The aggregate crypto market capitalization continues to hold $1.3 trillion and has respected that level since the peak of the bull market thus far. While alts have continued to sell off this week, BTC has practically been fixed to $33k.

The fate of the macro crypto market continues to hang in the balance in the short term and today we’ll analyze two assets that make up a portion of the larger macro picture – Ethereum and Binance Coin.

Ethereum Analysis

Ethereum’s historic stretch over the last 12 months has been dramatically impacted by bitcoin and the macro’s dearth of positivity over the last few months.

Ether dominance accounts for 16.4% of the aggregate market capitalization of $1.386 trillion. On this date last year the aggregate crypto market cap was $278 billion. Ether’s market cap alone is $225 billion at the time of writing.

Ether [-2.3%] is barely back below $2k and really trying to hold that level but bullish bidders have been unable to push ETH’s price back to the top of its range around $2,5k.

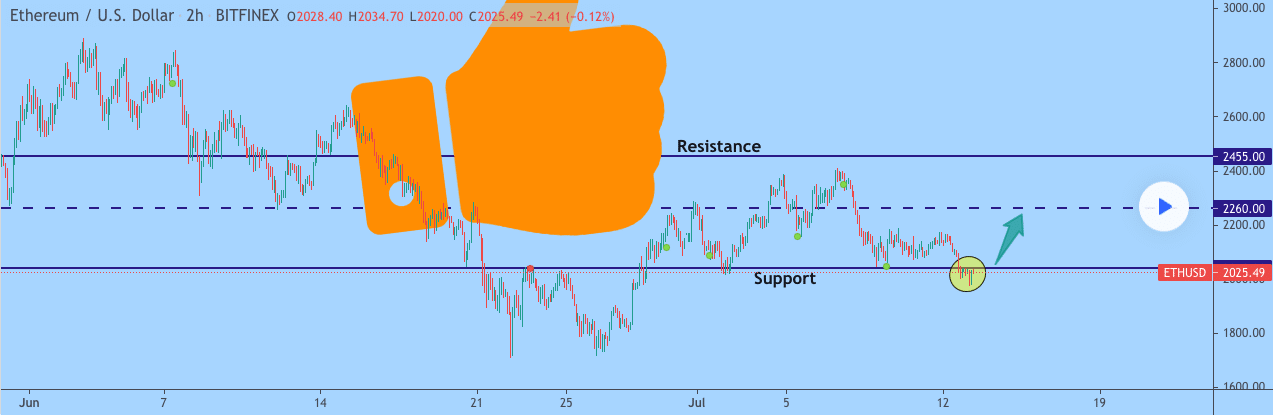

The below 2hr chart from AtlasTrades shows just how important this range is and how respected this range has been since the end of June.

The overhead resistance at $2,500 hasn’t been able to be cracked yet but the downside at $1,600 should be strong if challenged as well. Below $1,600 to the downside the next stop would be the former ATH around $1,400.

Ethereum’s 24 hour range is $1,918-$2,043. Ether’s average price for the last 30 days is $2,142.

Ether’s daily close on Tuesday was $1,940.72 for back to back closes in red figures.

Binance Coin [BNB] Analysis

Binance Coin [-.60%] continues to outperform the market during the downtrend and is +1,586% for the last 12 months.

To highlight BNB’s strong performance over the last year you only need to look at BNB against BTC and ETH. BNB is +374% against BTC for the last year and +109% against ETH.

Will Binance Coin continue to lap the field to close 2021 and to start 2022?

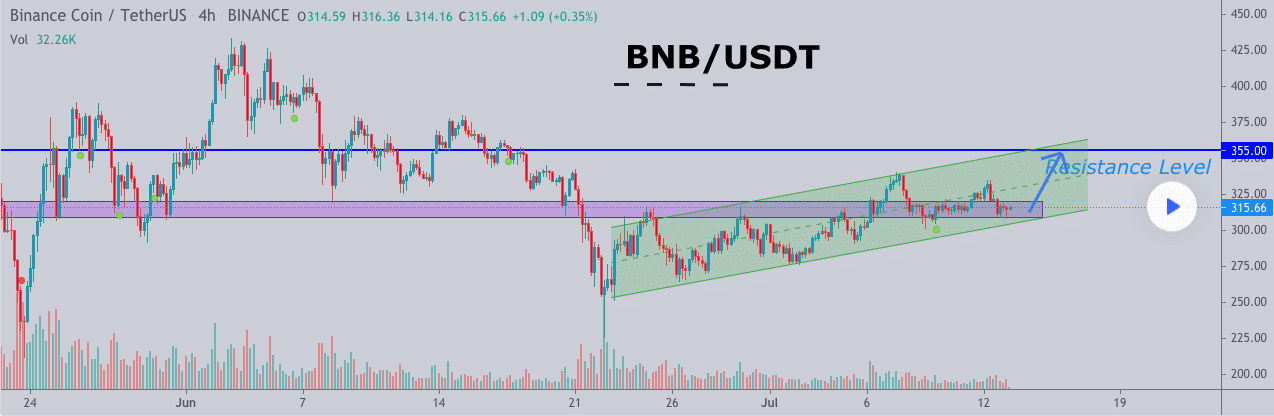

The above 4hr chart from YMGroup shows the rising channel BNB has been trading in dating back to the 22nd of June. Binance Coin has respected the bottom of this trendline almost 6 times during this stretch of price action.

If the macro does indeed turn around as many analysts believe it will this autumn, BNB could be positioned to help lead the market upward.

Binance Coin’s 24 hour range is $305-$318 and the 52 week range is $16-$684. BNB’s 30 day average price is $311.

BNB closed Tuesday’s daily candle worth $308.97 and in red figures for the second consecutive day.