Bitcoin and cryptocurrencies are rather speculative assets than investment products, this was reported by a Wells Fargo analysis of investment strategies.

This is the incipit of the section dedicated to Bitcoin:

“2020 has been a wild and crazy year, so it is only fitting that the best-performing asset group in 2020 has the craziest-sounding name — cryptocurrencies”.

The report analyzes Bitcoin’s performance, defining it as the best, but also the most volatile. Bitcoin in fact gained 170% in a year, doing even better than 2019 when it closed with +90% compared to 2018.

However, explains Wells Fargo, cryptocurrencies cause a lot of talk but that doesn’t mean that they are also able to attract capital. In fact, they write, market capitalization is $560 billion, which is a quarter of that of the technology companies listed on the S&P 500 with the largest market capitalization.

The aim of the report actually seems to be to downplay the value of Bitcoin because of its excessive volatility.

Sources: Bloomberg, Wells Fargo Investment Institute.

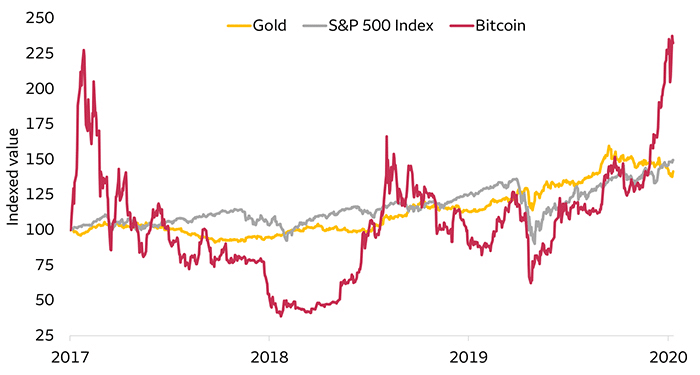

The chart in the report shows that yes, Bitcoin has performed better than gold and S&P 500 from 2017 to the present, but Wells Fargo’s analysts point to the “volatile journey” that Bitcoin investors have had to endure for three years.

Bitcoin and cryptocurrencies, speculation rather than investment

In fact, John La Forge writes:

“Up until only two months ago, three-year total returns were pretty much the same among the three assets, but volatility differed. Cryptocurrency investing today is a bit like living in the early days of the 1850’s gold rush, which involved more speculating than investing”.

Nevertheless, the conclusion seems to give confidence to the whole sector. John La Forge argues that cryptocurrencies can become an investment product one day. After all, in 12 years, they have gone from being worth nothing to a capitalization of $560 billion.

For this reason, the analyst argues:

“Fads don’t typically last 12 years. There are good reasons for this — reasons that every investor should hear. As we roll into 2021, we’ll be discussing the digital asset space more — its upside and downside”.