Bitcoin Analysis

Bitcoin’s price marked up again on Tuesday and when traders settled-up to close the day, BTC’s price was +$1.1.

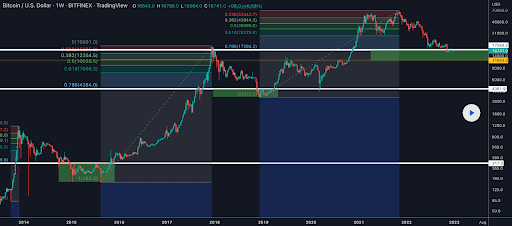

The BTC/USD 1W chart below from DyslexicStoner240 is where we’re leading-off for this Wednesday’s price analyses. BTC’s price is trading between the 1 fibonacci level [$3,215.2] and 0.786 [$17,284.2], at the time of writing.

If bullish Bitcoin market participants can regain the 0.786 there’s greater than a $10,000 gap to the next fib level. The 0.618 fib level [$28,328.9] is the next target overhead followed by 0.5 [$36,086.6], 0.382 [$43,844.3], and the 0.236 fib level [$53,442.7].

Conversely, bearish traders want to again retest BTC’s multi-year low of $15,505 on their way back to a four figure BTC price. If they’re successful at that aim, their ultimate target is the 1 fibonacci level [$3,215.2] which is a historical support level for bullish traders dating back to 2019 and predating the last bull market.

Bitcoin’s Moving Averages: 5-Day [$16,633.65], 20-Day [$16,941.79], 50-Day [$17,561.28], 100-Day [$18,815.41], 200-Day [$24,152.66], Year to Date [$16,738.57].

BTC’s 24 hour price range is $16,605-16,778 and its 7 day price range is $16,605-$16,778. Bitcoin’s 52 week price range is $15,505-$48,159.

The price of Bitcoin on this date last year was $45,830.

The average price of BTC for the last 30 days is $16,932.9 and its -1.1% over the same time frame.

Bitcoin’s price [+0.01%] closed its daily session worth $16,674.6 and in green figures for a third consecutive day on Tuesday.

Summary

Ethereum Analysis

Ether’s price also climbed higher during Tuesday’s trading session and when the day’s candle was painted, ETH’s price was +$0.65.

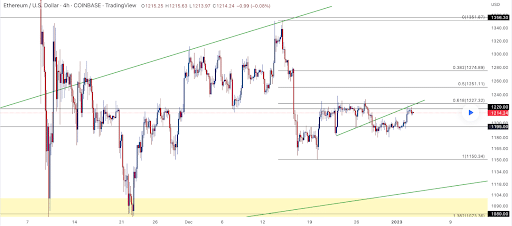

The second chart we’re examining for this Wednesday is the ETH/USD 4HR chart by DannyC914. At the time of writing, ETH’s price is trading between the 1 fibonacci level [$1,150.34] and the 0.618 fib level [$1,227.32].

The levels of control to the upside for those longing Ether are 0.618, 0.5 [$1,251.11], 0.382 [$1,274.89] and a full retracement from the spot that ETH’s price most recently suffered a breakdown at 0 [$1,351.97].

Contrariwise, the 1 fibonacci level is the primary aim of bearish market participants with an eventual aim to retest ETH’s 12-month low of $883.62.

ETH’s 24 hour price range is $1,204.93-$1,228.85 and its 7 day price range is $1,204.93-$1,228.85. Ether’s 52 week price range is $883.62-$3,888.86.

The price of ETH on this date in 2022 was $3,790.83.

The average price of ETH for the last 30 days is $1,233.04 and its -4.5% over the same stretch.

Ether’s price [+0.05%] closed its daily candle on Tuesday worth $1,214.55 and has also finished the last three days in positive digits.

Solana Analysis

Solana’s price was the top performer of the lot today and finished the day’s trading session up greater than 18% and +$2.10.

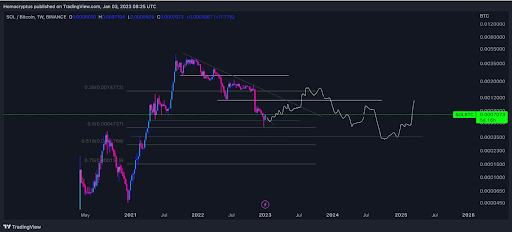

We’re moving to the last chart of emphasis for this Wednesday, the SOL/BTC 1W chart via Homocryptus. SOL’s price against BTC is trading between the 0.5 fibonacci level [$0.0004737] and the 0.25 fib level [$0.0014772], at the time of writing.

The primary target for SOL against BTC is the 0.25 fib level and if that level can be reclaimed it could signal at minimum the continuation of the current relief rally by Solana bulls.

On the opposite spectrum, bearish traders want to continue their larger downtrend and retest the 0.5 fib level. The targets below the 0.5 fib level are 0.618 [$0.0002769], and the 0.75 fib level [$0.0001519].

Solana’s price on this date last year was $167.76.

The average price of SOL over the last 30 days is $12.35 and its -3.62% over the same span.

Solana’s price [+18.63%] closed its daily candle worth $13.37 and in green figures for the fifth day in a row on Tuesday.