Bitcoin has jumped another 2% today, once again doubling its value since the beginning of the year.

This is the seventh consecutive day of gains for Bitcoin, equalling the record number of consecutive days between the end of December and the beginning of 2021.

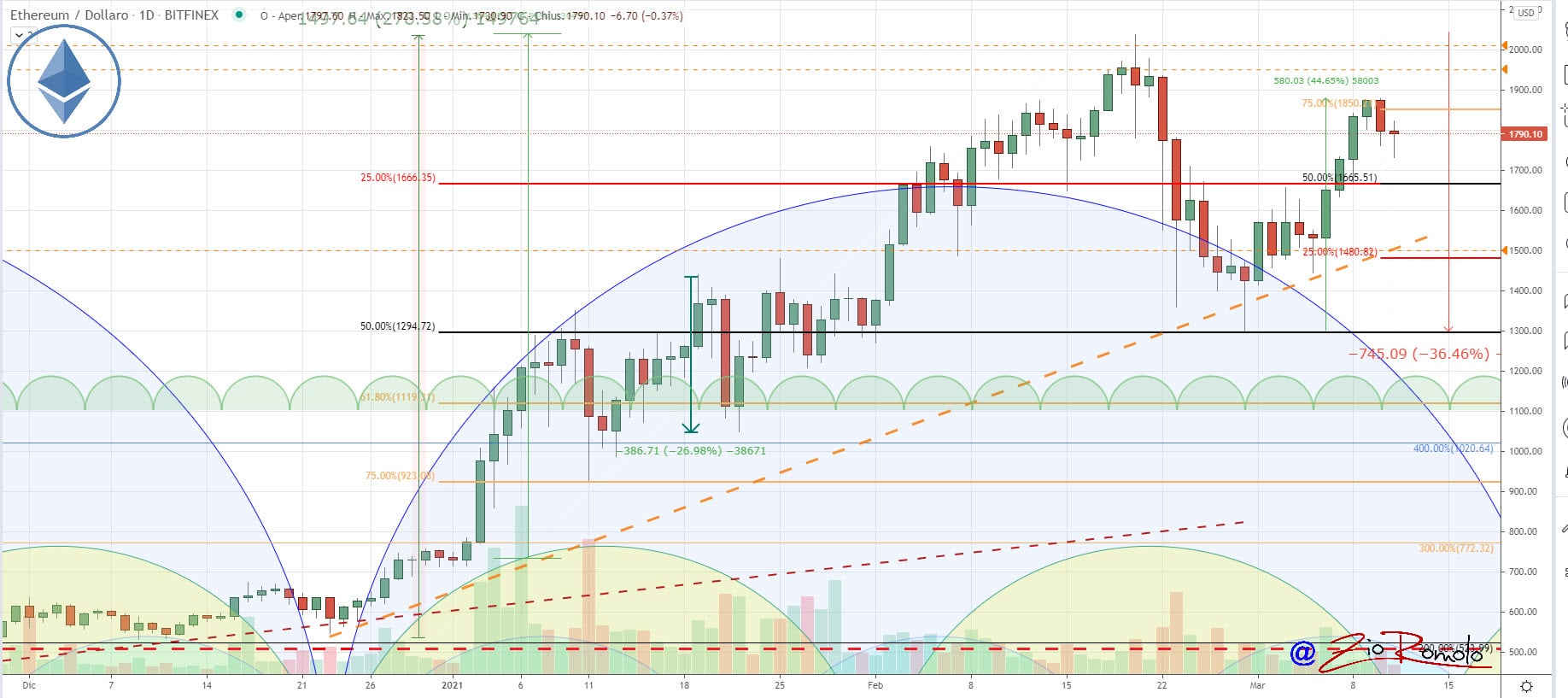

Ethereum also did well, rising again above $1,800, where profit-taking has started in recent hours. Ethereum has gained more than 150% since the beginning of the year.

Ethereum is now down 2%, so profit-taking is causing the price to slip back below $1,800 with a loss of 2% from yesterday’s highs.

The day is predominantly red. Among the big players, Binance and Bitcoin were once again up, as was Theta (THETA) in 16th place, with a daily gain of over 30% and a price that for the first time ever exceeded $7.

Better than Theta, Chiliz (CHZ) continues to shine, rising more than 40%, updating its all-time high above 40 cents.

The total market cap rises to $1.725 billion with Bitcoin climbing back above the $1 trillion mark after two weeks and dominance returning over 61%.

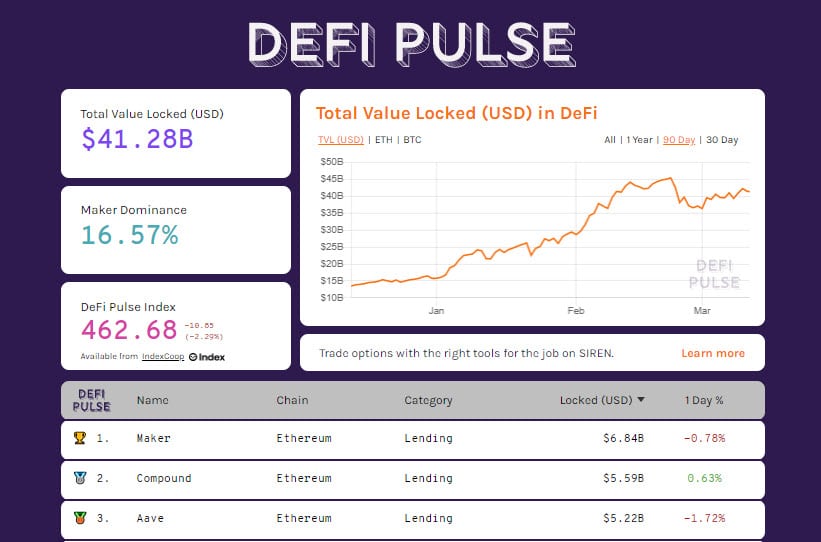

DeFi remains above $41 billion with tokenized Bitcoin continuing to fall back below 30,000 BTC, their lowest level in two months.

Summary

Bitcoin (BTC), a jump towards record highs

With the rise of the last few hours, Bitcoin prices are back within a step of the February 21st records, a climb accompanied by low volumes. If there are no volumes, the price should consolidate above $54,000 in the coming days.

Ethereum (ETH)

The climb towards the $1,900 mark, the highest peak in 13 days, triggers profit-taking with prices falling back to test the $1,750 mark. In both the short and medium-term, Ethereum is benefiting from the momentum that has accompanied the rise since late December. At the moment, only a return below 1,500 dollars would trigger the first signs of selling.