appear out of sync with the actual out-of-sample data.

- Placebo test: observed p-value of 0.15, with approximately 19% of permutations having a p-value ≤ to the observed one.

- Checks: the inclusion of events such as the Lunar New Year or the halving period worsens the accuracy of models (Brier score and calibration) Bitcoin halving: effects on price and hashrate.

The operational reading indicates that seasonality, in isolation, is not a reliable predictor; it is preferable to integrate it with macro variables, flows, and market positioning. That said, the combined framework offers greater robustness.

Chart 2 — Historical seasonality of Bitcoin’s monthly returns. Source: analysis based on market data (dataset and code to be attached in a public repository).

5) Rules and market: the Nasdaq effect on “crypto-treasury” operations

The growth of DATs has attracted increased regulatory scrutiny. In the USA, market practices and exchange requirements are steering towards greater disclosures in operations involving digital assets.

Although Nasdaq has not introduced formal rules specifically dedicated to DATs, the guidelines required for enhanced due diligence and, in some cases, the need to obtain shareholder approvals are driving the market. In this sense, transparency expectations are rising Michael Saylor continues to purchase BTC: post on X.

- Impact: this increased regulatory scrutiny could lead to a compression of market premiums for those vehicles with weaker governance, favoring instead those with strong internal controls Nasdaq proposes a rule change to list VanEck’s Avalanche ETF.

In essence, a more rigorous selection of issuers and vehicles could reduce informational asymmetries and idiosyncratic volatility.

6) PvP Phase of DAT: consolidation ahead

In the PvP phase, capital tends to concentrate on assets and vehicles that guarantee greater liquidity and transparency.

One can expect a convergence on large caps (such as BTC and ETH) during macro uncertainty cycles, M&A operations, and partnerships among smaller players aimed at cost and distribution optimization, and the exit from the market of those vehicles with fragile governance or unsustainable economic models. Yet, the competitive balance could remain dynamic Bitcoin in national reserve: Ukraine’s ambitious project.

7) What to monitor in the coming weeks

- US Inflation: monitor indicators such as CPI and core PCE and the trend of real rates.

- Outcomes and communications from the FOMC meetings on 09/17/2025 and 10/29/2025.

- Energy: oil and gas prices, given their secondary impact on inflation Goldman Sachs forecasts: the impact of Trump’s tariffs on the US stock market (USA).

- Flows: movements on spot ETFs and other listed products (BTC/ETH), including premiums/discounts on NAV Bitwise launches a new ETF linked to companies with Bitcoin reserves.

- Stablecoin supply: to be considered as a proxy for on-chain demand Why Euro stablecoins are set to surpass $100 billion in market capitalization.

Conclusions

The outlook for the short term appears positive: structural demand from the DAT, potential easing of rates, and a more defined regulatory framework support the hypothesis of Bitcoin’s outperformance in the 4th quarter of 2025.

It remains essential to monitor data related to inflation, energy, and flows from listed instruments to confirm this trajectory. Ultimately, the combination of top-down factors and dedicated flows is the point to follow.

Related Articles

- Bitcoin Halving: effects on price and hashrate

- DAT: what they are and why they matter for the market

- Fed Agenda 2025: what it means for crypto

Note on sources and method

- DAT holdings (BTC/ETH/SOL) as of 09/10/2025: aggregation of corporate filings and official communications.

- Fundraising 2025 (154 companies; ~$98.4 billion): data reported by Financial Times and report by Architect Partners [data to be verified].

- Money Market Funds: data confirmed by the Investment Company Institute.

- BTC Seasonality: analysis on historical market series 2013–2025; code and dataset to be made available in a public repository.

- Nasdaq and disclosure: summary based on official communications and listing practices, with official references to be integrated.