Investors, HODLers, crypto traders, and analysts of how much is Bitcoin worth in dollars are not the typical profiles seen (up to 20 years ago) on Wall Street in suits and ties. They are the 2.0 version free from the pre-established patterns in everyone’s mind (and that is also a good thing).

If until a few years ago it was common practice to wear formal clothes that highlighted economic hierarchies, this approach to the so-called “dress code” has changed a lot. The trend toward informality has spread to many sectors, not just tech, fueled in part by smart-working (remote work) characterized by online meetings that have changed formal work dress “codes” to casual ones.

Summary

The suit “doesn’t” make the man? How much is Bitcoin worth?

People’s perceptions and ideas of managers or investors are difficult to change. in fact, dressing a “certain way” makes it easier (since time immemorial) to fit into a new work environment or, more generally, affects the overall impressions you make because by the way you dress you are “sending a message” about who you are and where you stand or what you are aspiring to.

Does “how you present yourself” still make a difference?

It is a fact that crypto-millionaires have “invaded” the luxury market. Realizing a series of expensive purchases and sales of real estate and movable goods, they have become the new “whales” in this regard as well.

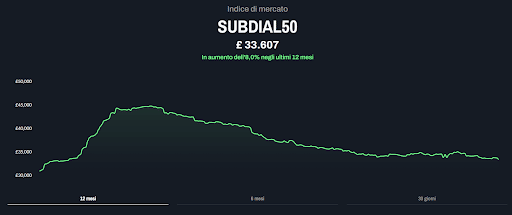

Luxury watches have been an excellent alternative to the usual diversified investments. In fact, according to Bloomberg research, over the past year and a half, buying Rolex, Patek Philippe and Audemars Piguet, seems to be the “easiest” and most immediate way. The Subdial50 index (basket containing the value of the 50 most traded luxury watches) shows +9% over the past 12 months, but down 4% from 2 months ago.

The index has had a strong performance following the notable rise in cryptocurrencies but also a steady descent since the financial markets and crypto have been going through a difficult period since the beginning of the year. After the highs of March and February 2022, Bitcoin saw a descent of more than 55% while the luxury watch index had two positive peaks and then a loss of more than 20 %. As a result, luxury watches are also selling.

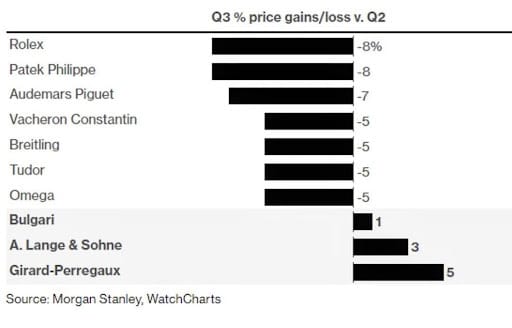

What’s more, while valuations continued to rise in 2021 and early 2022, even the most “desired” watches had a turnaround: the Rolex Daytona, had a 21% devaluation. There was also a slowdown for the used sector; according to Morgan Stanley (as shown in the chart above), prices fell by an average of 8% in the last quarter.

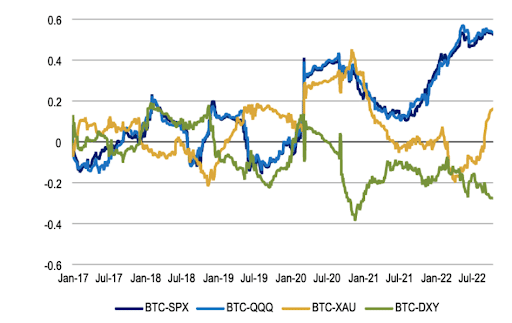

Meanwhile, Bitcoin, in addition to the luxury sector, remains positively correlated with the SP500, NASDAQ, and GOLD while being negative with the dollar (DXY).

Bank of America’s chart highlights this strong positive correlation as a possible “awareness” of investors in the face of macro uncertainty and the hope of hitting the actual market low.

Some positive data

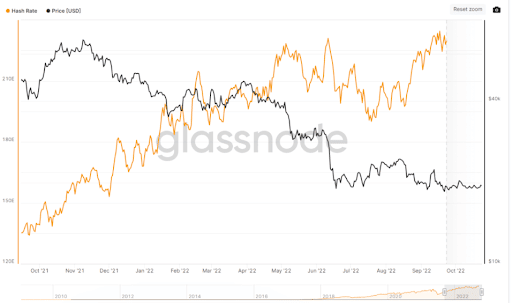

This month we have seen an increase in Bitcoin’s Hash Rate currently at 240 EH/s, although the growth has nevertheless reduced profits for miners.

Hash Rate refers to the processing power of the network i.e., calculations per second, so from this we infer that the higher the value the greater the expansion of mining operations and the use of increasingly efficient machines. In addition, let’s not forget that with the Ethereum Merge many miners have switched to Bitcoin, creating further competitiveness.

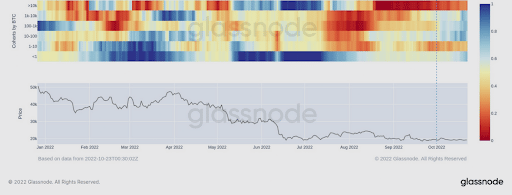

Despite the sideways movement of the price in recent months, the ongoing transactions strengthen and continue to build important support, denoted by the low volatility, which suggests an accumulation trend.

Especially in October, there is evidence of a change in balance shifting behavior by most wallets, from those with less than 1 Bitcoin to the Whales (Whales with 10 thousand Bitcoin) have shifted from selling (red square) to accumulating and increasing their net balance (blue square) at prices between $18 thousand and $20 thousand.

But beware, in case the bulls fail to maintain the support of $20 thousand to $19 thousand, any declines could bring volatility and the break of $18 thousand.

Going back to earlier, adapting one’s style can be profitable initially, but what matters over time are skills, nothing more.