Vodeno surveyed 2,004 European companies to conduct research on the state of international payments.

Summary

Vodeno’s new research on international payments

The report was compiled by Vodeno, a BaaS (Banking as a Service) financial institution that aims to revolutionize service offerings dedicated to retail and corporate customers.

With its innovative cloud-based and native platform, one of its main goals includes making the finalization of payments between two parties faster and cheaper.

The study considers this very aspect and aims to understand the general situation in Europe.

The data was collected through an anonymous survey addressed to 2,004 small and medium-sized enterprises (SMEs) operating in the European space.

To be specific, 504 came from the United Kingdom and the remaining 1,500 from Belgium, France and the Netherlands, 500 from each country, respectively.

All of the respondents are in senior management positions, so we collect data from those who directly make business decisions about payment management.

The damage done to the corporate structure as a result of current payment management

Most businesses say they are uncomfortable with the current payments ecosystem. Especially the international ones, they are slow and inconvenient, thus doing damage to the cash flow organizational structure of the company.

These kinds of problems, of course, occur in both sending and receiving money.

As a result, such flow limits the quality and timeliness of a company’s operations management, thus slowing down the entire chain of production of a good or service, up to the collection of payment.

In short, a dog biting its own tail. Nevertheless, this helps to highlight some of the shortcomings, despite the technology on the market today, and thus underscore the importance of this process.

Moreover, we are currently in a general macroeconomic state characterized by restrictive and very aggressive monetary policies designed to combat excessive inflation.

That said, it is easy to understand how for EMSs, especially those that do not enjoy a high quality of capital, managing net working capital and short-term liquidity turns out to be like oxygen.

Nikhil Sengupta, Global Sales Director at Vodeno, said:

“Speed, ease and cost of payments is of utmost importance to SMEs, and our research underlines how high costs and lengthy delays in receiving payments are seriously hindering their day-to-day operations and growth plans.

Instant payment processing is now on the radar for most of Europe’s SMEs, but the question is whether they can find the right partner to deliver this, efficiently without exorbitant fees.

Today, there is a greater choice for SMEs where payment processing is concerned, and BaaS providers are leading the charge to give access to faster payment options that are secure and cost efficient.”

Analysis of collected data and international payments performance

In a perfect world, all funds would reach the counterparty instantly. The survey shows how only 10% of respondents have access to instant payments.

Then there is a further 11%, who nonetheless manage to stand out from the crowd, who say they finalize payments within an hour.

It is worth mentioning, however, that many blockchains come very close to this kind of reality with their native tokens.

Some solutions, such as Bitcoin’s Lightning Network, turn out to be even better than traditional ones.

35% of businesses that participated in the survey say that international payments take two to three days to reach their business.

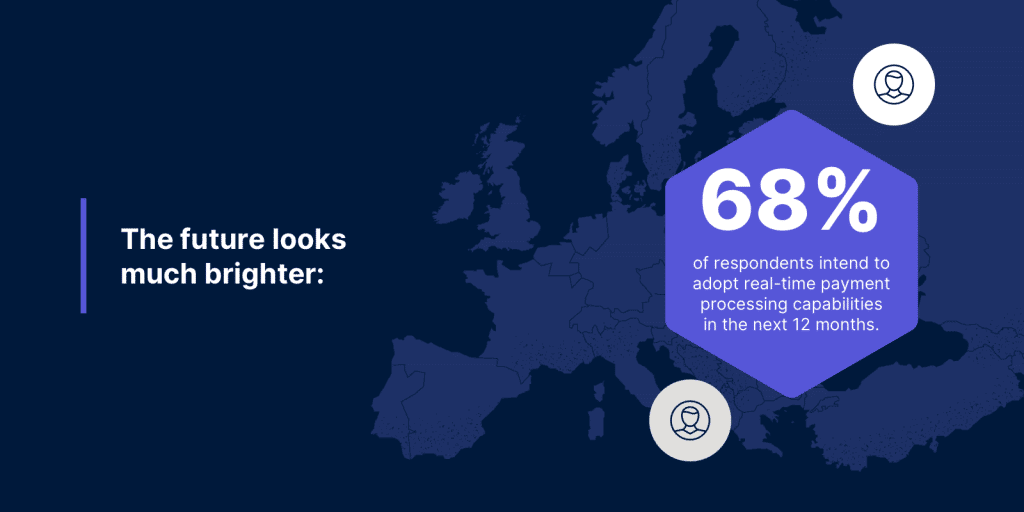

Fortunately, the future looks brighter. In fact, 68% of respondents plan to implement an infrastructure capable of processing payments in real time within the next 12 months.

In this way, all businesses would be able to strengthen their cash flow availability. It is enough to consider that precisely because of delays in transaction processing, 54% were forced to take out a loan to meet their payment commitments.

Thanks to solutions offered by blockchain or innovative BaaS such as Vodeno, it is now possible to solve these kinds of problems almost entirely. This kind of approach will be able to greatly improve the health of a business, large or small, thus making the quality of payments better, with much faster, safer and cheaper transactions.