Summary

Bitcoin Analysis

Bitcoin’s price was sent lower to conclude the week’s final daily candle on Sunday and finished -$965.

The BTC/USD 1D chart below from George_27 shows BTC’s price bumping up against the top of its descending channel. Bitcoin’s price was rejected at the $46k level as traders will note below. Bullish traders are attempting to crack the bottom of the $44k-$46k level but have been denied thus far, at the time of writing.

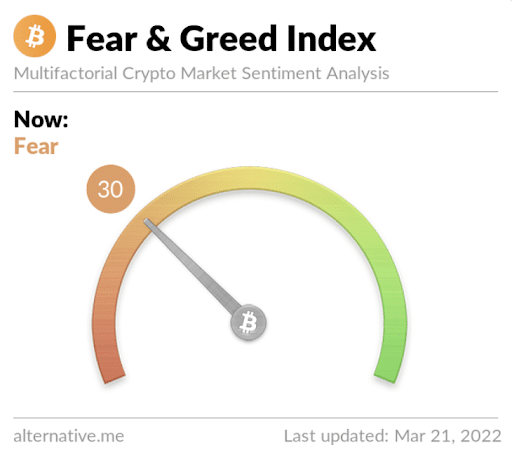

The Fear and Greed Index is 30 Fear and is -1 from Sunday’s reading of 31 Fear.

Bitcoin’s Moving Averages: 5-Day [$40,382.62], 20-Day [$39,966.53], 50-Day [$40,465.43], 100-Day [$47,204.72], 200-Day [$45,793.23], Year to Date [$40,803.25].

BTC’s 24 hour price range is $41,020-$42,322 and its 7 day price range is $37,842-$42,322. Bitcoin’s 52 week price range is $29,341-$69,044.

The price of bitcoin on this date last year was $57,573.

The average price of BTC for the last 30 days is $39,890.

Bitcoin’s price [-2.29%] closed its daily candle worth $41,249 and in red figures for the first time in three days on Sunday.

Ethereum Analysis

Ether’s price also traded lower to close its daily candle on Sunday than it opened the day and concluded its daily session -$87.88.

The second chart we’re analyzing today is the ETH/USD 1HR chart below from @BalanceOt. Ether’s price is trading between 23.60% [$2,902.11] and 0.00% [$2,983.20], at the time of writing.

Bullish Ether traders are seeking a full retracement just below the $3k level before testing that level and hopefully regaining it.

Conversely, bearish ETH market participants are looking to push ETH’s price back below the $2,9k level and down to test a secondary target of 38.20% [$2,851.94]. If they’re successful at the 38.20% fibonacci level the third target of bearish traders is 50.00% [$2,811.40].

ETH’s 24 hour price range is $2,826-$2,962 and its 7 day price range is $2,518-$2,974. Ether’s 52 week price range is $1,558-$4,878.

The price of ETH on this date in 2021 was $1,790.

The average price of ETH for the last 30 days is $2,699.

Ether’s price [-2.98%] closed its daily candle on Sunday worth $2,861.79 and in red digits for the first time in seven days.

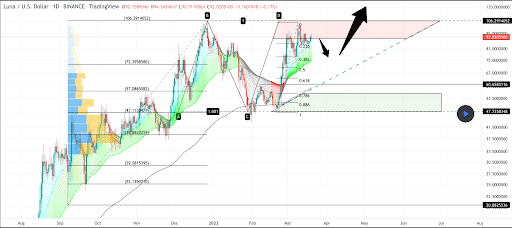

Luna Analysis

Luna’s price finished -$1.56 and in red figures for the first time in three days on Sunday.

The third project we’re looking at today is Luna and the LUNA/USD 1D chart from Super_B_XinR. Luna’s price is trading between the 0.236 fib level [$87.08] and a full retracement at 0 [$103.88].

Bullish Luna market participants are aiming to again go up and test a psychological resistance back at the three figure boundary and then they’ll take aim at Luna’s all-time high of $103.88.

From the bearish perspective, they’re seeking to snap the 0.236 fib level and then looking to send Luna’s price down to test 0.382 [$77.22]. The third target to the downside for bearish Luna traders is 0.5 [$70.41].

Luna’s 24 hour price range is $90.32-$94.38 and its 7 day price range is $83.11-$94.97. Luna’s 52 week price range is $4.08-$103.88.

Luna’s price on this date last year was $22.00.

The average price of LUNA over the last 30 days is $81.83.

Luna’s price [-1.69%] finished its daily session on Sunday worth $90.61 and above the $90 level again for the second consecutive day.