Yesterday, Coinbase announced changes to its fee structure.

In a post on its official blog, it warned that new fees will go into effect today, Tuesday, 20 September 2022.

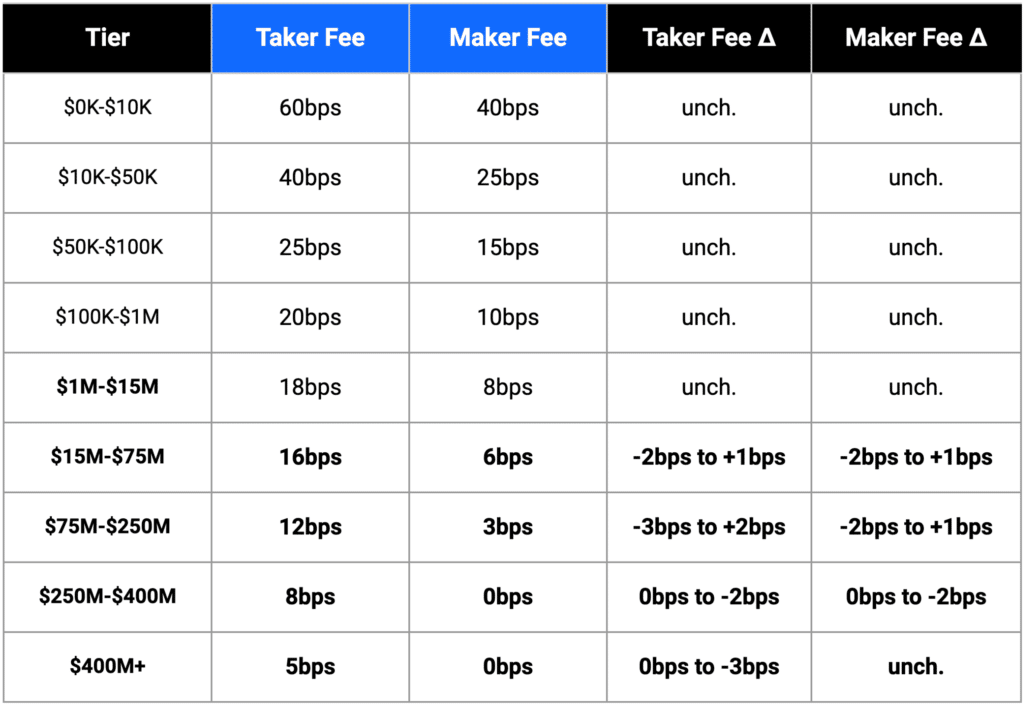

The exchange’s new fee structure was introduced to account for changes in global cryptocurrency trading volumes, and asset prices. In particular, the monthly trading volume required to qualify for the middle and upper tiers of their hourly fee has been reduced.

The new fee schedule will apply on Coinbase Exchange as well as the Pro and Advanced Trade versions.

Summary

Coinbase changes fees policy

This is not the first time Coinbase has updated its fee structure, and it probably won’t be the last either. Given the volatility of the crypto markets, both in the short and medium to long term, the company adjusts the cost of its services to market changes.

In particular, this time transaction levels below $100,000 are unchanged, while higher levels vary. The goal is to incentivize higher volume traders.

Coinbase began as a simple, affordable exchange. During its early years, it acquired many tens of millions of users in this way, but these were limited to a few very small transactions.

Over time, it became an increasingly institutional exchange, and with its landing on the stock exchange in April 2021, it became the real benchmark for the US market in this sector

Because of this, its business strategy has also evolved over time, and especially its positioning in the marketplace, moving from being a simple exchange for small mutual investors to a large platform aimed also and especially at large institutional clients.

Indeed, it has also added an increasing number of functions, most notably that of institutional-grade custody, which has enabled it to attract even large clients.

That is why it is not surprising that it is now turning its greatest focus precisely to large institutional investors, trying to attract as many of them as possible with lower fees.

This is especially true during the bear market, i.e., when investors and speculators generate far lower profits, thus necessarily having to take great care to keep costs down. In such a context, Coinbase’s decision to reduce fees to large traders takes on an easily understandable significance.

The exchange’s long-term goals

Although some things have changed over time, others have remained the same.

Coinbase co-founder and CEO Brian Armstrong today re-shared on his official Twitter profile a 2016 guide of sorts that contains some clear indications of what the exchange’s philosophy is still today.

Old one but a good one https://t.co/XxQu4DyDAO

Came up today when I met with our current APM (associate product manager) class.

— Brian Armstrong 🛡️ (@brian_armstrong) September 19, 2022

Coinbase is a company that was founded as far back as 2012, which was the year of the first Bitcoin halving, but until 2017 it was known to very few people. The boom happened right from 2017, so this document goes back to the pre-boom era of the exchange.

It is a kind of guide for product managers (PMs), but what is of interest is the philosophy that emerges from this guide.

The first point that emerges is the focus on the needs and desires of customers. Customers seem to be at the center of Coinbase’s attention, which also explains why with the entry of large institutional customers the exchange has decided to make changes to better meet their needs.

In 2016, Armstrong may have been exaggerating a bit when he asked PMs to literally “get inside the customers’ heads,” but this gives a very good idea of what he wants those working at Coinbase to do. Truly understanding the needs and desires of customers is the first necessary step in satisfying them.

The second point is common to many successful companies, which is to be guided by data, not personal feelings.

The third though, is not so common, because it suggests that PMs should not be people who make decisions and impose them from above, but instead calls for being mediators who “create consensus among all stakeholders,” imposing their own decisions only when necessary, such as in deadlock conditions.

After all, it is precisely “consensus building” that is one of the founding principles behind Bitcoin and cryptocurrencies.

Indeed, here Armstrong refers to the need to communicate a lot, both to enable consensus building and to communicate it to others so that everyone knows about it.

The last point comes as a consequence of the first four and involves developing the product vision, and striving to create something truly exceptional. The goal of this phase is to literally arrive at “creating joy for the customer.”

The customer-oriented vision

The pursuit of excellence is also precisely what moved Satoshi Nakamoto to create the absolute masterpiece that is the Bitcoin whitepaper, and from this perspective, it is clear what Coinbase wants to aim for.

It is probably this pursuit of excellence, combined with a great knowledge of their customers, that led the exchange to become dominant in the US in terms of the entry-level user base at first. If, as it seems, they are continuing to apply the same strategy now that they are targeting large institutional clients, it is possible that their goal is to dominate also in this domain in the US.

However, this will not be easy at all, because there are already other major players in the US crypto sector that have been able to position themselves quite well in this segment of the crypto market. Nevertheless, being publicly listed gives Coinbase an extra edge, as the listing requires the company to publicly provide the SEC with all important information about itself, which greatly elevates the level of transparency in its operations.

Moreover, it is not known whether Coinbase’s large competitors also adopt the same strategy, which is admittedly uncommon, especially in the financial sector. The attempt to “create something exceptional” is more in line with the crypto philosophy, the one from which Satoshi Nakamoto emerged, rather than that of traditional finance in which what matters most, if not exclusively, is making a lot of money. Thus, it is possible that Coinbase may have an edge, especially over traditional companies, because of a kind of “crypto legacy” that it has carried with it since its inception.