In the just-released September Bloomberg Crypto Outlook, it is stated that Bitcoin is on track to become the world’s digital reserve asset.

This report was published recently, and was written by Bloomberg’s BI Senior Commodity Strategist Mike McGlone.

Summary

According to the report, cryptocurrencies are reviving

McGlone argues that cryptocurrencies appear to be enjoying a resurgence thanks to a refreshed bullish market, with Bitcoin lagging somewhat behind DeFi and Ethereum.

First of all, he sees the price of BTC heading towards $100,000, and that of ETH towards $5,000, i.e. +100% and +28% respectively, although he does not say by when this should happen. He does, however, specify that a decline in macro risks would be needed to get there.

He also sees portfolios that include gold and bonds as “increasingly naked” unless there is also some BTC and ETH.

The fact is that, having survived the May and June correction, crypto assets would now be ready to thrive.

He writes: “We see the crypto market more likely to resume its upward trajectory than drop below the 2Q lows”.

And while similar scenarios have already been described by other analysts lately, what McGlone writes begins to outline unprecedented scenarios within the world of traditional finance, to which Bloomberg rightfully belongs.

A potential revolution

In fact, according to the Bloomberg analyst, cryptocurrencies reflect a potential revolution in money and finance, and Bitcoin “is well on its way to becoming the digital reserve asset in a world going that way”.

That is, there is explicit talk of a process of revolution in money itself, and of Bitcoin as the big player in this revolution.

Indeed, in such a scenario McGlone speculates that Bitcoin might in the future even be recognized globally above all as a store of value, suggesting between the lines that it might take the place of gold.

He then adds that Ethereum recently joined bitcoin in this respect, with a declining supply trajectory by code, and that it is the number 2 cryptocurrency as it is “the building block of DeFi”.

The report also states that bitcoin and gold have high potential to continue to rise in value, particularly if US Treasury bond yields resume their downward trajectories.

A sustained bullish market

Regarding bitcoin, McGlone says that having corrected by more than 50% and formed a good base of support within what should be considered a sustained bullish market, the likelihood is that price trajectories will resume their upward trajectories. Furthermore, in the years following the halving (2013, 2027 and 2021) there has been a 55x increase in value in the past in 2013, and a 15x increase in 2017, while in this 2021 it has stopped at a 4x increase for now.

According to McGlone, Bitcoin represents the digital future, as it may have solved the age-old problem of being both an easily transportable, transactional, global reserve asset with 24/7 trading, relatively scarce and essentially owned or controlled by no one.

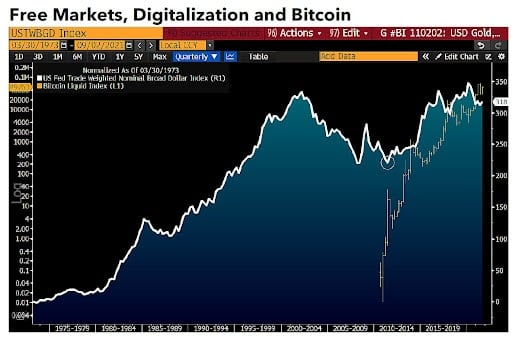

Finally, he adds a chart that seems to suggest that the trajectory of the trade-weighted broad dollar began to rise after the advent of Bitcoin.