This article explores a breakout trading system on Bitcoin.

Summary

Not only “Hold”

This operation is mentioned because if it is true that the simple buy&hold, or as it is called by some: “hold”, of cryptocurrencies still pays a lot (see the last rally of 2021) there are also other approaches, other strategies, which if set correctly can pay just as well. These strategies can also contain what are the risks of a more trivial “buy and forget” type of operation, which could somehow expose our account to greater fluctuations than a short-term long/short operation.

But what are the predominant characteristics of the cryptocurrency market? Does their nature tend more to follow well-defined trends or to reverse on precise price levels? This is the first question that needs to be answered because, in order to have an advantage, an “edge”, over the market, it is necessary to know what are the peculiarities of the underlying that you are going to trade.

The “trend following” strategy on Bitcoin

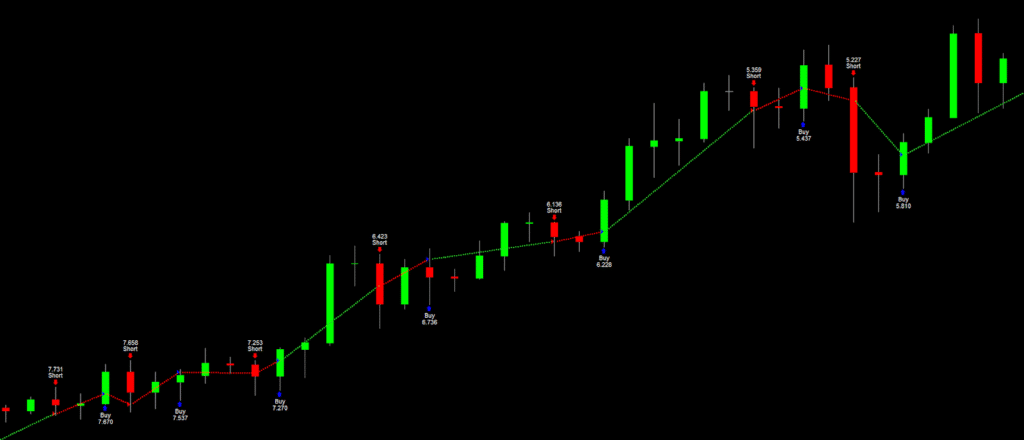

The most traded cryptocurrency was examined: Bitcoin. A simple “trend following” strategy that buys and sells on precise levels, namely the high and low of the previous day. Figure 1 shows an example of how the previous day’s highs and lows vary.

These levels are updated once a day and remain fixed throughout the session. The idea is to use the trends to your advantage. If the market goes up until it breaks the highs of the previous day then a long position should be entered. If the market goes down to the lower trigger, the previous day’s low, then a short position should be entered.

Figure 2 shows an example of the pattern in question, where we see the strategy entering when the levels mentioned above are broken. In the chart are plotted Daily bars and a size of $100,000 is used for each trade (this is to standardize the backtest). Bitcoin has really gone up a lot in the last few years and to have uniformity of results, a very large fixed monetary size is used which allows to scale the number of contracts without problems.

This strategy will tend to gain in the moments when the market breaks sensitive levels and continues in that direction in the following days. direction also in the following days.

We then proceed with a test of this idea on the past, to see what kind of returns it would have generated.

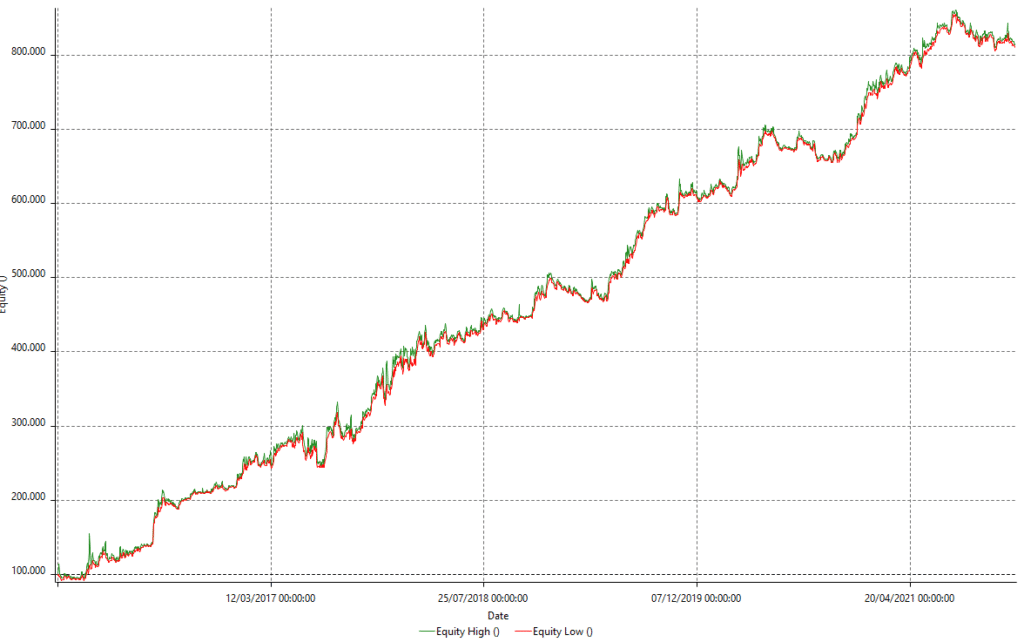

As can be seen from the image in Figure 3, the cumulative profit curve that would have been generated from 2015 – the year the study started – to the present day, would have generated significant profits.

The curve seems to be very constant both in the initial moments of the backtest and in the last period, where a very small weakening of performance is visible.

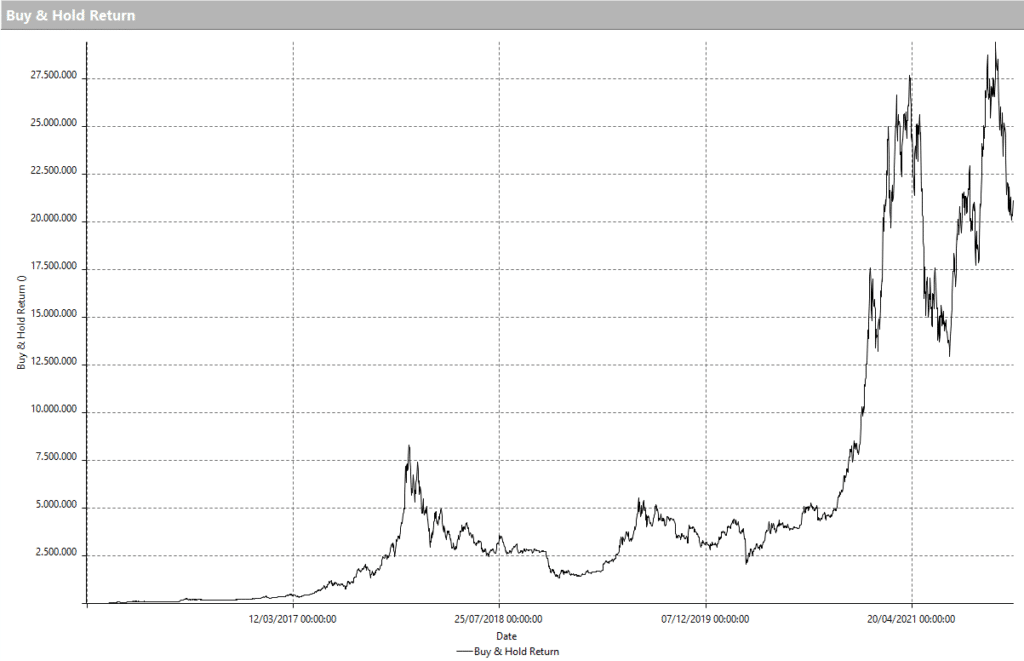

Clearly, the profits that would have been generated by the simple buy&hold of Bitcoin (Figure 4) would have been much higher (in absolute value). However, it is also possible to notice how the progression of profits is better with a systematic trend following operation (both long and short), compared to the simple buy&hold. In particular, the drawdowns of the strategy are much lower, indicating that the pains generated by this operativity could be less than the buy&hold strategy.

Moreover, judging from the profit curve, the systematic operation would have produced excellent gains in almost every period of the historical period considered. This is quite different when looking at the price of Bitcoin which has experienced many years of “bear market”. Difficult, if not impossible, to sustain. Think about the first big drawdown of the curve, particularly if you had started “holding” Bitcoin in late 2017. Within a few months you would have faced a drawdown of a hefty 50%, which would have even worsened in the months ahead. To recover a 50% drawdown requires positive performance of 100%. Whereas after a “run-up” of 100%, a drawdown of 50% would be sufficient to return to the starting point.

Apart from being difficult to sustain psychologically, there is also a significant risk factor in the simple buy&hold, compared to a long/short operation that can protect the investor when the market becomes extremely volatile.

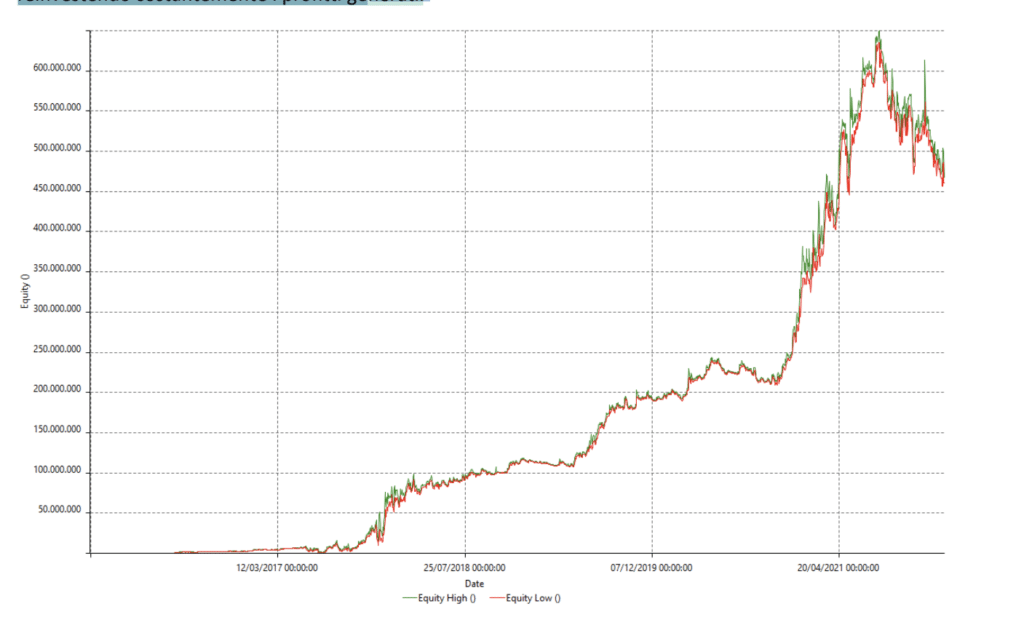

In the test conducted so far (trend following strategy on Bitcoin) the potential of reinvestment of profits generated during the years is not considered. What would happen if active management of the number of contracts was added to this strategy?

For example, by setting up a classic money management method, i.e. the “Fixed Fractional”, where a fixed percentage of the capital is invested, would the profits generated by the systematic operation be better than the buy&hold (even if only the profits generated were considered)? In Figure 5 we can see that the answer is yes, because by applying money management to the breakout strategy, we get frighteningly large profits. And that’s only by risking 1% of your capital per trade and constantly reinvesting the profits generated.

There are a number of factors to consider, but from what has emerged in this study, both strategies provide excellent results. Only one of them, however, safeguards more the investor, as well as ensuring large profits if the strategy is used through the reinvestment of profits. Obviously, reference is made to the systematic and automatic strategy. On the other hand, the buy-and-hold would have exposed the investor’s account to long drawdowns that are really very difficult to manage.

Author:

Andrea Unger. Italian trader and author known for being the only four-time World Trading Champion (2008, 2009, 2010, and 2012). Graduated with honors in Mechanical Engineering at Politecnico di Milano, member of MENSA, independent trader since 2001.