1 year and $1000 invested in the first 10 crypto assets ($100 in each cryptocurrency): this is the investment a Reddit user made in 2019 to calculate the return, repeating an experiment conducted in 2018 that resulted in an 88% loss.

On the contrary, in 2019 the user obtained a return of 1.74%.

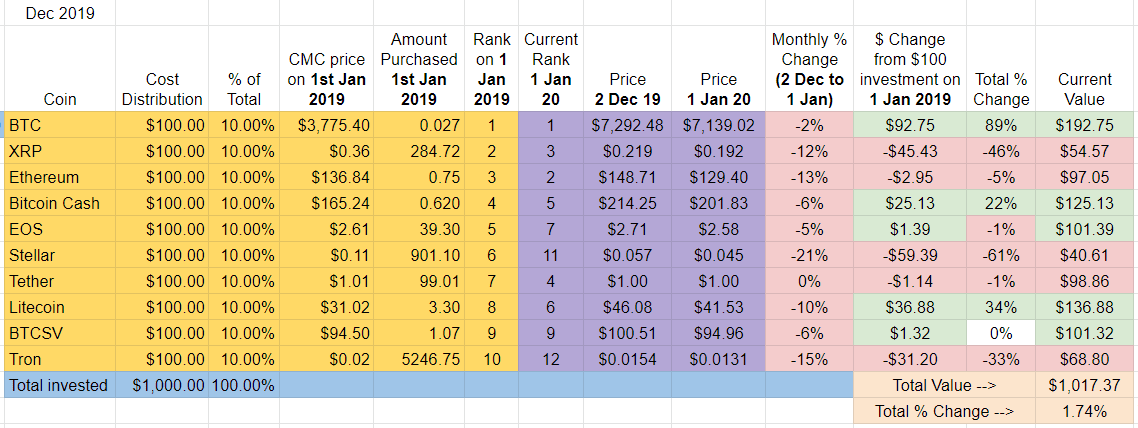

The published table shows the reasoning and logic of the user who focused on the first 10 crypto assets per market cap on January 1st, 2019 (BTC, XRP ETH, BCH, EOS, XLM, UDST, LTC, BSV and TRX) and invested $100 in each of them, buying them at the price of January 1st, 2019.

Obviously, over the course of a year both the positions and prices of the cryptocurrencies have changed considerably in some cases and, one year later, some of them have even fallen outside the top 10 per market cap.

Analyzing the table in detail, it’s clear that bitcoin proved to be the best asset, going from $3,775 to $7,139, which brought a return of 89%, doubling the initial investment.

A different story instead for Ripple (XRP), which went from a price of $0.36 to $0.19 with a loss of 46%, effectively halving the initial investment; whereas for Ethereum (ETH) the decrease was only 5%.

EOS was not very volatile, remaining at the same levels, and obviously also the stablecoin Tether (USDT) recorded only a slight loss of 1%.

Positive performances include Bitcoin Cash (BCH) with a return of 22% and Litecoin (LTC) which in January 2019 recorded a value of $31, while a year later it reached the value of $41 with an increase of 34%.

A poor performance for TRON (TRX) which, despite the series of news that came out in 2019, sees a loss of 33% and a drop to position 12 on CoinMarketCap, although this is nothing compared to the disastrous trend that involved Stellar Lumens (XLM) which lost 61%, going from a value of $0.11 to $ 0.04 a year later. Therefore, XLM was the asset that resulted in the biggest loss of money.

While it is true that diversification leads to a dilation of risk, this certainly does not exclude the loss on the initial investment since, as seen, the losses for some crypto assets were more than 60%.