The US Congress has passed the Infrastructure Bill, which will also have implications for crypto taxes.

Summary

The Infrastructure Bill

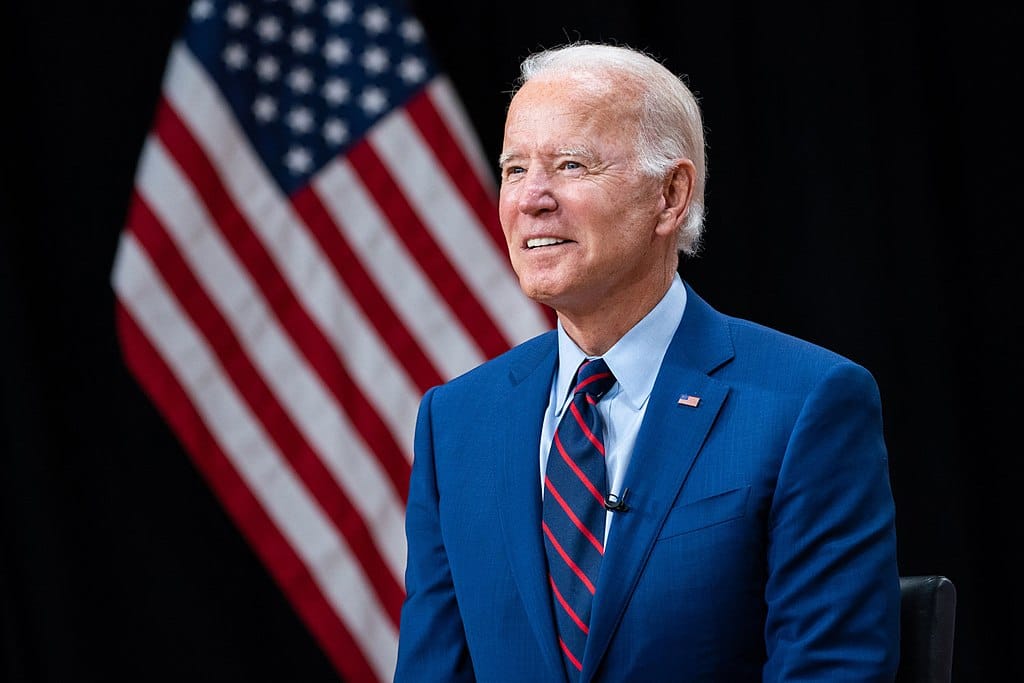

Joe Biden had a relieved smile on his face when he announced to the press that the Infrastructure Bill, the very ambitious $1.2 trillion infrastructure plan, is now law.

It is the largest investment plan in 70 years, dating back to Roosevelt’s New Deal in 1933.

America, as Biden often reminds us,

“is the richest country in the world, but only thirteenth in terms of infrastructure provision”.

This grand plan should finally close this gap with other industrialized countries.

“We will not increase the deficit. On the contrary, we will reduce it over time. Because the spending measures will be financed by making the richest people pay what’s fair, what they owe”,

President Biden said.

Crypto taxes, what the Infrastructure Bill entails

But it’s not just the rich who will have to use their taxes to finance this massive spending plan, because if it is approved as it was in the first draft, the plan would decisively affect the entire cryptocurrency market.

The bill envisages a tax levy on cryptocurrency transactions of $28 billion.

In August, two amendments seeking to reduce this tax burden on cryptocurrency-related activities such as mining were rejected by the US Senate.

In drafting the legislation, the US senators included a change to the Internal Revenue Service’s classic definition of “broker” specifically to include organizations that trade cryptocurrencies.

This means that if the bill is signed into law by President Biden, as seems likely, centralized cryptocurrency exchanges such as Coinbase, Huobi, Binance and BitMEX will be considered brokers and will be required by law to report their transactions directly to the IRS.

Crypto world in turmoil

The cryptocurrency world immediately rose up in protest at what it sees as a punitive measure for the industry.

Meltem Demirors, CSO of Coinshares said bluntly:

“This bill is unconstitutional and inherently anti-American. Private citizens have the right to financial privacy and financial freedom. Absolutely shameful to see this”.

The US has long been debating how to tax and regulate cryptocurrency transactions and related activities.

The new infrastructure plan seeks to fill a regulatory void that grants cryptocurrencies privileged status over the traditional financial world, at least from a tax perspective.

Currently, US investors must report their gains in cryptocurrencies to the IRS as they would for any investment.

But the POSA report claimed that the bill will now require them to also report the receipt of any digital assets worth more than $10,000. Failure to do so within 15 days will be considered a tax offence.

But clearly, these provisions in the world of cryptocurrencies, especially in the world of decentralized finance, are a very complicated operation, because they are not controlled by a central authority as in the case of traditional financial investments.