According to some data, the growth of Bitcoin retail investors is growing at a steady and slow pace.

The adoption of blockchain takes place when a significant percentage of people start using Bitcoin regularly to make and receive payments, but it is a slow path full of obstacles that all innovative technologies have had to face.

Before being used globally, as a store of value or means of payment, Bitcoin must overcome known problems such as usability, scalability and the privacy of transactions, since, as FED Governor Jerome Powell said a few days ago, no one will ever want to move money on an open and transparent ledger.

There are also widespread doubts about the centralization of mining, where few actors control the computing power that sustains the network, as well as the amount of network fees that are at risk of becoming too expensive in the face of high transaction volumes.

The metrics of Bitcoin adoption

Since 2009, the year in which the first Bitcoin block was mined, Google searches have indicated a low and slightly rising interest rate, net of interest peaks attributable to periods in which bitcoin has experienced price spikes.

The highest number of searches was reached in December 2017, and it is now at 15-20% of that value.

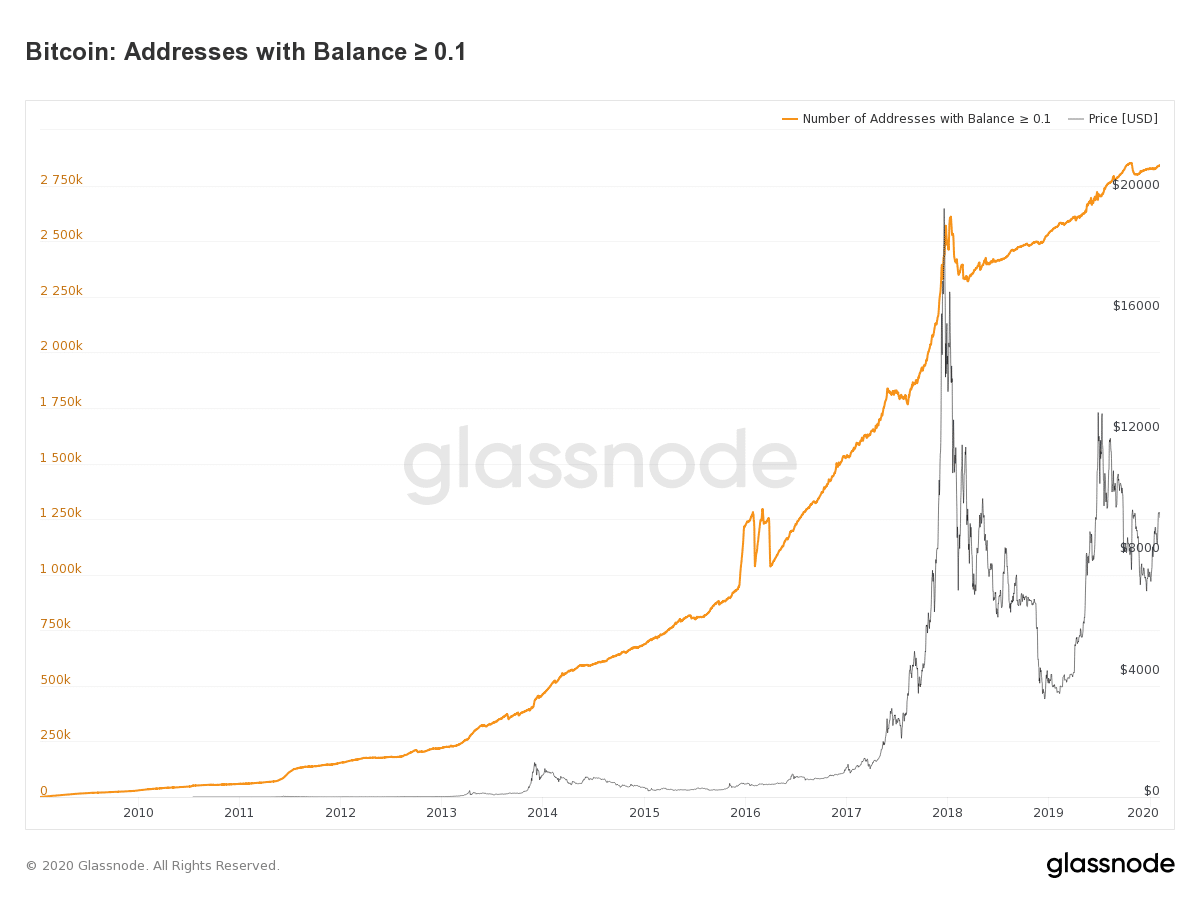

Nevertheless, looking at the number of addresses with more than 0.1 bitcoin, it is possible to see that the cryptocurrency created by Satoshi Nakamoto lives a slow and constant adoption, which aside from the bull market surges and the halving of July 2016 is overall constant and linear over time.

One-tenth of bitcoin is equivalent to about a thousand dollars, which represents an investment value accessible to small investors in industrialized countries who want to experiment with a highly speculative asset. The number of addresses that have more than 0.1 BTC amounts to almost 3 million at this time.

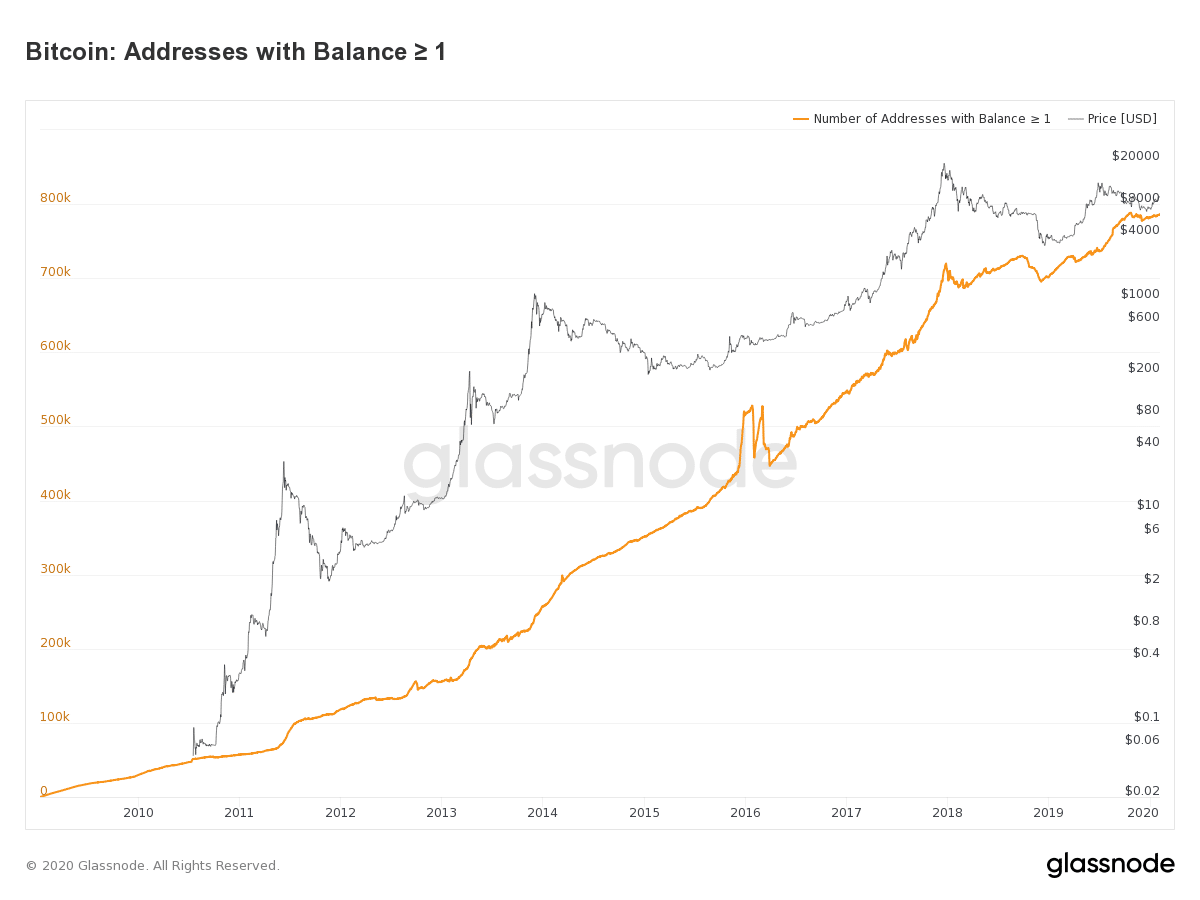

The same thing can be said by looking at the graph of the number of addresses with more than 1 BTC, which although representing a more substantial investment in the current order of 10,000 dollars, is also growing steadily, reaching the current figure of almost 800 thousand addresses.

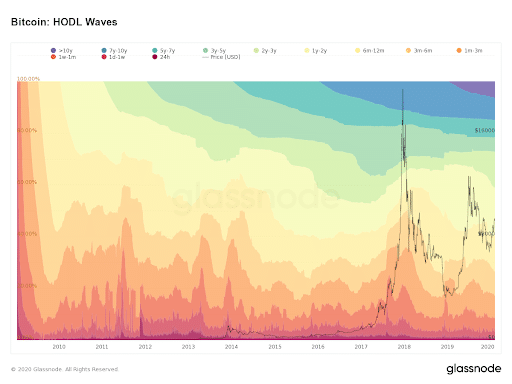

HODL waves are also interesting to analyze, i.e. how long bitcoins have been stationary in an address in relation to time. It can be observed that since the last ATH, the percentage of users that hold BTC stationary in an address for more than 1-2 and 3-4 years (light yellow and light green) has increased, and now represents about 31% of Bitcoin holders, compared to 23% a year ago.

True adoption, the much-vaunted “mass adoption“, will only happen if companies and retail investors continue to innovate and facilitate the purchase and use of Bitcoin, as well as its safe storage.

Obstacles that are now a benchmark among the various blockchains, such as the number of transactions per second and their settlement, will one day become like the megapixels of digital cameras or smartphones.

If initially there was a concern about choosing a model that offered a higher resolution to take decent photos, now we have reached levels where this feature has virtually no importance.

In the future, Bitcoin will easily be used by everyone as a store of value or as a means of payment.