According to CoinMarketCap data, 75% of the trading volume on Coinbase Pro in the last 24 hours was generated by bitcoin alone.

From January 2018, when it reached its lowest peak, bitcoin dominance began to rise, from a low of 33% to the current 68%, with a real surge in April 2019.

However, bitcoin’s absolute domination over all other cryptocurrencies is not exclusive to market capitalisation: BTC also dominates in terms of trading volumes.

Coinbase is the largest American exchange and in the last 24 hours has recorded a trading volume of almost 480 million dollars.

Of these, 75% involved bitcoin: in other words, the BTC trading volume on Coinbase Pro is now three times higher than that of all other cryptocurrencies put together.

While it’s true that not many altcoins are available on Coinbase, CoinMarketCap tracks as many as 50 exchange pairs on Coinbase Pro, 15 of which are bitcoin (i.e. only 30%).

For example, the BTC/USD exchange pair has totalled more than $280 million in the last 24 hours, whereas the first one that does not concern bitcoin, ETH/USD, stands at $25 million: more than 10 times less.

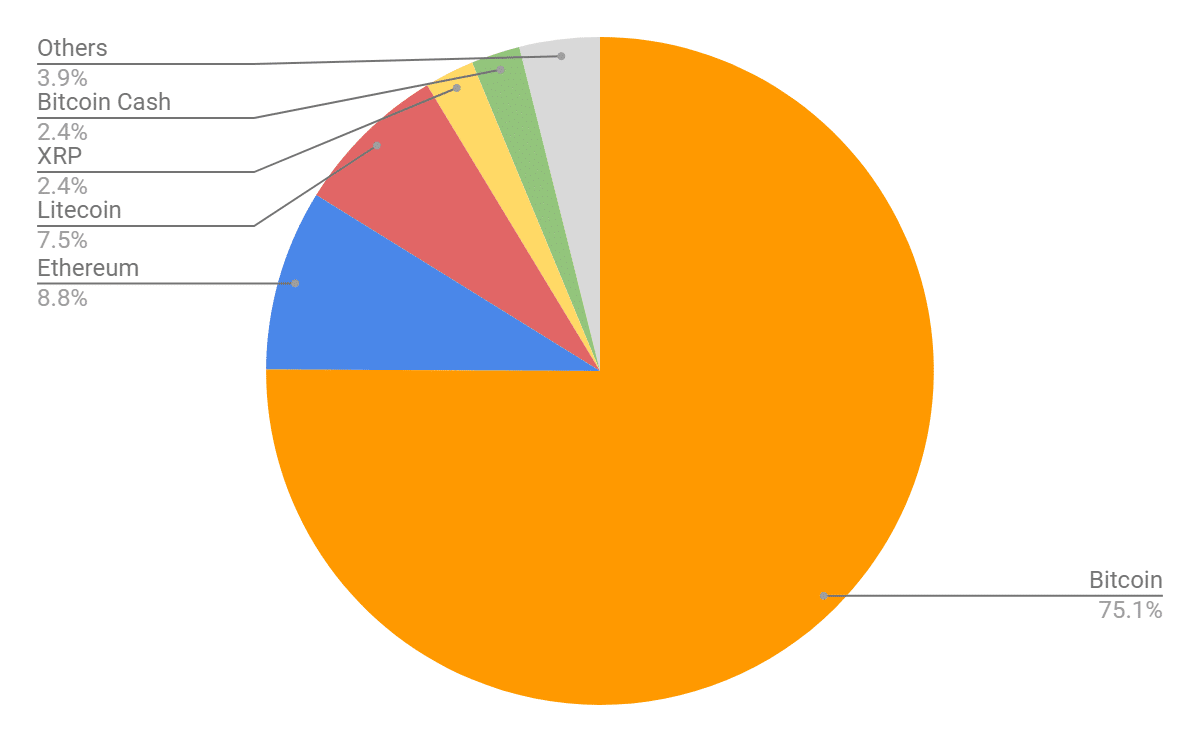

To be exact, BTC, with its 75.1% of trading volume Coinbase Pro, is followed by Ethereum with 8.8%, Litecoin with 7.5% and XRP and Bitcoin Cash with 2.4%.

The remaining cryptocurrencies combined represent only 3.9% of the trading volume on the US exchange.

This is even more surprising considering Coinbase’s strategy of adding more and more cryptocurrencies. Recently, for example, they announced that the goal is to provide support for all cryptocurrencies that meet their technical standards and that comply with the law, coming to provide access to their customers to at least 90% of the market capitalisation of all cryptocurrencies in circulation.

So far, this strategy does not seem to have produced significant results, since the role of altcoins within the crypto market seems to be diminishing in the last few months. However, it is not certain that this trend will continue indefinitely.