Recently, the fTLD, which is responsible for registering DNS (Domain Name System), issued a document on changes to the policy on .bank domains.

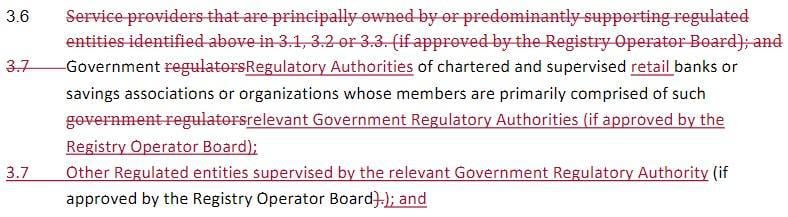

In this document, the category “service provider” has been removed to obtain certain domains, as in the case of the .bank. To obtain this domain, organisations will be required to have special permissions.

In fact, this change puts into practice a blockade that makes peer-to-peer payment service providers, money transfer applications and non-bank institutions not eligible. These types of companies, therefore, will not be able to buy the .bank domain, a solution that has been promoted and explained by Heather Diaz, Senior Director of compliance and policy at fTLD:

“More recently, as the financial services arena has evolved, particularly as it relates to fintechs offering financial products/services [e.g., P2P payment providers, cryptocurrency companies], we have found that some prospective Registrants were seeking domains to enhance their legitimacy to market to regulated entities and/or consumers. We’re making this move to further secure these trusted spaces.”

In addition, a period of 30 days has been set, from July 25th, 2019 to August 24th, 2019, during which there will be a public hearing on the initiative. Several authorities have already commented positively on the matter, arguing that the integrity and security of the .bank domain should be maintained.

“As an early adopter of .bank and member of the Advisory Council, we also voted in favor of these changes to maintain the integrity and security of the domain”, explained Adam Sandberg of Bridge Community Bank.

At the same time, Kevin Brandt of the Independent Insurance Agents and Brokers of America also says he wants to add the .INSURANCE domain to the restrictions.

“The additional clarifying language to the .INSURANCE Registrant Eligibility Policy are much appreciated and the addition of the Board approval category will be important as the insurance industry continues to evolve. We support these changes.”