Bitcoin’s hashrate has seen a slight reduction in recent days.

Summary

After the all-time high, Bitcoin hashrate falls

Following the all-time high on 8 June, when it surpassed 250 Ehash/s with a peak at nearly 290, it now seems to have stabilized around 200 Ehash/s.

This is a 20% drop from the highs, with a post-record low of around 175 Ehash/s made on 17 June.

It is no coincidence that just then, shortly after the middle of the month, the price also hit an annual low, which fell to around $17,500 and then rebounded to $21,000.

Bitcoin’s hashrate fluctuations since the record high on 8 June have been influenced directly by the price decline, whereas previously it seemed that the two metrics proceeded disjointedly.

In fact, from the beginning of the year until the June record, hashrate grew from 170 Ehash/s to 250, while price fell from $47,000 to $30,000. This divergence is only due to the fact that hashrate grows very slowly, whereas during 2021 the price had grown fast.

It is enough to mention that at the end of 2020 the hashrate was below 150 Ehash/s, with a price below $30,000. In 2021 the price rose to nearly $70,000, so it is more than normal that hashrate also rose thereafter, with its classic lag.

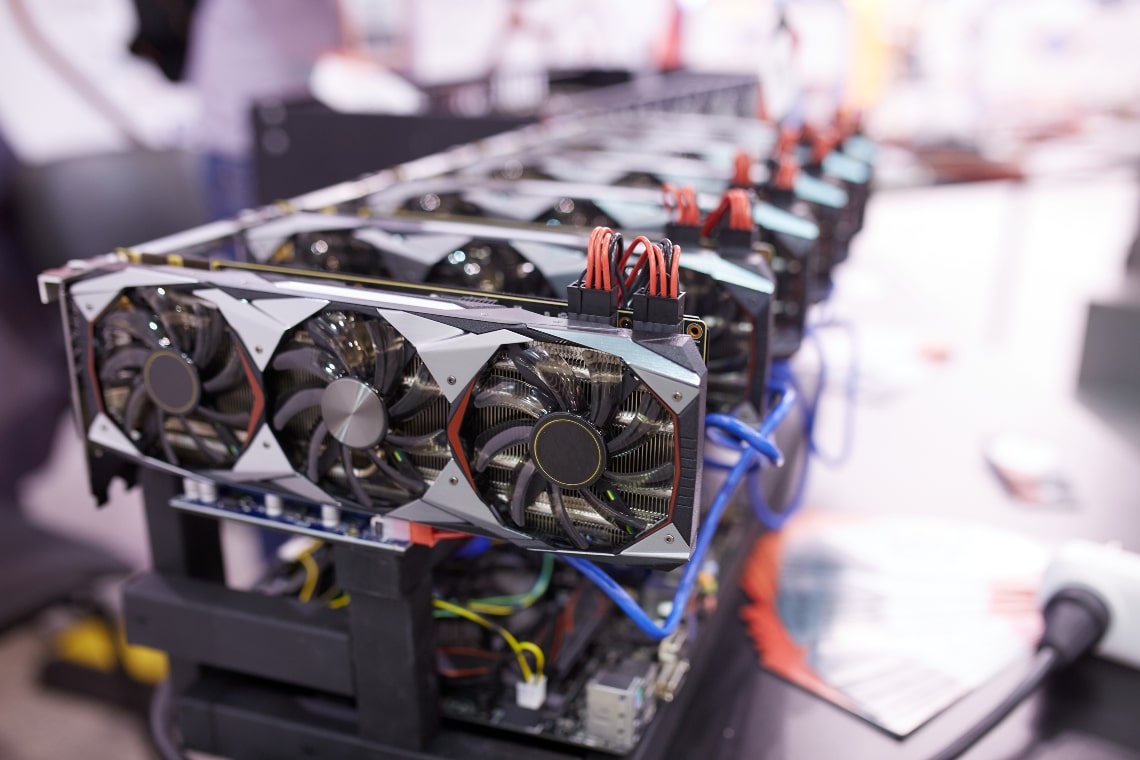

However, it is very likely that the release of more efficient machines, i.e. machines capable of obtaining higher hashrates without increasing energy consumption, and thus the cost of extracting BTC, also had an influence.

The combination of these two events that have been going on for a year and a half now slowly led up to the historic peak on 8 June, after which this medium-to-long-term growth petered out.

As the price fell again in the following days, the inevitable consequence was a decline in hashrate.

This dynamic becomes even clearer when analyzing the profitability curve.

Less profitable miners disable some of the equipment

By October 2020 it had touched new annual lows, falling just above $0.06 per day per Thash/s. As soon as the bull run began, profitability literally soared to near $0.5 in April 2021. Practically in less than six months it increased almost tenfold.

This prompted many miners to increase their computing power, causing the total hashrate to rise from 100 to 185 Ehash/s.

After an initial descent and a return to just under $0.5 per day in November 2021, the profitability of Bitcoin mining over the next few months plummeted, back below $0.1 per day.

It is worth noting that the annual low for this metric was reached on 19 June, after which the collapse seems to have stopped.

It is thus possible that the medium- to long-term adjustment in the hashrate could be said to be over, should BTC prices remain stable around $21,000.