How to earn interest on your cryptocurrencies with BlockFi?

The large number of people who decide to buy and hold bitcoin for a long time is growing every day. Today they range from nerds, who love to experiment with new technologies, to professional investors who skilfully diversify their portfolios, to large institutional funds and big players in the fintech sector, such as PayPal.

Summary

HODL

Anyone who holds bitcoin as a store of value, in the belief that its value will be appreciated over time and as a hedge against rising inflation, is referred to as “HODLer“, from the term HODL, which originated as a typo in a 2013 post on Bitcointalk, now widely adopted by the crypto community.

Earn

Hodlers, until recently, were only able to wait patiently for the price of their cryptocurrency to rise. Today, thanks to various CeFi (centralized finance) platforms, they have the possibility of earning a very good interest by holding their tokens on these platforms.

Hodl & Earn

With this first article, we inaugurate a mini-series dedicated to the presentation of CeFi platforms, which allow earning interest on cryptocurrencies. We will focus our attention on the pros and cons of each, as well as assessing the risks associated with this activity.

There is also the possibility of earning even more substantial interest through DeFi, but this requires slightly more advanced skills and will not be the subject of this mini-series.

All that glitters is not gold

First of all, it is useful to understand that when engaging in this activity there are additional risks involved, as compared to holding cryptocurrencies in offline wallets (cold wallet).

The new risks, to which we are exposed, are mostly related to the so-called “platform risk”; therefore, our account being hacked, or the platform being hacked or turning out to be a scam.

All these new risks can be mitigated in two main ways:

- by diversifying, thus using several platforms, even with less interest

- relying on solid, reliable platforms with a valid authentication system (2FA).

Interest on crypto with BlockFi

Today we are analyzing the BlockFi platform which, with its BlockFi Interest Account, is the most institutionalized solution in this area, as it is supported by the likes of Coinbase Ventures, Morgan Creek Capital Management, Winklevoss Capital and others.

With minimalistic graphics it simplifies your balance sheet (INTEREST ACCOUNT BALANCE), the interest already earned (TOTAL INTEREST PAID) and the interest that will be paid at the end of the month (ACCRUED INTEREST), all expressed in US dollars.

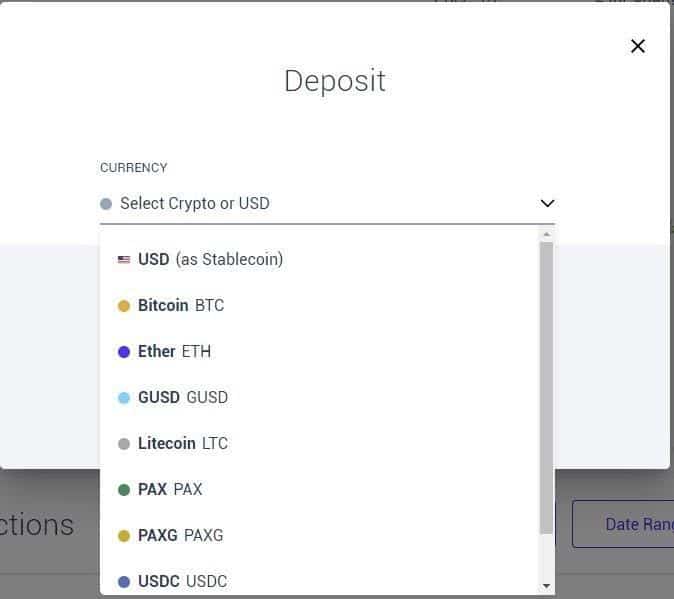

Ease of use is the feature that sets it apart: to start earning interest it is simply necessary to make a deposit using one of the supported cryptocurrencies

Simply click on the “+ Deposit” button and the menu for selecting the accepted cryptocurrency will open.

By selecting the crypto on which we wish to earn interest, we will be shown the address of the wallet on which to deposit the funds and for convenience also in QR Code format.

We will be shown a warning that is very important, advising us not to deposit a different cryptocurrency to that address than the one previously chosen, otherwise we will lose the funds sent.

Finally, any estimated transaction costs, vendor fees, etc. will be shown.

The BlockFi platform does not charge any deposit fees, nor does it charge fees for the first monthly withdrawal.

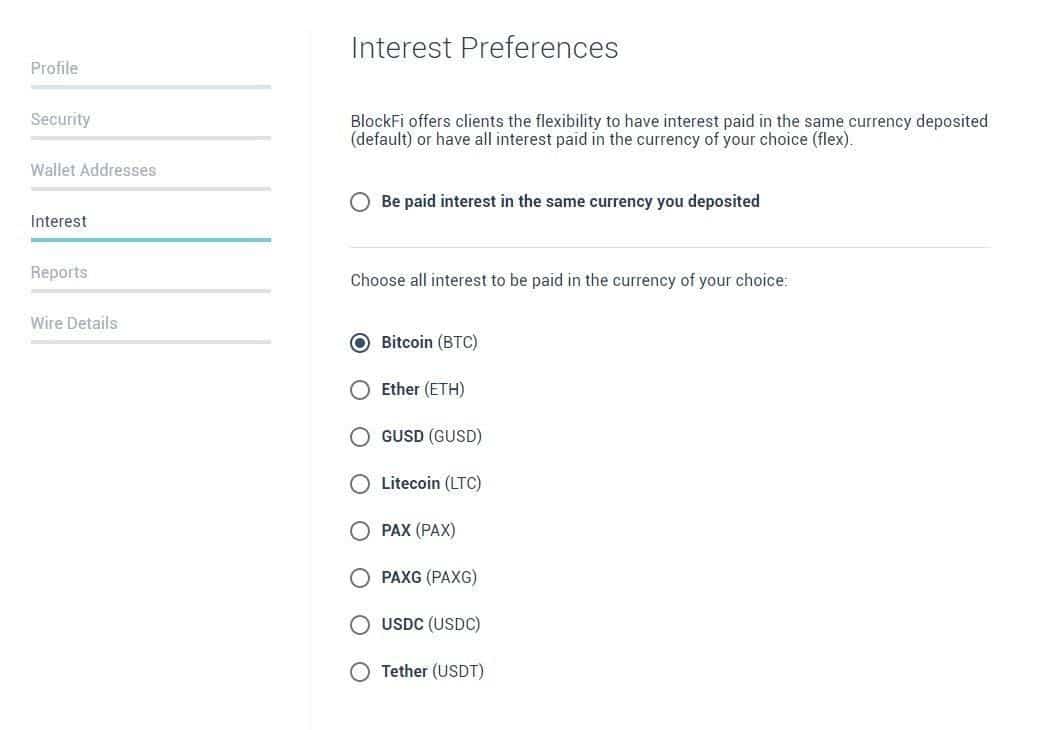

Another extremely interesting feature is that of being able to choose in which cryptocurrency you want to receive interest.

You can then decide to receive it in the same crypto, or channel the interest accrued by the various cryptocurrencies, converting it all into your preferred one.

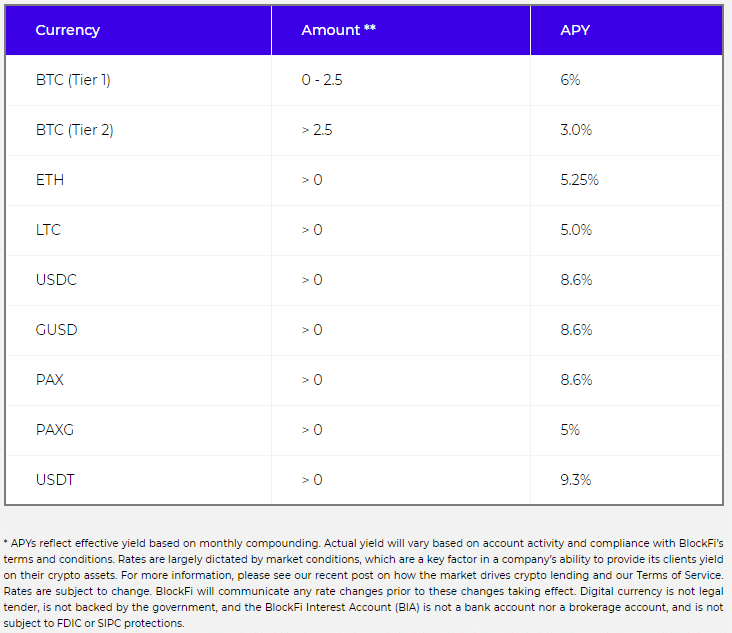

Interest is paid at the end of each month and rates are now very competitive: as reported on https://blockfi.com/rates/ we can receive 6% per annum on BTC, 5.25% per annum on ETH, 5% on PAXG (Pax Gold, essentially tokenized gold) up to 9.3% on USDT.

As stated by BlockFi, interest rates may vary over time depending on market conditions and customer activity.

The platform offers a small first deposit bonus, which varies over time (currently $10 by depositing $100), by signing up via a referral link from a friend who introduces us.

You can sign up here if you prefer.

Up-to-date conditions on sign-up bonuses are available at this address.

Ultimately, the BlockFi platform, with its BIA (BlockFi Interest Account), offers an extremely simple and immediate solution, with excellent interest rates and the much-appreciated feature of being able to choose which cryptocurrency to receive interest in.

When diversifying CeFi platforms offering interest, BlockFi is certainly to be taken into account.