Bancor, a protocol for providing liquidity to the various tokens and blockchains, has announced that it has created a portal for statistics and market data to monitor the overall performance of its tokens and the various pools:

A new community-built interface using @graphprotocol displays in-depth Bancor market data:https://t.co/1vV7OTVjqq

📊 View network analytics

💧 Track the most active liquidity pools

⚡️ Convert #ERC20 tokensDeveloped by @StevenNonis

Learn more: https://t.co/s5Aaffq6vv

— Bancor (@Bancor) April 28, 2020

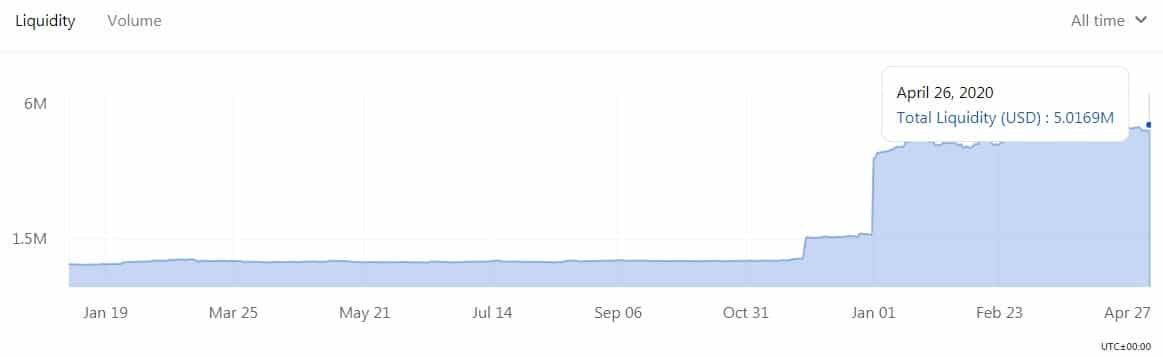

The interface is quite minimalistic but allows the user to see that both liquidity and volumes have always grown over time, especially since the beginning of 2020. The same trend takes place for decentralized finance (DeFi), which has exceeded one billion dollars:

The data shows which are the most converted crypto pools with their respective tokens. Obviously, Ethereum (ETH) is in the first place, followed by Enjin Coin (ENJ) and Basic Attention Token (BAT).

The whole project is open source so anyone can add or improve functions. Some of these contributions will be remunerated such as supporting wallets, introducing data on a dynamic and temporal basis, the various APRs and so on.

In addition, the same platform allows buying and selling assets and converting them with all the pools that there are, so there are no limits for the available tokens. The same is also true for the recent pBTC pTokens, obviously all on the Ethereum blockchain.

It should be remembered that the platform is still in beta, so there could be unexpected errors and it should be used with caution, so as not to lose funds in trades gone wrong, in fact, millions have already been lost due to attacks in this sector and other pools.

The major players in decentralized finance (DeFi) are moving and strongly marking a turning point with other projects and other protocols, for example, the perpetual contracts launched by dYdX and the various tokens pegged to Bitcoin (BTC) that allow this type of operations.