Summary

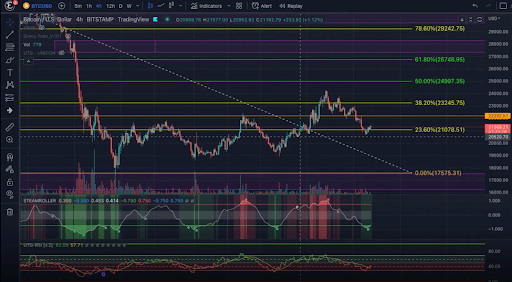

Bitcoin Analysis

Bitcoin’s price was controlled during Wednesday’s trading session entirely by buyers who bullishly engulfed the daily time frame. BTC’s price also closed its daily session +$1,680.

The first chart we’re providing analysis for this Thursday is the BTC/USD 4HR chart below from Unity-Trading-Group. BTC’s price is trading between the 23.60% fibonacci level [$21,078.51] and 38.20% [$23,245.75], at the time of writing.

Bullish BTC market participants are returned back above the heartline on the 4HR timescale and a trip up to test the current supply line could be next.

The first overhead target for BTC traders seeking further upside is the 38.20% fib level with a secondary target of 50.00% [$24,997.35]. The third target above for BTC bulls is 61.80% [$26,748.95].

At variance with bulls, bearish BTC traders want to push BTC’s price back below 23.60% and retest 12-month lows and a full fibonacci retracement at 0 [$17,575.31].

Bitcoin’s Moving Averages: 5-Day [$22,094.18], 20-Day [$21,094.96], 50-Day [$24,110.3], 100-Day [$31,839.34], 200-Day [$40,276.1], Year to Date [$34,783.91].

BTC’s 24 hour price range is $21,056-$23,100 and its 7 day price range is $20,783-$23,728. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $40,004.

The average price of BTC for the last 30 days is $21,044.3 and its +2.1% over the same period.

Bitcoin’s price [+7.9%] closed its daily candle worth $22,951 and back in green figures on Wednesday after sellers controlled the prior two days of trading.

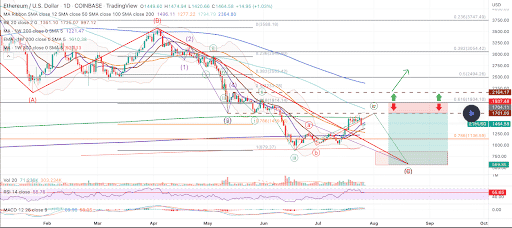

Ethereum Analysis

Ether’s price closed at its highest level since June 10th on Wednesday and +$185.07 for its daily session.

The second chart we’re looking at today is the ETH/USD 1D chart below by Crypto-Swing. ETH’s price is trading between 0.786 [$1,136.59] and 0.618 [$1,934.1], at the time of writing.

Ether bulls are looking above at the 0.786 as a first target with a secondary target of 0.5 [$2,494.26] and a third target to the upside of 0.382 [$3,054.42].

The targets below for bearish ETH traders are the 0.786 fib level followed by a retest of ETH’s 12-month low of $883.62.

ETH’s 24 hour price range is $1,440.83-$1,644.44 and its 7 day price range is $1,356.17-$1,644.44. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $2,301.45.

The average price of ETH for the last 30 days is $1,279.76 and its +24.72 over the same time frame.

Ether’s price [+12.76%] closed its daily candle on Wednesday worth $1,635.98 and in green figures for the fourth time in five days.

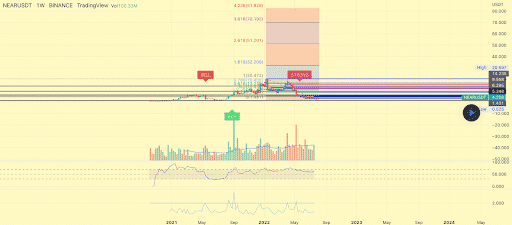

Near Protocol Analysis

Near Protocol’s price rallied over 10% higher on Wednesday and when traders settled-up at session close it was +$0.40.

The last chart this Thursday we’re analyzing is the NEAR/USD 1W chart below from Trading_Hill. NEAR’s price is trading between 0 [$1.48] and 0.236 [$5.963], at the time of writing.

NEAR’s price is -80.4% from its all-time high, at the time of writing and bullish traders are aiming to reclaim the 0.236 with the next target being the 0.382 fibonacci level [$8.735]. The third target overhead for bullish NEAR market participants is 0.5 [$10.976].

Conversely, traders that are short the NEAR market are looking to push NEAR’s price below the 0 fibonacci level with a secondary aim of sending NEAR’s price below $1 for the first time since December 17, 2020.

Near’s Moving Averages: 5-Day [$4.01], 20-Day [$3.69], 50-Day [$4.23], Year to Date [$8.14].

Near Protocol’s 24 hour price range is $3.63-$4.19 and its 7 day price range is $3.61-$4.71. Near Protocol’s 52 week price range is $2.13-$20.44.

NEAR’s price on this date last year was $2.22.

The average price of NEAR over the last 30 days is $3.68 and its -2.02% for the same duration.

Near Protocol’s price [+10.54%] closed Wednesday’s trading session worth $4.15 and in green figures for the first time in three days.