Around mid-December, the price of crypto Cronos (CRO) had fallen to annual lows, below $0.056.

Cronos went into distress due to the failure of FTX, because CRO is Crypto.com’s cryptocurrency.

Summary

Fears about Crypto.com and its crypto Cronos (CRO)

FTX was one of the largest crypto exchanges in the world. It was centralized and regulated, so many believed it was solid and well-run.

Instead, with its implosion it turned out that it wasn’t at all: it was very poorly managed and had very weak foundations. The fact that it was based in the Bahamas for many meant that the authorities’ controls over its management were insufficient and too shallow, effectively allowing mismanagement that is hardly allowed in other countries.

After its collapse, various speculations began circulating shortly before mid-November that the regulated crypto exchange Crypto.com might also have the same problems.

Indeed, during the days when FTX’s FTT token collapsed, CRO also lost 33%, falling from $0.12 to $0.08 in just three days.

However, after a brief recovery above $0.09, the price went back down, touching $0.057 on 14 November.

At the time, there were fears that FTX’s collapse would spread to other exchanges, and Crypto.com was one of those on which such fears were focused.

Instead, Crypto.com held up very well to that moment of panic, so much so that by the next day the price of CRO was back to $0.076.

However, this was not a real recovery, but only a technical rebound, so much so that from the next day a new downward run began.

During those weeks there was fear that the exchange would not be able to cope with the immense demand for withdrawals from customers, with several rumors that it was on the verge of bankruptcy. This did not happen, because Crypto.com continued to process all withdrawals with no apparent problems, but CRO’s price continued to fall until it hit a new annual low twice, on 17 and 20 December, at just over $0.055.

The dissolution of fears

As of 21 December, such dwellings seem to have begun to dissolve.

It can by no means be said yet that they have already dissolved, but given that Crypto.com continues to have no problem meeting all withdrawal requests, and given that these requests are down from the peaks of the past few weeks, it certainly seems that such dissolution has at least begun.

On 25 December, the CRO price was briefly back above $0.06, while now it has fallen to $0.057.

In other words, the waning phase may also have ended, while now a lateralization phase above $0.055 may have been triggered.

However, nothing should be taken for granted, because in such a distressed situation all it takes is a few pieces of bad news for the descent to resume.

Moreover, the entire crypto market is not having a good time, although it has been in a lateralization phase since mid-November in some ways similar to that of CRO over the past week.

The 2022 of the crypto Cronos (CRO)

The year 2022 has been a bad year for the cryptocurrency Cronos, but the evaluation improves somewhat when analyzing its performance over the long term.

It hit an all-time high in November last year when it briefly exceeded $0.96. The accumulated loss since then exceeds 94%.

At the beginning of 2022, the price was about $0.55, or ten times the current price.

But the peak in November 2021 was caused by the inflating of a resounding speculative bubble.

In fact, in November 2020, before the beginning of the latest big bull run in the crypto markets, the price was below $0.06, so over the course of 2021, it registered an excellent +1,500%.

The curious thing is that the bursting of the bubble brought the price of CRO during 2022 back to roughly the same pre-bubble levels. Therefore, it is possible that the collapse is over, barring further negative news.

It is worth mentioning that during 2020 the price had peaked at $0.17, or almost three times the current level. This suggests rather clearly that for Cronos the current situation is indeed one of severe distress.

The doubling of users

Recently, Crypto.com published a report according to which during 2023 global cryptocurrency owners could almost double.

The report reveals that there was still an increase in cryptocurrency use globally in 2022, despite difficult macroeconomic conditions. In fact, the total number of people in the world who own cryptocurrencies reportedly surpassed the 400 million mark, reaching 402 million in November.

The average monthly growth rate during 2022 was 2.9%, and according to Crypto.com’s forecasts it could become between 600 and 800 million in 2023. This would be 10% of the entire world population.

It is worth noting that in 2022 there has been no decrease in cryptocurrency users, although in March, April, and July the increase was close to zero.

The largest increase occurred in September, which was the month of Ethereum’s switch to PoS, and the second largest in August.

It is surprising that while in May, i.e. during the month of the implosion of the Terra/Luna ecosystem, they increased by 4.4%, in November, during the collapse of FTX, they increased by only 1.5%. However, this could be explained by the fact that the FTX collapse started shortly after the beginning of the month, while the Terra implosion took place from just before mid-month onward. In fact, the increase in users in June was only 1.2%.

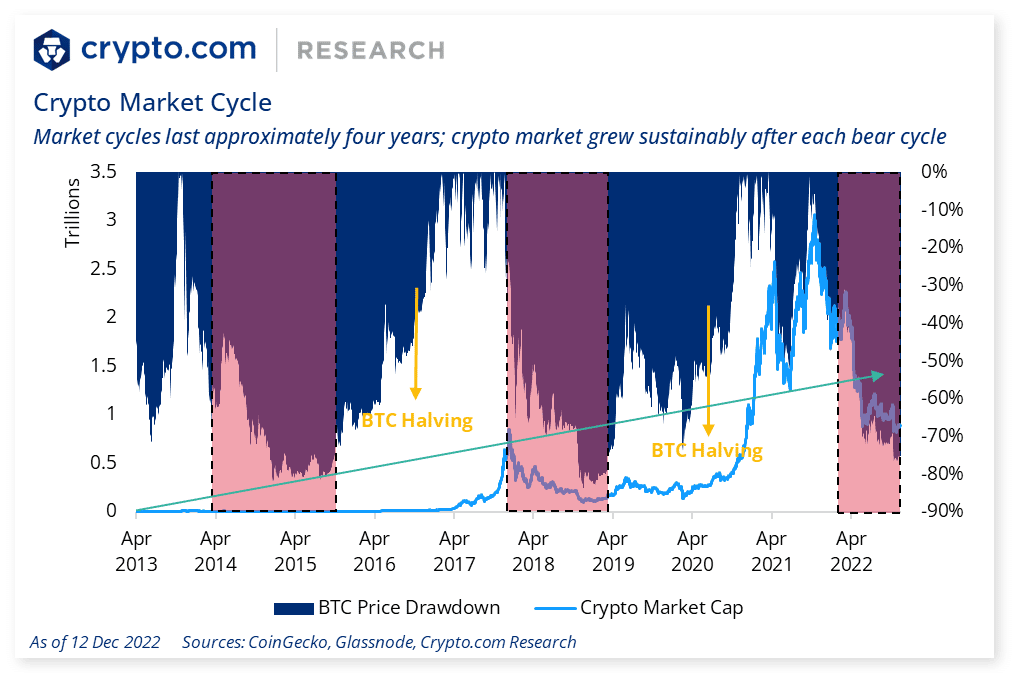

According to the Crypto.com report, the crypto market is still in the “winter” phase (so-called “crypto winter”), but this is just one of the natural phases of market cycles.

It is worth noting that this report also uses Bitcoin halving as a reference for cycle detection.

Also interesting is the fact that trading volumes on decentralized exchanges increased proportionally in November, following the FTX collapse, after several months in which they had declined instead. Curiously, the reduction began in June with the collapse of Celsius.

The role of DEXs

Given the fragility of centralized exchanges, it is somewhat surprising that the market share of DEXs (Decentralized Exchanges) did not increase during 2022.

In fact, although it increased mostly in November, it had actually decreased a lot from June onward. In fact, the November level was still lower than at the beginning of the year.

What is not explained is why users who are afraid of how their funds are managed on centralized exchanges continue to use them in large majorities. It is possible that many simply do not know how to go about using DEXs, since CEXs are designed to be as easy to use as possible, but it should not be ruled out that many do not even know about the existence of DEXs, or where to find them, or the fact that they are used with non-custodial wallets.

What one really struggles to understand is why many people persist in wanting to use custodial wallets despite being afraid that their custodian will lose all their funds. It is true that non-custodial wallets require much more effort in protecting the seed and private keys, but they solve the problem of having to trust a third-party custodian.