What determines the earnings of a bitcoin (BTC) miner? The fundamental answer to this question is hidden in another question: does it really matter?

If you are not involved in the mining process, what reasons could you have to understand the underlying mechanism and the dynamics involved?

Until recently, the reasons for this interest were driven by the need to create sufficient trust in the network. Digital coins based on blockchain have no successful comparisons with those created previously and based on different systems:

- E-gold;

- WebMoney;

- Liberty Reserve;

- Perfect money.

The Proof of Work underlying Bitcoin generates a mechanism that connects it to the real world, in a better way than any other previous experimentation.

The concept can be explained with a sentence taken from a recent interview with Peter Rizun on the subject:

“The proof-of-work that each coin contains. The digital makeup of each bitcoin is proof itself of the huge pool of computing power and energy that went into forging that coin. Bitcoin to me is more physical than paper money”.

Trusting a protocol and being convinced that it is safe requires a great deal of fundamental training.

The first to bet on Bitcoin and the technologies that were inspired by it spent a lot of time in front of the computer to understand the phenomenon, they discussed it with technicians, friends and strangers, using BitcoinTalk and other communication platforms on the subject.

The new generation of interested parties has a greater confidence in the resilience of the network and often underestimates the research of the fundamentals, pursuing the dynamics from a purely speculative point of view and trusting the dominant or emerging narrative, added to the emotions triggered by social media.

Often users do not even move their funds from exchanges and are not capable of interfacing with many of the tools made available by the community.

For this reason, projects completely devoid of fundamentals have absorbed a lot of interest both in economic terms and in terms of trust, thus diverting interest and a lot of capital to dangerous destinations.

The real earnings of a bitcoin miner today:

- The BTC reward, available to those who offer the necessary computing power to solve the mathematical problem of PoW. This reward is dictated by the Bitcoin code itself.

- The transaction fees (costs) to be paid by the user. They are set arbitrarily by the users or by the wallet services they rely on. Here is a service for selecting the best amount.

Fixed costs such as the depreciation of hardware, electricity, personnel costs, etc., are subtracted from revenues.

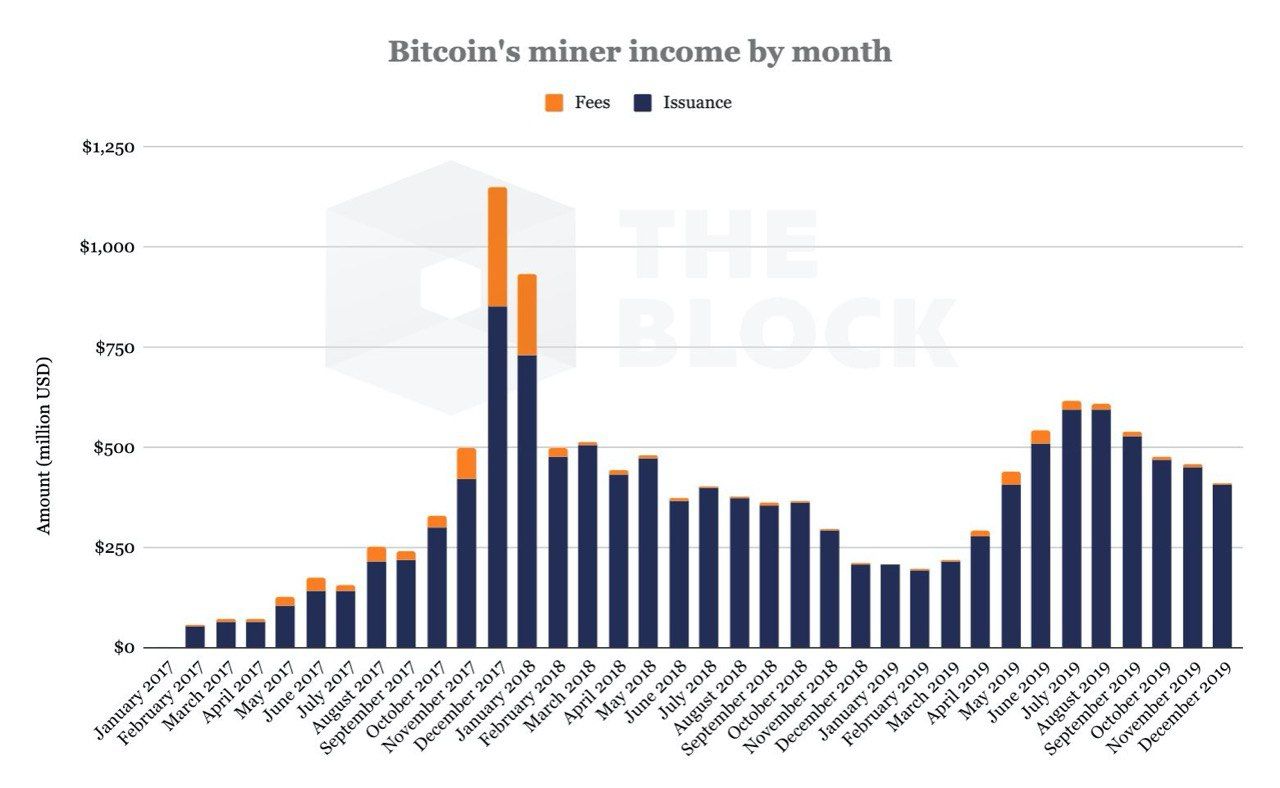

The second point has become a relevant topic in recent years, let’s see a graph before going into more detail:

As can be seen, the blue bars indicate the proceeds of the BTC reward granted by the code to the miners for the discovery of the block, while in orange the proceeds of the fees.

The trend of the graph and the width of the bars pose questions on the dynamics with which revenues vary over time.

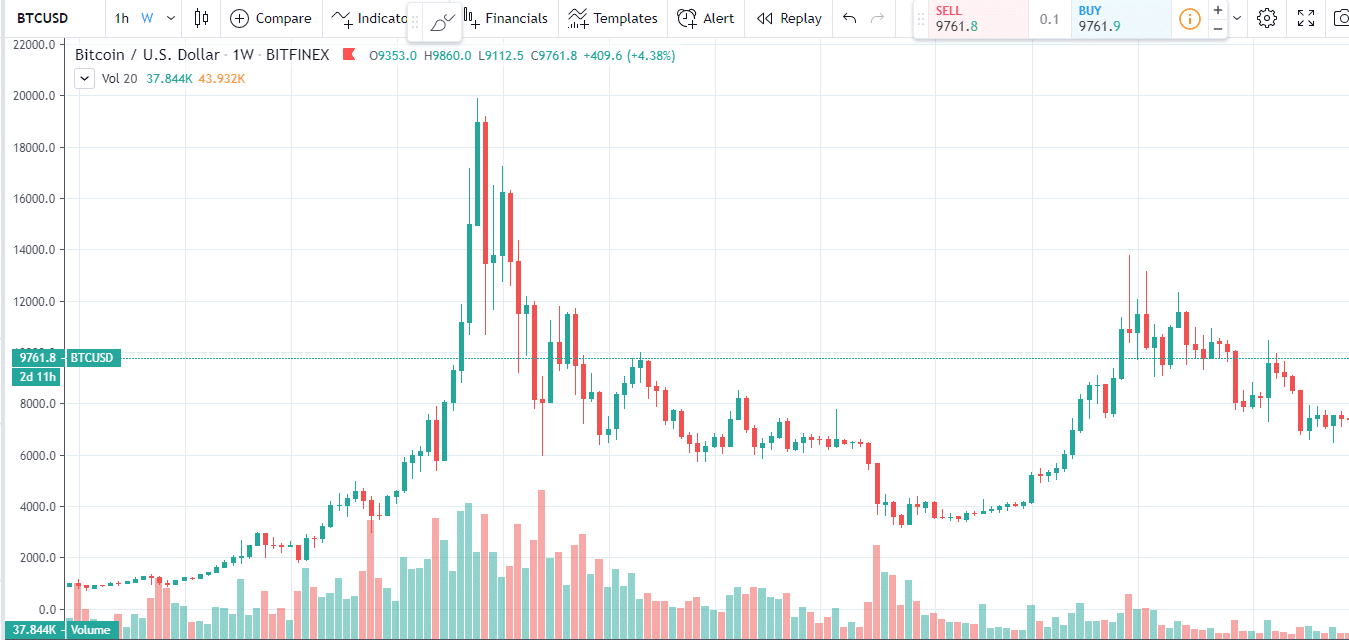

Here is a parallel to this graph of the BTC price:

There is no doubt that the correlation is strong. As can be deduced, it depends on the fact that by increasing the price of BTC, miners obtain, in traditional currency, greater shares by selling the result of their work on the market.

The choice to keep mined BTC belongs to the single-player and therefore is not covered by the first chart.

But what does the height of the orange bars in the first graph depend on? It may depend on two factors:

- The number of transactions per block;

- The cost of fees per transaction.

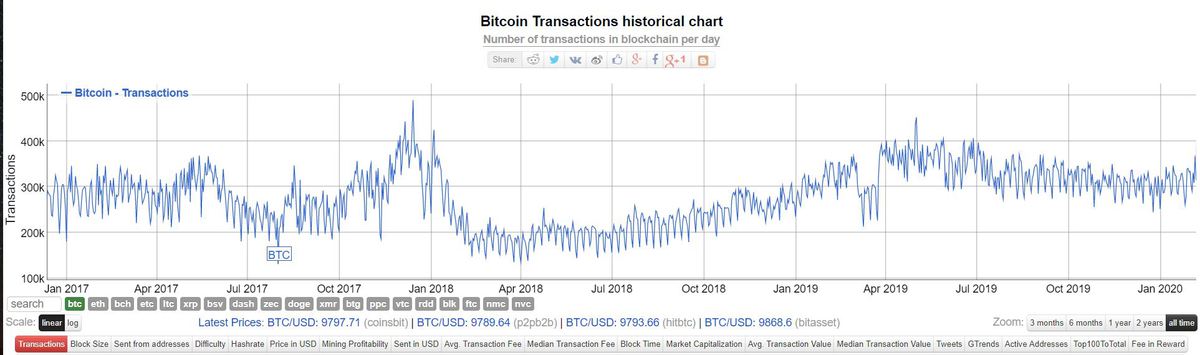

Let’s check the trend of the transactions in the following chart and of course, we will find that the peaks correspond, but the trend cannot be superimposed on the first chart as it does with the price. Let’s look at the obvious reasons only for some of them.

The number of possible transactions is limited by the size of the block. This capacity has expanded with the advent of SegWit, a non-mandatory update of the Bitcoin core client. It modifies some settings in order to recover space by separating signatures from the input list and making it possible to use Lightning Network (malleability fix).

Hence Bitcoin, generating a block about every 10 minutes or so, has a maximum transaction capacity per unit of time.

Effects of increasing the use of Bitcoin

The orange bars in the first chart therefore do not lengthen only due to the increase in the number of transactions. They also grow as a result of the increase in costs per transaction that a user is willing to pay in order to have their tx included in the block.

This is why there is a concomitance between price spikes and fee income.

During strong price increases, higher transaction demand is generated. The rush of exchanges to buy and sell BTC, combined with normal usage, fill the block by triggering a fee market that rewards the highest bidder.

When the supply is fixed, the price increases with an increase in demand. Transactions were paid more than $50 by those who probably rushed on an exchange to sell BTC for $19k.

The chart below shows the average costs per transaction and closes the correlation.

Effects of Halving

As it is well known and foreseen by the code, this is the year of the halving of the BTC reward for each uncovered block, the reward will go from 12.5 to 6.25 BTC per block.

The planned inflation of the Bitcoin code foresees a maximum of 21 million BTC. This is what is ahead:

In a few months, the orange line will fall further down the x-axis by half.

Many people expect this to generate a new price increase. It is caused by relative deflation. The number of BTC constantly entering the market is decreasing, and a lower supply with stable demand should increase the price.

However, this reasoning is incomplete because it does not take into account the economic dynamics on which the amount of BTC sold by miners to pay for electricity and machine depreciation is based.

We won’t go into this aspect in more detail, but we will point out that without driving transactional costs sky high, the only way to make Bitcoin mining profitable in the future is a dramatic price increase.

This, however, would not solve the fact that sooner or later it would have to be the fees to sustain the costs of the miners, precisely because of the total cap being 21 million coins.

But even so, assuming that there is a price increase in the coming years to support mining, there is a need for adoption. Adoption is synonymous with increased transactions. As transactions increase, the blocks get full and fees rise, which means that there will be problems with unpredictable transaction costs again.

Whether opening a Lightning Network channel or switching from an exchange to a Wallet, will the masses be willing to accept volatile and often very high transaction costs?

The narrative of digital gold says yes, but we have to see what the market will say.

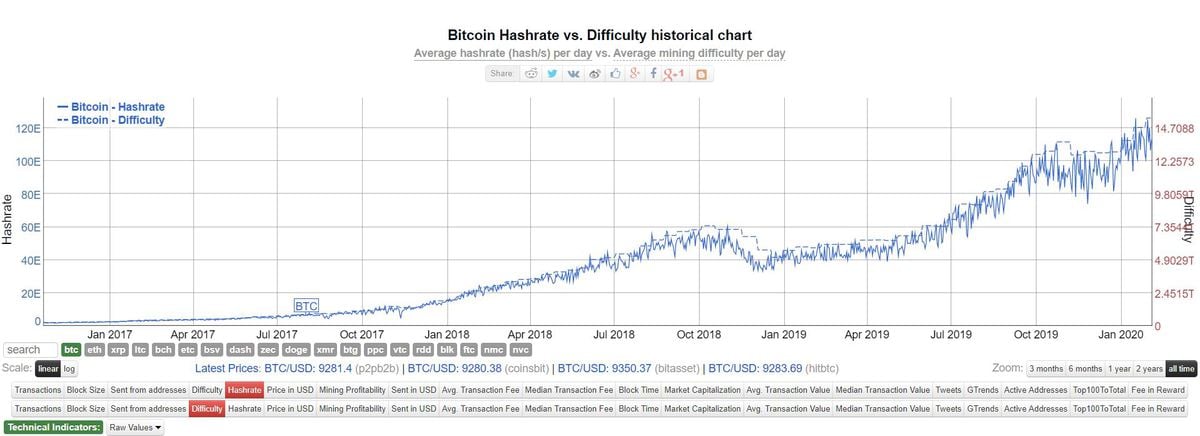

The miners will certainly follow the adoption and the blockchain that will allow them to earn from their work. Securing the network is the cornerstone on which the whole system is built. In the meantime, the Hashrate sha256 increases with the difficulty.