Yesterday, a post was published on Coinbase’s official blog highlighting how the correlation between the bitcoin price and the S&P 500 index is merely temporary.

The analysis was carried out by Mike Co and Shawn Dejbakhsh, who explicitly claim the following:

“Although Bitcoin has recently sold off alongside the S&P 500, based on historical data, recent positive correlation may be temporary”

Co and Dejbakhsh recall that for years bitcoin has been widely regarded as an “unrelated” asset and that overall this has been statistically true.

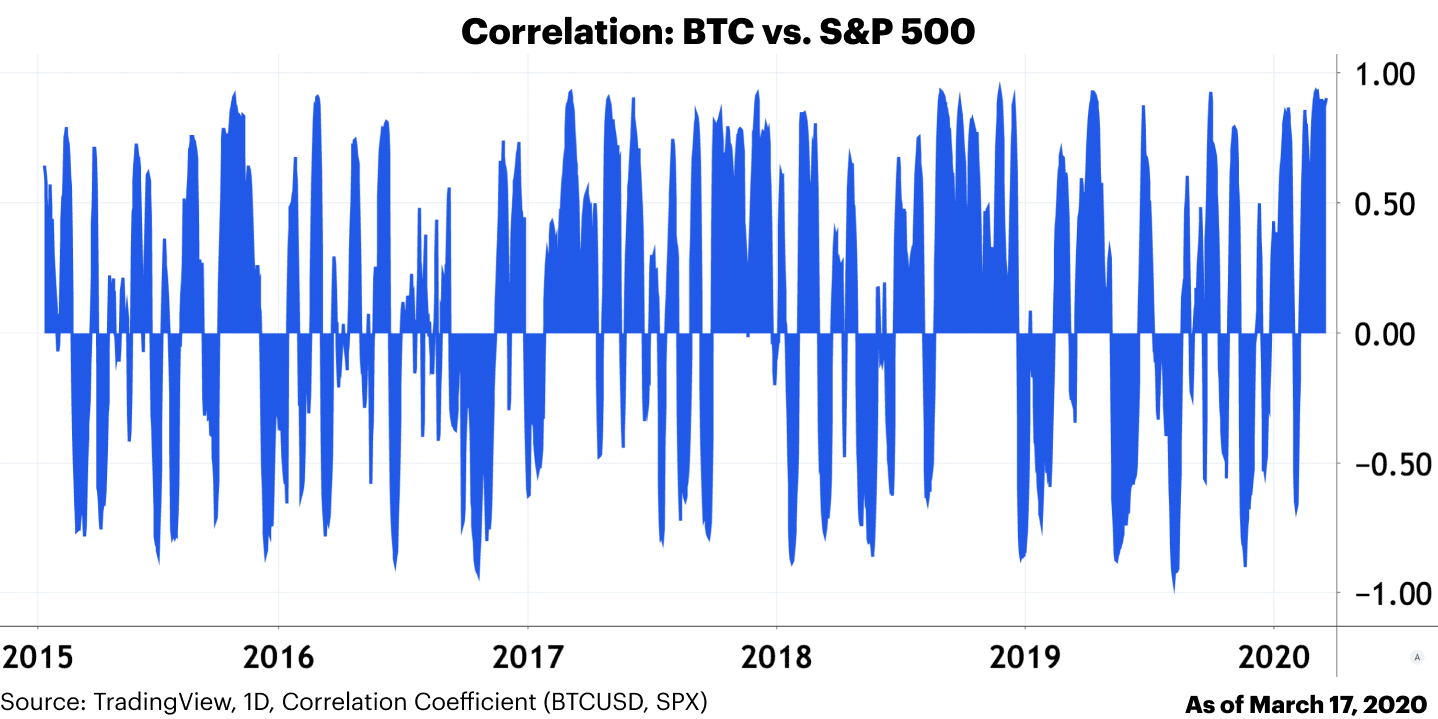

This is demonstrated by the correlation coefficient between the price of BTC and the US S&P 500 index, which has remained very low for much of its history. However, there has been a positive correlation recently.

The evolution of this correlation over time clearly shows that it is a very volatile correlation, moving rapidly from highs to lows.

In other words, the two indices do not show a lasting correlation at all in the long term.

Quite the contrary, at certain times the correlation has even been reversed, such as in January 2020, and this reversal has occurred more than twenty times since 2015.

This clearly means that BTC has been largely unrelated to major stock market indices throughout its history.

In fact, if the same degree of correlation is calculated with the S&P 500 index and the Dow Jones Industrial (DJI) index, for example, the graph looks completely different, with an almost constant high level of correlation over time.

Another interesting comparison, on the other hand, is that of the degree of correlation of the price of BTC with that of ETH, which reveals a remarkable correlation, especially from 2018.

Therefore, this study clearly reveals that there is no historical, or lasting, correlation between the trend of the bitcoin price and that of the S&P 500 index, or of the American stock exchanges in general.

In addition, the President of CoinShares, Danny Masters, recently revealed to Bloomberg that he believes that, in this period of real lockdown for many activities, Bitcoin is actually favoured, because it is probably the only financial asset that can operate completely remotely, without anyone really needing to physically go to work to operate the network.

TTo this point he added:

“While things look bleak for everything, I can’t think of a better asset to buy than Bitcoin”.

The same Bloomberg article also mentions some “good news for cryptocurrency fans”, with Bequant’s head of research for a digital asset company, Denis Vinokourov, adding:

“The crypto market attempted to decouple from the S&P 500 correlation trade that has been at the forefront of recent market activity and after days of trading in the red. While Bitcoin may have been trading in lockstep with other risk assets, namely equities, the odds of this correlation breaking down were always high”.