Investors are bracing for extreme volatility in the crypto market heading into Wednesday’s FOMC meeting.

The Federal Reserve is set to decide on changes to the federal funds target rate, a move that has significant long-term implications for the US economy and financial markets.

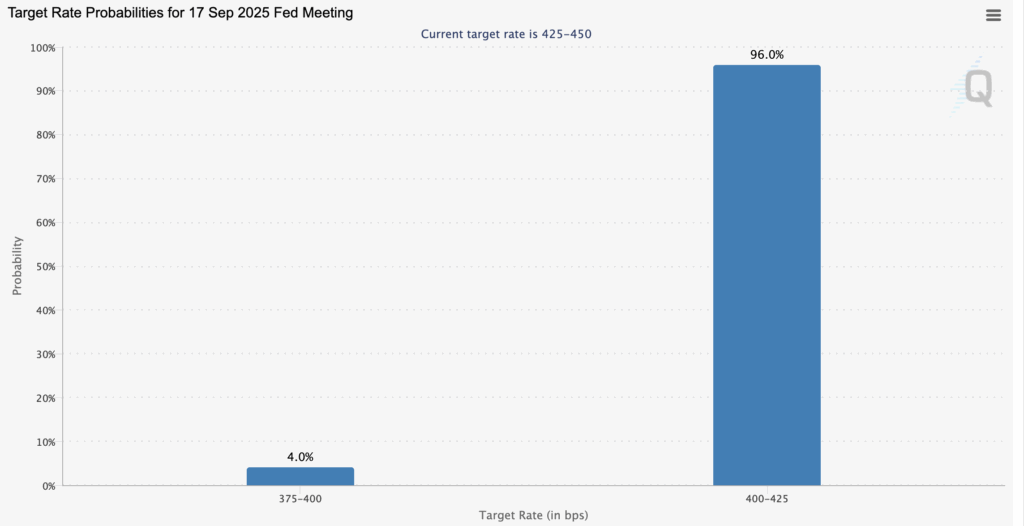

Markets are pricing in a 25-basis-point interest rate cut, with CME FedWatch assigning a 96% probability to the move. There is also a slim chance that the Fed proceeds with a more aggressive 50 bps cut, citing the weakness in the US jobs market.

Crypto prices are exhibiting indecisive price action as investors deleverage ahead of Fed Chair Jerome Powell’s speech post-FOMC.

Bitcoin has tumbled back to $115,300, while the altcoins are faring much worse. Meme coins have erased much of their last week’s gains, with Pepe, Fartcoin and Floki among the biggest losers.

Experts believe this week’s FOMC could be a “sell the news” event, resulting in an initial pullback and consolidation before a bullish reversal. However, a few crypto assets could surprise the market with strong rallies.

Summary

How To Trade The FOMC Meeting On Wednesday?

The actual FOMC decision is unlikely to surprise investors, unless the Fed decides to proceed with a 50 bps cut. The market has already priced in a 25 bps rate cut.

CME FedWatch, which tracks the bets placed by interest rate traders and the 30-day Fed Funds future prices, now shows 96% odds of this move.

However, all eyes are on Fed Chair Jerome Powell’s comments post-FOMC.

Currently, CME FedWatch and major Wall Street institutions expect three rate cuts this year, citing downside risks in the U.S. jobs market. Should Powell validate this sentiment in his speech, it would mark a decidedly bullish signal for financial markets, including crypto.

On the contrary, if the Fed Chair looks to rein in expectations, it could result in short-term downside volatility.

Traders should stay away from high leverage this week. Prominent analyst Stefan B is anticipating “no logic rallies”, “Dalai Lama dumps”, and the “Darth Maul” price action following the FOMC. Simply put, inexperienced traders shouldn’t try to navigate such extreme volatility.

Even spot buyers shouldn’t look to catch the knife, a phenomenon which includes buying aggressively into steep sell-offs before the bottom is truly in. Instead, they should wait for successful retests of key support levels.

These Cryptos Could Rally Post-FOMC

There is a strong possibility that this week’s FOMC turns out to be a “sell the news” event. The possibility of a strong dump should be factored in.

However, a few crypto assets continue to exhibit bullish strength.

For instance, XRP is outperforming Ethereum and Solana in Monday’s crypto crash. If it manages to reclaim the $3 support level on Wednesday, $3.60 becomes a realistic price target for September.

Similarly, if Dogecoin manages to successfully defend the $0.25 support level post-FOMC, it could start a rally to new all-time highs.

Even Fartcoin could surprise investors with its bullish strength, despite Monday’s correction. It has formed a bullish divergence with its RSI and on-balance volume, which suggests strong buying pressure. A successful retest of the $0.76 support could trigger a rally to $1.

Prominent analyst Timeless Being is also bullish on Bonk, citing its ecosystem development, healthy orderbook and a strong base.

These Low-Cap Cryptos Could Offer Up To 100x Returns

If Fed Chair Jerome Powell hints at the start of an aggressive rate-cutting cycle, it could trigger an explosive crypto bull market.

This provides the ideal backdrop for low-cap cryptos to deliver outsized returns. Investors buying high-upside meme coins early could capture life-changing gains before the end of the year.

For instance, Bitcoin Hyper (HYPER) is being backed by many prominent analysts as the next 100x crypto.

It is the newest BTC layer-2 project, which uses Solana Virtual Machine and zero-knowledge architecture to improve the network congestion and poor scalability on Bitcoin.

Layer-2 coins have high upside potential, and many reach multibillion-dollar valuations. As a result, HYPER continues to record six-figure whale investments during its ongoing presale and has already raised over $16 million in short order.

Similarly, MaxiDoge (MAXI) has emerged as the hottest low-cap alternative to Dogecoin.

The project is a satire on crypto bros and degens, which makes it both humorous and relatable, two of the best qualities in a meme coin.

The MAXI presale has raised more than $2 million in its ICO, with experts viewing it as one of the best cryptos to buy now.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware that our commercial partners may use affiliate programs to generate revenue through the links in this article.