SPONSORED POST*

The crypto market can be incredibly lucrative if you can successfully anticipate which up-and-coming altcoins are going to shoot up in value. Anyone who bought cryptocurrencies like Avalanche, Solana, Shiba Inu and Cardano early on made thousands of percent in capital gains on their rapid rise last year. Now in 2022, crypto investors are looking for the next big thing and one coin is edging ahead of the pack. RBIS, the token behind the ArbiSmart project is currently valued at approximately $0.5 but a variety of indicators point towards a significant rise in price in the months ahead.

Summary

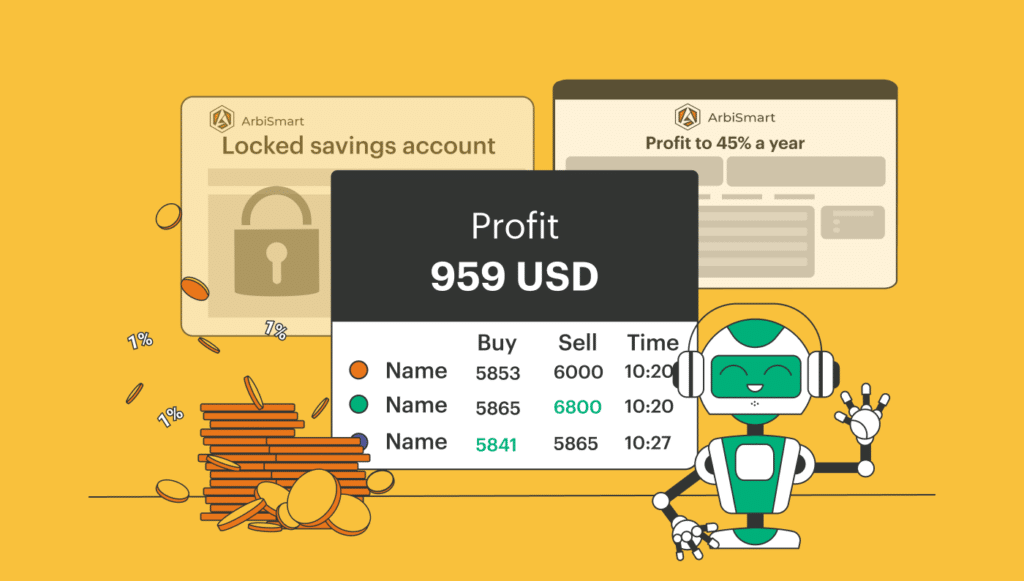

The strong profit track record

ArbiSmart has built its steadily growing community by providing automated crypto arbitrage. The platform generates consistent passive profits from temporary price differences across exchanges that reach up to 45% a year. It’s worth noting that since price discrepancies emerge equally regularly, whether the market is soaring or sinking, ArbiSmart is able to generate reliable, steady profits even in a crypto crash.

Passive profits can also be earned by storing capital in a locked, long-term savings account. Based on the amount deposited and the time-period chosen for the lock on the funds, interest rates can reach as high as 1% a day.

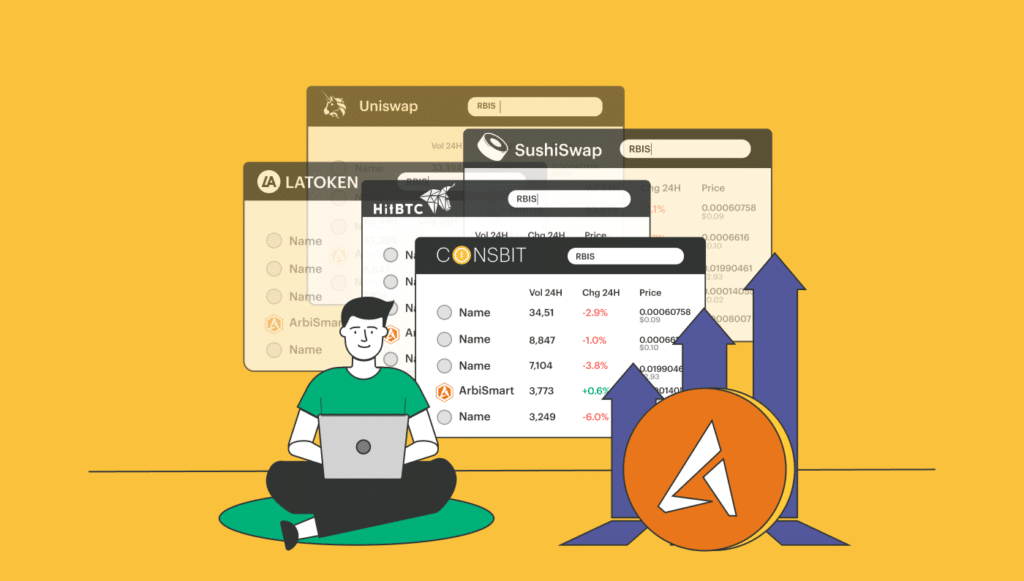

The accelerated listing process of RBIS

The RBIS listing, which began at the start of January is gathering momentum, and the token is already available on major global exchanges like, SushiSwap, Coinsbit, HitBTC, LAToken and Uniswap.

Every additional listing means higher liquidity, greater trading volume and an increasingly large audience, as new exchange communities gain exposure to the token.

Rising demand will incentivize more leading exchanges to add RBIS throughout 2022, which should push up the token price even higher.

The expanding array of crypto services

The ArbiSmart evolution from a crypto arbitrage platform into a multi-service crypto finance ecosystem will be kicking into high gear later his month with the introduction of a decentralized yield farming program. Participants will be able to contribute to ETH/RBIS and USDT/RBIS liquidity pools for industry-high rewards. In return for staking capital, RBIS holders will receive up to 190,000% APY, as well as 0.3% of the fees on every transaction.

ArbiSmart is keeping up the pace next quarter, with the release of a marketplace for non-fungible tokens (NFTs). The NFTs, which can be bought with RBIS, certify the ownership and authenticity of a collection of 10,000 unique digital artworks.

Q2 will also see the introduction of a wallet supporting both FIAT and crypto. In addition to providing secure storage, the interest-generating wallet will offer highly competitive rates of of up to 45% a year, depending on the size and currency of the deposit.

These upcoming developments are set to raise token demand, while simultaneously causing the limited supply of RBIS to drop. Throughout H2 of 2022, and into 2023, the demand should soar even higher, as a result of the fact that multiple new RBIS utilities are being introduced. These will include a mobile app for buying storing and exchanging crypto, an ArbiSmart cryptocurrency exchange, and a launchpad funding promising new altcoins. Planning ahead, ArbiSmart has also just upgraded its EU license to authorize it to provide crypto banking services, and in the coming year, it is aiming to offer IBANs, payment service solutions and crypto debit cards.

With demand on track to outpace supply, as new RBIS utilities are introduced in the coming months, the price is likely to increase significantly, and analysts are projecting a 4,000% jump in 2022.

To make the highest possible gains on the growth of the ArbiSmart project, buy RBIS now!

*This article has been paid. The Cryptonomist didn’t write the article nor has tested the platform.