Chainlink CEO Sergey Nazarov says:

“If you work in the DeFi, to the question: have you decentralized all the processes of your platform, the answer must be a categorical yes”.

It was January 9th, 2020 when Chainlink and Aave announced a partnership to launch the Oracle Aave Network, and this is why the Community Call held yesterday, organized by Aave, was attended by Nazarov, who thus describes his enthusiasm for the project:

“We built ChainLink in the hope of seeing services like Aave that we have been waiting for for years”.

The passion with which Aave’s first community call begins is the testimony of how these young people approach their work.

Stani Kulechov, Aave’s CEO, thanked the Chainlink team for their support and help with the integration of the node even during the Christmas holidays. A decentralized generation of visionaries who combine skills with a single purpose:

“Make possible what for traditional finance would be unimaginable”.

These are the words used by Emilio Frangella to describe the project, mindful of his previous experiences in the banking sector that have allowed him to grow his experience in fintech.

This first community call was attended by ChainLink CEO Sergey Nazarov and the main players of Aave: a DeFi platform created thanks to ETHLend.

While Aave largely exceeds one million dollars in available liquidity, a series of public interventions aimed at the team’s work begins. The keyword is: interoperability

Community Call 1

During the first few moments of this chat between teams, the strength of the partnership between Aave and Chainlink comes to light.

Chainlink has now become a well-known project in the blockchain world. As the name suggests, the platform serves as a bridge between smart contracts and the external world.

A link that allows contracts to interface with the outside world and execute their own code by accessing external sources of information called oracles. Aave is in great need of Chainlink’s involvement in the functioning of the smart contracts on which their DeFi project is based.

It is vital to have reliable data on the price of the assets connected to the lending contracts on the platform.

How does ChainLink work

Using a node, Chainlink allows companies that implement it to make specific requests to oracles in a decentralized manner. No intermediary will manage access to the data and therefore no one can manipulate it.

Whereas outside the chain, Chainlink distributes Oracle nodes connected to their API and Ethereum blockchain through a system of incentives paid using the native utility token LINK.

External nodes are responsible for their reputation and the data collected never comes from a single source. This allows the project to avoid manipulation or risk of fraud when connecting to the external data source.

Imagine what would happen if the functionality of a decentralized finance contract depended on data from a single entity.

The peculiarities of Aave

Although a lot of lending-related projects have been launched, what can be seen on Aave is unique.

To allow a constant flow of loans with a variable interest rate depending on the amount of liquidity present in the platform, Aave has designed a contract capable of managing a lending pool.

As the liquidity of the pool changes, there will be an interest rate that could encourage the deposit or make the loan more attractive to the borrower in a completely disintermediate supply and demand mechanism.

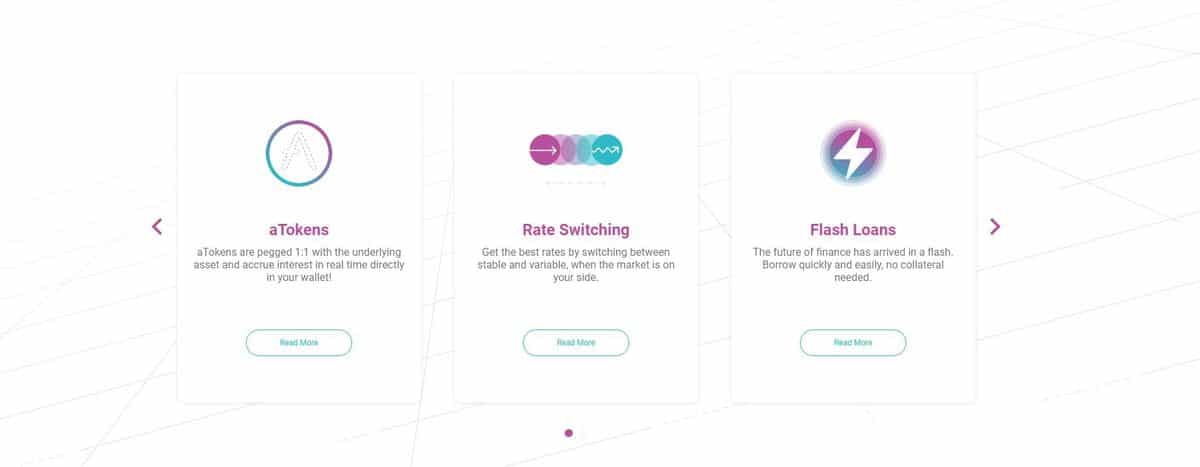

Their special tokens called a-tokens are linked 1:1 to the deposit of liquidity holders. For example, if a lender deposits their ETH on a platform, they will receive their a-ETH.

This is where the magic happens: unlike the competitors, the contract provides for a gradual release of the interest shares which will increase the numerical base of the token. It therefore represents exactly the ETH deposited, which in the a-ETH version will increase in number according to the interest accrued.

When the position is closed, a higher number of Ethereum will be unlocked and the user will not have to deal with any other type of token or even manage a difficult accounting on the interest.

When lending USDT you receive USDT, when lending BAT you receive BAT.

A-tokens are ERC20 tokens that are for all intents and purposes tradable on the market, potentially it will be possible to exchange tokens that accrue interest.

This newly born project has 16 cryptocurrencies available for lending and more than $1 million in liquidity, and it seems to have what it takes to be successful.

What to expect from Aave

- Great excitement for collateral-Swaps: Imagine being able to trade quickly a-tokens which generate interest as a function of the rate offered by the market without going through an exchange.

- The future will also see the birth of the Pool Factory, which will be managed and governed by LEND tokens and will allow offering personal lending pools.