A couple of days ago, ZeroHedge published an article explicitly quoting a Goldman Sachs prediction on the price of Ethereum (ETH).

Inflation triggers a crypto boom

ZeroHedge quotes a note from the bank’s managing director for global markets, Bernhard Rzymelka, which would show that cryptocurrencies have been trading in line with the breakevens of inflation since 2019.

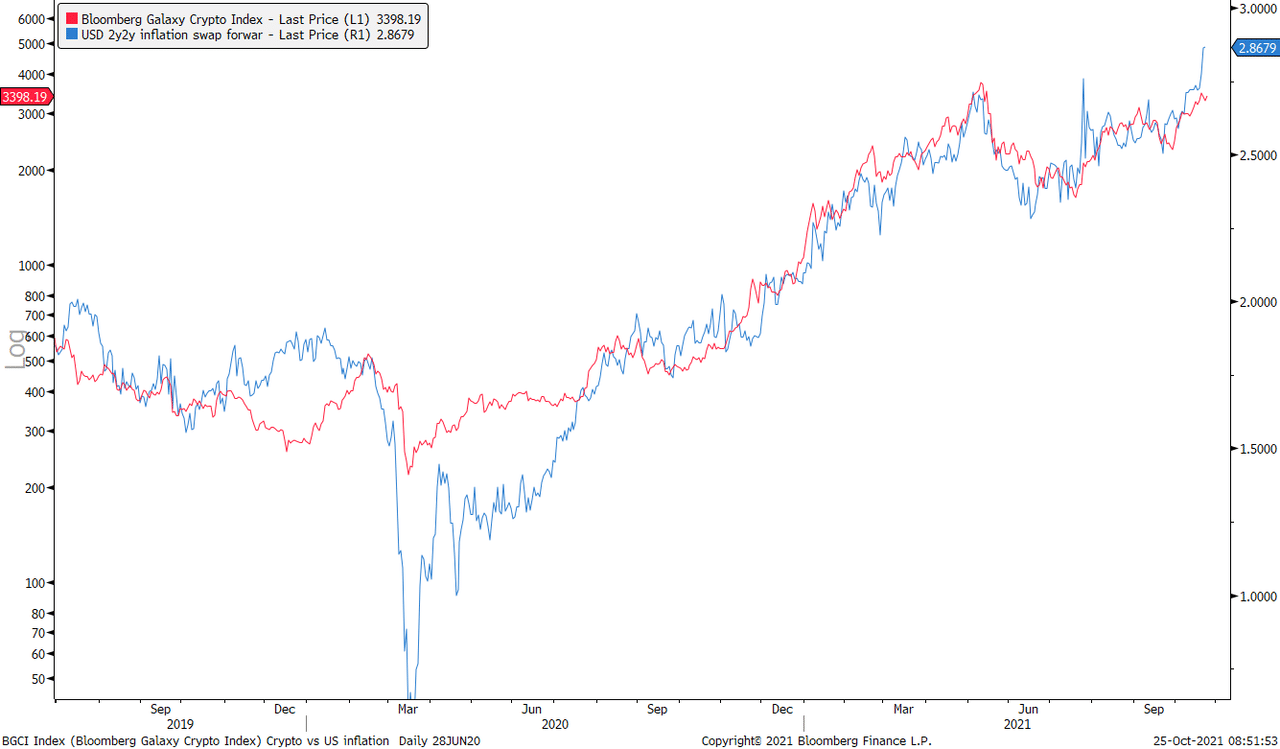

The analysis would be based on a chart showing a comparison between the Bloomberg Galaxy Crypto Index on a logarithmic scale and the 2-year US dollar inflation swap.

This comparison seems to draw a correlation between the two curves, although there is no evidence that this is actually a causal relationship. However, their conclusions are that inflation is certainly a driving force behind the recent rise in the value of cryptocurrencies.

ZeroHedge comments:

“Which is delightfully ironic as some of crypto’s biggest detractors are also some of the biggest Fed fanboys, who habitually cheer on the Fed’s catastrophic monetary policy; little did they know that the record surge in cryptos would be most direct outcome of said policy”.

Goldman Sachs: a favourable environment for Ethereum

In light of this, Rzymelka argues that the current environment looks favourable for Ethereum (ETH), because it has been tracking inflation markets particularly closely recently. The latest spike in inflation breakeven would suggest new potential, should this correlation persist.

Rzymelka also adds that the recent spike to just under $4,500 could be either a sign of bull run exhaustion or a starting point for a new acceleration. In that case, the price of ETH could rise as high as $8,000 in the next couple of months, assuming the aforementioned correlation with inflation persists.

Another interesting factor is the fact that the RSI has yet to reach the overbought levels seen during bullish periods in the past, which would suggest a possible new rally.

Rzymelka also points out that US inflation swaps suggest core inflation of 2.50% or higher for the next 5 years; which could bring further benefits in the long run.