Throughout the weekend prices remained at the levels of Friday without giving any indication, accompanied by trading volumes below the average of recent weeks, but now the price of bitcoin – along with that of 80% of all other cryptocurrencies – increases in value.

Among the first 20 crypto today, in fact, there are only two negative signs: Iota (IOTA), which loses 2%, and Leo token (LEO), which loses about 1%, continuing to fluctuate around the launch price set at 1 dollar. BSV scores the best rise of the day with +15%.

On the second step of the podium, Chainlink (LINK) rises by 13%, on a par with Chilliz (CHZ), a token that is part of the Socios.com project, aiming to offer team sports fans the opportunity to participate in tokenised events.

Among the top 5, there was also an excellent rise by Bitcoin Cash (BCH), which rose 7%. The two bitcoin forks, BCH and BSV, are trying to get away from the drops that characterised them both in the last part of September with prices ending up revising last spring’s levels.

On the other hand, the worst is Centrality (CNNZ), which is shrinking by about 10%.

Today, for the first time, the goal of 3,000 cryptocurrencies listed on CoinMarketCap has been crossed. It is a historic milestone that comes after more than a year from the milestone of 2,000 cryptocurrencies.

The volumes this week remain above 55 billion, slightly better than the trading levels of the weekend when it was below 50 billion.

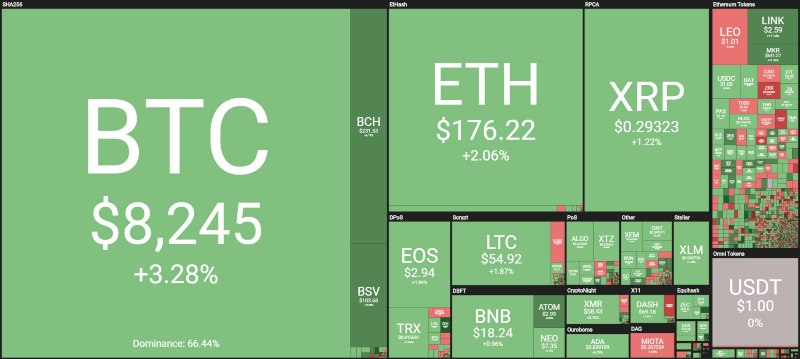

Total capitalisation rises to 123 billion, recovering 10 billion since the end of last week. The dominance of the bitcoin remains unchanged at 66.4%. Ethereum recovers and returns to 8.6%, while XRP, by contrast, remains above 5.6%.

Summary

The price of bitcoin (BTC) increases in value

The price of bitcoin, after having seen prices fluctuate around 8,000 dollars since last Thursday and throughout the weekend, from the first lights of the day increases with a rise of the day that goes beyond 3%: the values return to revise the levels of a week ago, just above the threshold of 8,300 dollars.

Bitcoin has recovered the boring bearish movement that has characterised it throughout the past week. It is a clear signal that comes with volumes that do not give clear indications of actual purchases. This is a technical rise in order to test the 8,300-8,400 area, levels that have rejected the short-term rebound.

For bitcoin, prices continue to remain in the lateral band, in a congestion that has lasted for a month, between 7,800 and 8,700 dollars. In the medium term, the structure does not change, and therefore the operating signals remain unchanged.

Ethereum (ETH) price

Ethereum’s prices reach the end of a medium-long term triangle. The lower side begins with the lows between mid-December and early February and passes joining the lows of the last period between the end of September and mid-October, in the $170-175 area.

While, instead, in the upper side of the triangle, the break would occur with pushes over 180-185 dollars. By now, at a technical level, Ethereum enters a delicate phase structurally, since the breaking upwards or downwards could trigger a volatility due to speculation.

The moment could have arrived in which Ethereum, after approximately two months, no longer provides technical operating indications in view of medium-long term. The next hours and days of the week could change the appearance of congestion, which has been characterising Ethereum for over two months.