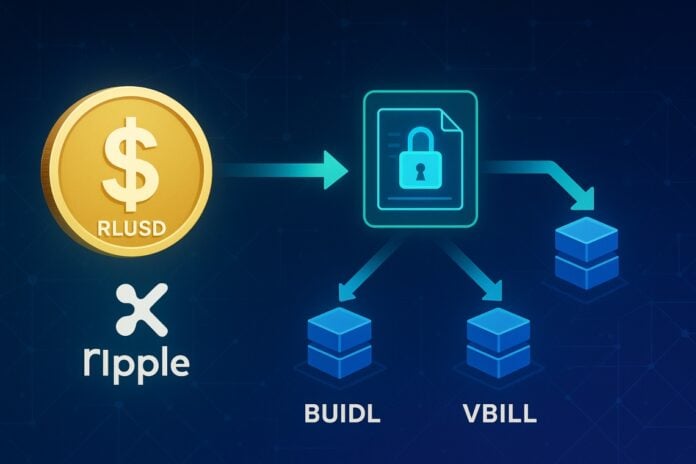

According to Ripple, the institutional stablecoin RLUSD is now extended to BlackRock’s tokenized money-market funds (BUIDL) and VanEck’s (VBILL) via a new smart contract on Securitize, enabling on-demand conversions and a 24/7 off-ramp to on-chain liquidity.

Summary

In Brief

- Integration: BUIDL (BlackRock) and VBILL (VanEck) connected to RLUSD via Securitize Ripple.

- Off‑ramp 24/7: direct exchange of tokenized shares into RLUSD, without banking windows.

- Scale: circulation of RLUSD over $700 million, backed by liquid reserves at a 1:1 ratio Ripple.

- Compliance: issuer regulated under the New York DFS trust charter NYDFS.

- Roadmap: DeFi support and settlement for tokenized real-world assets, with deployment planned on XRP Ledger and a new frontier of institutional crypto banking.

The fact: RLUSD connects tokenized funds and on‑chain liquidity

Ripple has activated a direct link between tokenized money-market funds and its stablecoin RLUSD, integrating BlackRock and VanEck products through the Securitize platform. In this context, investors can convert fund shares BUIDL and VBILL into on-chain liquidity in real-time.

The on-chain off-ramp system reduces operational frictions between traditional finance and blockchain, offering a continuous and interoperable settlement mechanism for tokenized real assets. That said, the added value lies in the constant availability and native execution on the network.

How the exchange “quote → RLUSD” works

Basic Mechanics

A new smart contract implemented on Securitize receives the tokenized shares of the fund and instantly releases RLUSD. The conversion occurs on-chain at a 1:1 valuation ratio, with the service always active and continuous operation.

Requirements and Limits

- KYC/AML: access restricted to duly verified investors by both Securitize and the fund issuers.

- Fee: possible conversion and custody fees according to the specifications provided by Securitize and the issuers.

- Operations: on-demand process not bound by fixed windows; finalization times depend on the blockchain network used.

Standard and network

The contract interacts both with the tokens representing the funds and with RLUSD, within environments compatible with Securitize’s infrastructure.

It should be noted that the multi-chain deployment of RLUSD ranges from enterprise ecosystems to DeFi platforms, with a rollout planned on the XRP Ledger to expand its usability and initiatives like that of Standard Chartered for spot trading of Bitcoin and Ether.

Why it matters: operational impact and institutional uses

The integration acts as a bridge between traditional finance and on-chain solutions, capable of operating as a settlement layer for tokenized real assets, facilitating cross-border payments, and supporting corporate treasuries. In fact, the availability of native stable liquidity can impact treasury and trading processes.

- Immediate liquidity for tokenized funds and trading desks.

- Reduction of counterparty risk in the settlement of real assets.

- Greater interoperability between traditional custody systems and smart contracts, as demonstrated by initiatives from Ripple Custody.

However, a critical point remains the dependence on gatekeepers for KYC and the single tokenization infrastructure, elements that can impact resilience and capital portability.

Regulation and Guarantee Model

RLUSD is issued by an entity regulated under the New York DFS trust charter NYDFS and backed by liquid reserves at a 1:1 ratio, a setup that combines regulatory compliance and on‑chain usability in enterprise contexts.

The regulatory framework concerning stablecoins and tokenized real assets, in the USA as well as in the EU, is evolving: thus allowing room for developments in the legal treatment of tokens and their on-chain conversions. For regulatory updates, refer to the official pages of the NYDFS and the policy documents published by the competent authorities.

Market Data and Context

- RLUSD Circulation: over $700 million, as stated by the issuer Ripple.

- Use: institutional payments, selected DeFi pools, and corporate treasuries.

- Real assets: tokenized funds, representing exposures to T-bills and money-market, are growing as a source of regulated on-chain yield, supported by platforms like Ondo Finance.

According to data collected from public on-chain dashboards (e.g., Etherscan and XRPSCAN), our preliminary analysis indicates significant movements towards RLUSD: during the period from September 1–23, 2025, on-chain conversions in the order of hundreds of millions of dollars were recorded, confirming the growing interest in instant off-ramps.

Industry analysts we consulted also note how 24/7 availability and multi-venue compatibility can influence market-making processes and institutional cash management strategies.

Market observers highlight that direct access to stable liquidity could accelerate the adoption of tokenized real assets; however, concentration of issuers and regulatory risks remain aspects to be closely monitored.

Quotes and Positions

Jack McDonald, SVP of Stablecoins at Ripple, described the integration as “a natural step” to bridge the gap between the traditional financial system and the crypto world, emphasizing how RLUSD is configured as a regulated tool suitable for enterprise needs.

However, independent analysts suggest integrating additional metrics on conversion volumes, average settlement times, and multi-venue interoperability.

Quick FAQ

Which products are involved?

The tokens related to the BUIDL (BlackRock) and VBILL (VanEck) funds represent exposures to money-market and T-bill in tokenized form. For operational details, see the technical documentation of the issuers and Securitize.

Is RLUSD coming to the XRP Ledger?

Yes, deployment on the XRP Ledger is planned, extending the use of the stablecoin to DeFi environments in addition to institutional channels.

Are there slippages or restrictions?

The conversion occurs at a nominal value of 1:1; however, eligibility limits, operational caps, and fees may apply, as specified in the documentation released by the issuers.

Key Numbers

- Guarantee: 1:1 ratio with liquid reserves.

- Regime: trust regulated by the New York DFS (NYDFS).

- RLUSD Circulation: over $700M.

- Feature: 24/7 off-ramp to on-chain liquidity.

- Platforms: smart contract on Securitize; deployment planned on XRP Ledger.

Ongoing Update: follow the official channels of the issuers for any changes on fees, limits, and multi‑chain support.

For technical and regulatory insights, also refer to our analyses on Stablecoin, Fund Tokenization, and the revolution of tokenization with Ripple and Securitize.