New report from the Intelligence division of Blockware Solutions analyzes and predicts the adoption rate of Bitcoin and other disruptive technologies.

Summary

Blockware Intelligence’s report: an analysis of Bitcoin adoption

The latest publication from Blockware Intelligence, the research division of Blockware Solutions, analyzes user adoption of Bitcoin.

To predict the rate of Bitcoin adoption, the model compared the adoption curves of the most disruptive technologies that have changed the concept of society forever. These include the Internet, followed by the automobile, electricity, radio, smartphones, social media etc.

The report explains how the curve representing the time series of the adoption rate of a technology is never linear:

“Societal adoption of disruptive technologies is never a linear process – it has always followed an exponential S-Curve pattern. Bitcoin is a disruptive technology network that is quantifiably still in its early stages of adoption”.

We’ve been talking about the fateful mass adoption for years now. But what is meant specifically, and how is it calculated?

Mass adoption, in this case of Bitcoin, refers to the percentage of the world’s population that adopts and uses BTC as currency, as an alternative or in addition to the traditional fiat currency.

To fulfil this specific task, Bitcoin should fulfil the main functions of currency: unit of account, medium of exchange and store of value. Due to the general volatility of the cryptocurrency market, some of these properties may be compromised.

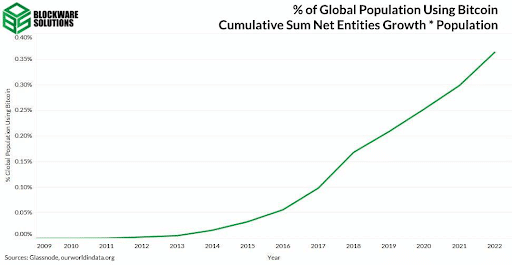

The following graph shows the cumulative sum of new users as a proportion of the global population.

Report Findings & Results

Bitcoin, like all technologies that need a community to support them, especially social media, enjoys the so-called “network effect”. This means that the more people recognize and adopt it, the more it reaps benefits, and vice versa.

Just think of Facebook’s network for example. If it were used by only 10 people, it would fail to fulfil its potential, just as those who use it would not benefit at all.

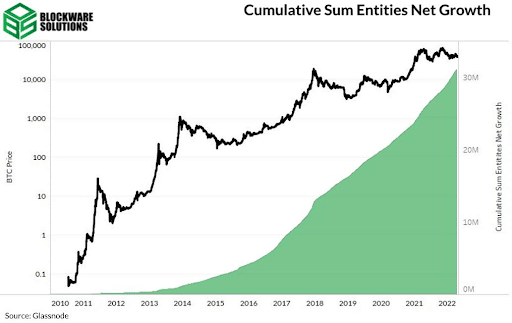

Consequently, more adoption equals a higher price. There is a positive relationship between the two factors, as the utility of the cryptocurrency itself increases, which is followed by an expansion in demand that increases its value.

In this graph, the metric to the right of the y-axis represents the growth in users net of those who have left the network. This type of approach thus allows more information to be obtained, rather than just studying the entry of new users.

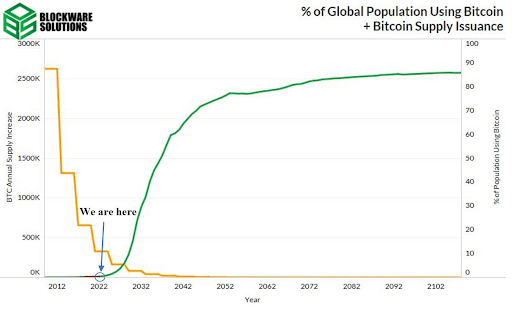

The same variable was then used to calculate the final forecast of future Bitcoin adoption, projected beyond the year 2102.

The report concludes by warning readers not to assume and absolutely not to take the results obtained as true:

“This is not meant to serve as a scientific short term trading tool, but rather a conceptual guide for long term Bitcoin investors”.