Bitcoin Analysis

Bitcoin’s price painted its third straight candle in positive figures to start this week and concluded its daily session +$178.2.

First off for this Thursday we’re analyzing the BTC/USD 12HR chart below by nagihatoum. BTC’s price is trading between the 0.236 fibonacci level [$16,933.13] and the 0.5 fib level [$18,346.88], at the time of writing.

If bulls of the Bitcoin market can hold the 0.236 and the $17k level, they’ve overhead targets therefore of 0.75 [$19,794.32], 1 [$21,355.94], 1.618 [$25,765.64], and the 2 fib level [$28,935.54].

Bearish traders are conversely aiming to send BTC’s price again below the 0.236 fib level with a secondary aim of 0 [$15,761.80].

Bitcoin’s Moving Averages: 5-Day [$16,678.57], 20-Day [$16,929.28], 50-Day [$17,492.46], 100-Day [$18,743.10], 200-Day [$23,998.94], Year to Date [$16,741.02].

BTC’s 24 hour price range is $16,652.7-$16,991.9 and its 7 day price range is $16,652.7-$16,991.9. Bitcoin’s 52 week price range is $15,505-$48,162.

The price of Bitcoin on this date last year was $43,421.3.

The average price of BTC for the last 30 days is $16,906.1 and its -1.7% during the same stretch.

Bitcoin’s price [+1.07%] closed its daily candle worth $16,852.8 and in green figures for a fourth consecutive day on Wednesday.

Summary

Ethereum Analysis

Ether’s price also marked-up during Wednesday’s daily session and finished its daily candle +$42.36.

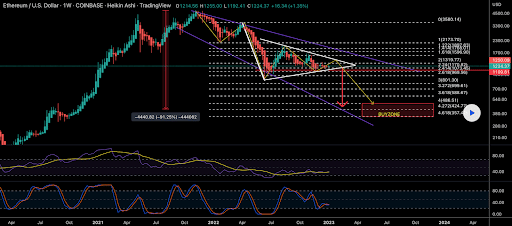

The ETH/USD 1W chart from mamenmamel87 is the second chart on our docket for this Thursday. At the time of writing, Ether’s price is nestled between the 2.24 [$1,170.82] and the 2 fibonacci level [$1,319.77].

Targets to the upside on Ether are the 2 fib level followed by 1.618 [$1,596.90], 1.414 [$1,768.01], 1.272 [$1,897.83], 1 [$2,173.70] and a full retracement to the spot of the larger breakdown on the weekly time frame at 0 [$3,580.14].

Conversely, targets to the downside on Ether are 2.24, 2.414 [$1,073.45], 2.618 [$969.56], 3 [$801.30], 3.272 [$699.61], 3.618 [$588.67], 4 [$486.51], 4.272 [$424.77], and the 4.618 [$357.42].

ETH’s 24 hour price range is $1,212.71-$1,272.6 and its 7 day price range is $1,212.71-$1,272.6. Ether’s 52 week price range is $883.62-$3,846.31.

The price of ETH on this date last year was $3,535.07.

The average price of ETH for the last 30 days is $1,231.62 and its -3.32% for the same period.

Ether’s price [+3.49%] closed its daily session on Wednesday worth $1,256.91 and also in green candles for a fourth consecutive day.

Avalanche Analysis

Avalanche’s price was the top performer of today’s price analyses and concluded its daily session +$0.70.

The AVAX/USDT 1D chart from PersianBlockchain is where we’re wrapping up today’s price analyses. Avalanche’s price is trading between the 0.382 fib level [$11.28] and the 0.236 [$12.47], at the time of writing.

Avalanche’s price is up over 7% for the last seven days and bullish traders are looking to regain the 0.236 firstly. The second target for bulls is the 0.118 fib level [$13.43] followed by a third target to above of a full retracement of 0 [$14.39].

The levels to the downside after the 0.382 are the 0.5 fib level [$10.31], 0.618 [$9.35], 0.786 [$7.98] and the 1 fibonacci level [$6.23].

Avalanche’s price on this date in 2022 was $97.39.

The average price of AVAX over the last 30 days is $12.28 and its -11.41% over the same span.

Avalanche’s price [+6.15%] closed its daily candle on Wednesday worth $12.08 and in positive digits for a third day in a row.