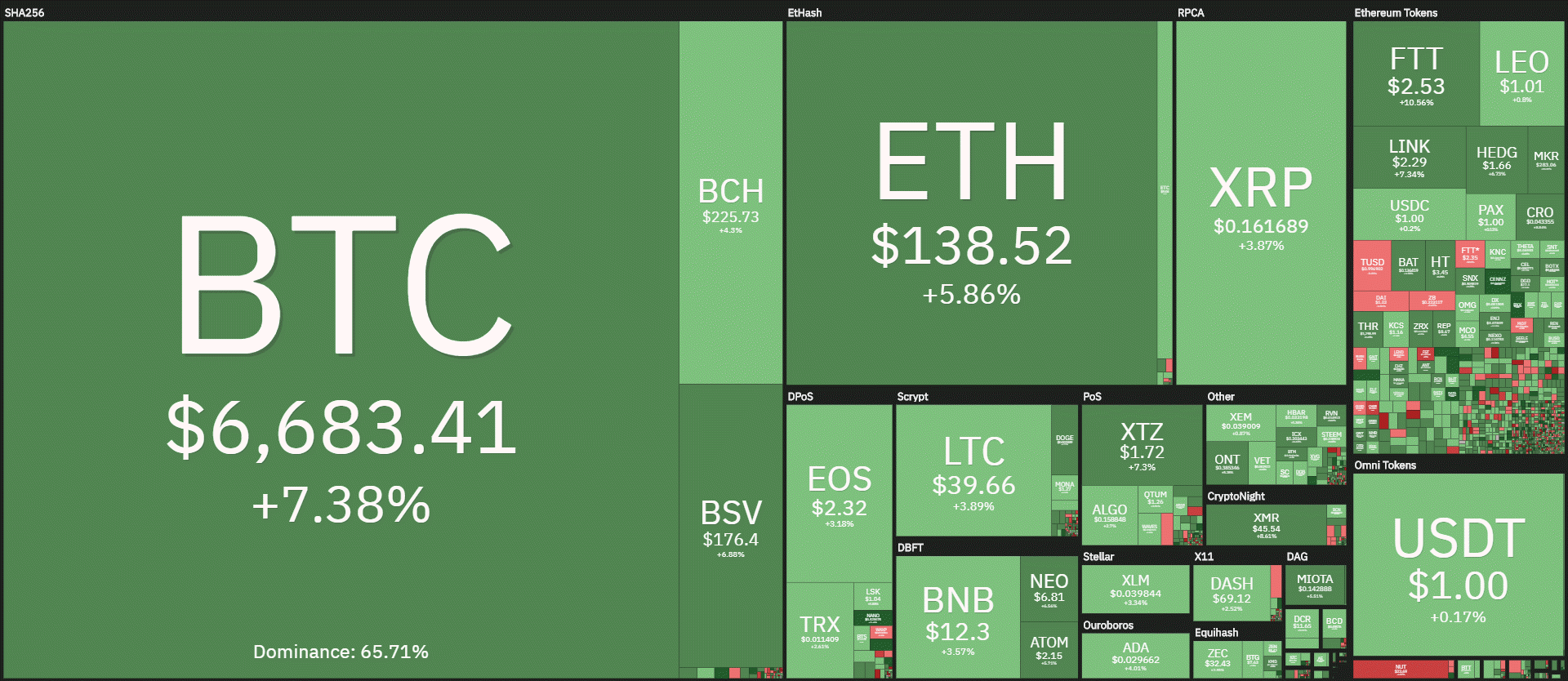

Bitcoin is still on the rise, performing very well and placing itself as the best in the top 20. A rise that in some parts of the day has exceeded 10%. BTC is shadowed by Ethereum (ETH) that from the lows of March 13th shows a specular trend to that of the queen of cryptocurrencies.

Among the first 100, as confirmation of the excellent positive day, the second in a row, there are several double-digit positive signs, for at least 15-20 positions.

It seems that investors are welcoming the US monetary policy and the world stock exchanges are also showing good rises today, even more than 5-6% for the Italian Ftse Mib.

The two assets, traditional financial stock exchanges and cryptocurrencies are once again aligning, even if at the moment the first signs of a turnaround have come from cryptocurrencies. 11 days have elapsed since the sinking of March 13th, which has seen the lows of recent months and in some cases of recent years.

The best of the day is GXChain (GXC) that with a strong jump of 50% enters among the top 100 most capitalized.

Among the big ones is the high jump of Monero (XMR) that with a +11% of the day brings XMR to climb positions, conquering the 14th in the ranking.

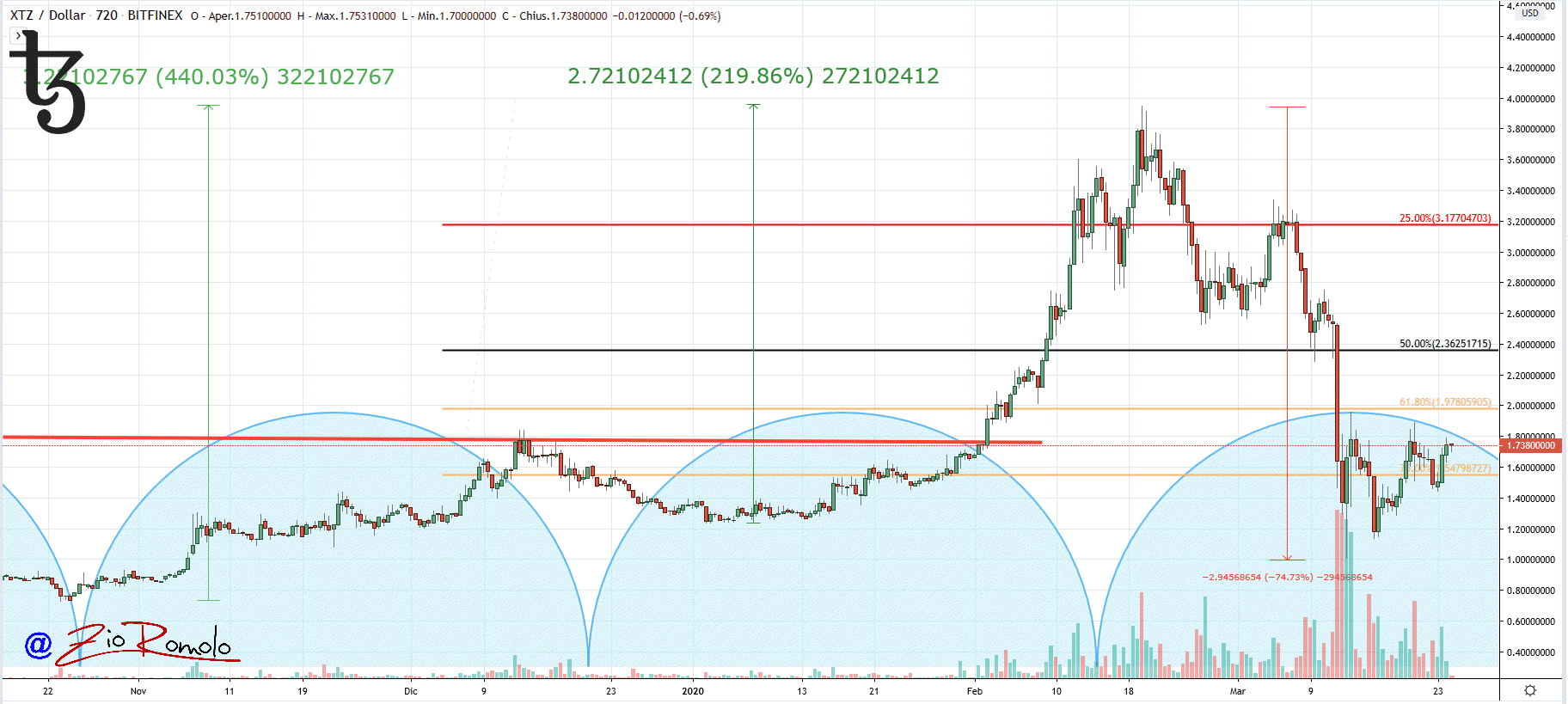

Also noteworthy is the rise of Tezos (XTZ) that returns to give a good bullish signal with prices that return over $1.80. Together with Chainlink (LINK), Tezos had characterized the first two months of the year, driving the increases even in the most inverted phases.

With +9% growth in the day, XTZ recorded one of the best performances among the altcoins. For Tezos, the current rise in prices to $1.80 allows it to confirm its 10th position in the standings.

On the opposite side of the top 100, there’s only one red sign, which is also at the bottom of the standings: it’s Molecular Future (MOF) which has been showing strong signs of weakness since the beginning of the year. With last week’s decline and lows, it lost about 80% from the highs reached in early January.

Molecular Future seems to show a strong reflection of what’s happening in this period as it’s a token linked to a platform that offers financial management services. Most probably the trend in financial markets is knocking down the price of the token back to the levels of last October.

The entire sector continues to trade well with about $130 billion in volumes on a daily basis, which is half of what was traded yesterday, confirming that the day’s increase in altcoins is not supported by particular purchases.

The movements of Bitcoin, which yesterday recorded volumes of 2 billion dollars in counter value, remain high. It almost seems like a figure that can go unnoticed and instead should be followed carefully in this delicate phase.

The market cap rises slightly and goes up to 185 billion, recovering 10 billion from yesterday’s levels. The dominance of Bitcoin continues to erode marginal fractions, reaching almost 66%.

The rise of today is also good for the dominance of Ethereum, which reconquers 8.3%, whereas XRP falls again, below the threshold of 3.9%, oscillating at the lowest levels of capitalization of the last three years.

Summary

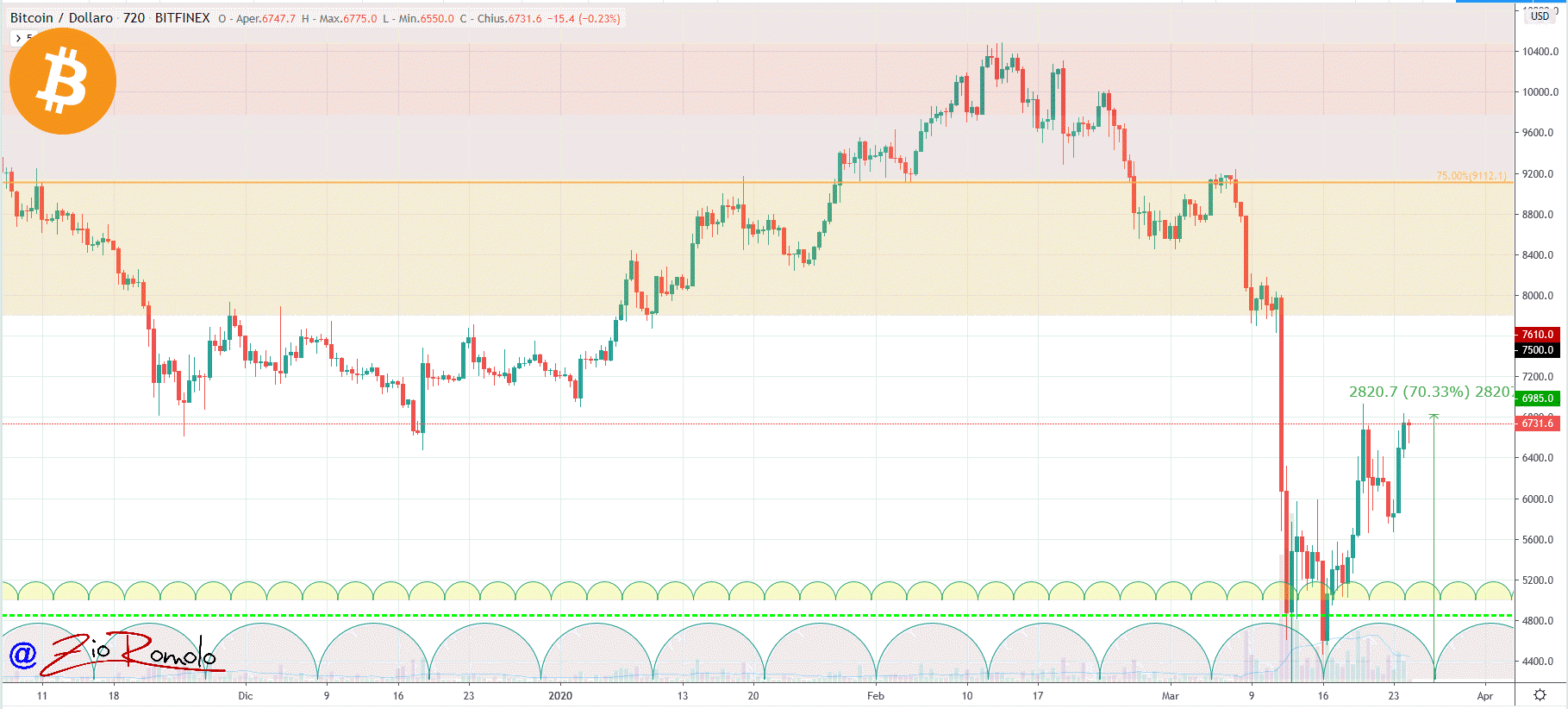

Bitcoin (BTC) on the rise

Bitcoin tries to regain last Friday’s relative highs again, going as high as $6,800. The $6,000 seems to be holding steady. A rise above $7,000 which corresponds to 75% of the sell-off accused between March 12th and 13th is a first sign of a possible reversal in a monthly perspective.

More confirmation will be needed, the main one being the recovery of the $8,200. Otherwise, with a fall to $5,500, the lows between Sunday and Monday, the current movement will be considered only a rebound within a bearish trend.

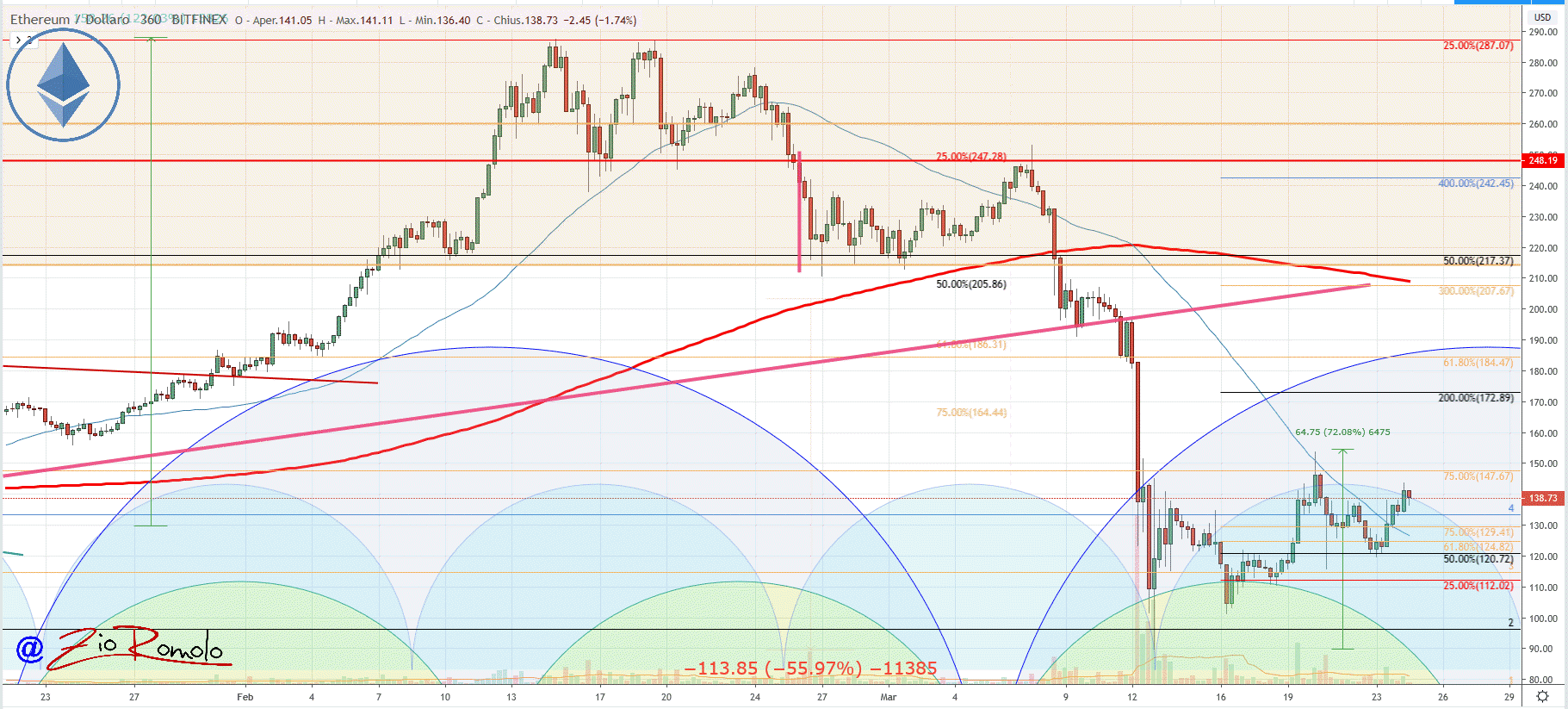

Ethereum (ETH)

In recent days, Ethereum has been developing a specular trend with BTC. After managing to maintain last night’s lows of $120, it is once again returning to a $140, a short-term resistance threshold.

In case of a break, the push to confirm the uptrend will have to sustain the rise above the $152, relative highs reached last Friday. A possible confirmation of this movement would project to the next ambitious target in the area 190 dollars.

Otherwise, a return of the bearish force and pressures under 120 dollars would contextualize the current movement as a rebound in a downward trend.