The past few months have witnessed a very strong shock throughout the crypto world. The reference is to the FTX case, which until recently was among the best-known cryptocurrency exchanges in the world, second only to Binance, which at present has declared bankruptcy to the relevant authorities.

Investor confidence in the crypto world is faltering. This is due not only to the FTX case, which comes on top of the LUNA case that shocked the industry last spring, but also to how these events have unfolded in a very short time indeed.

Summary

The story of FTX’s collapse and market dynamics

The founder of FTX is Sam Bankman-Fried, known to most simply as ‘SBF,’ which is the nickname he uses on Twitter. His exchange was widely used by cryptocurrency traders around the globe. It was also regulated in a great number of countries, but this unfortunately did not prevent trouble for the unfortunate traders who had deposited their money with his exchange.

It might be said that FTX, through affiliates such as Alameda, was investing the money deposited by customers by placing a large sum of FTT tokens (issued by FTX itself) as collateral. A type of maneuver that would appear to constitute fraudulent activity by putting customer deposits at great risk.

Like other tokens, FTT was characterized by high volatility, an element that in itself is already a major contraindication to its use as a form of collateral, which should therefore be avoided or at least limited. Moreover, it is worth noting that FTT tokens were issued directly by FTX, and this certainly denotes a not-so-high solidity of the company, since it was a guarantee fund not composed of traditional currencies such as the Dollar or the Euro, but simply of tokens and some BTC and ETH.

As if that were not enough, two days after the bankruptcy, one of FTX’s main competitors, Binance, announced its willingness to sell $2.1 billion of FTT on the market. The spread of this news generated panic by creating a virtual ‘teller’s race’ of sorts. The FTX exchange thus faced massive withdrawals and within two days ran out of liquidity and stopped withdrawals.

Fortunately, a large number of other exchanges after this inauspicious event ran for cover by triggering an audit mechanism called ‘Proof of Reserves’, releasing various reports on Twitter confirming their soundness and disclosing the assets held, in an attempt to halt the continuous withdrawals that were triggered in November and which continued, albeit in a milder form, in December.

Unfortunately, this is not the first time an intermediary (exchange or broker) has run into problems due to excessively risky or even fraudulent transactions made with their clients’ deposits. Given their role as intermediaries, it could be said that crypto exchanges also serve the function of the traditional broker, allowing retail traders to trade in the market. Unlike traditional brokers, exchanges have also evolved into other forms of intermediation such as investing in DeFi or the Staking mechanism.

How to choose the right exchange?

Given the similarity in role with the broker, choosing the exchange on which to deposit one’s money should be done by paying attention to the same characteristics usually assessed when choosing a broker.

First, in order to understand the seriousness of the broker or exchange itself, take a look at its equity situation. Conducting this type of research can certainly be a tedious activity, but it could also help in safeguarding savings in the event of a broker or exchange default.

Second, it is very important not to focus only on fee costs, but also to analyze which and how many markets are covered by the broker or exchange, and whether there are additional fees for the desired services.

No one likes to pay higher fees. However, this is believed to be a secondary issue in verifying the quality and reliability of a service provider. In summary, one can also accept higher commissions as long as one is trading with a broker or exchange that is reliable, transparent, and offers all the necessary services.

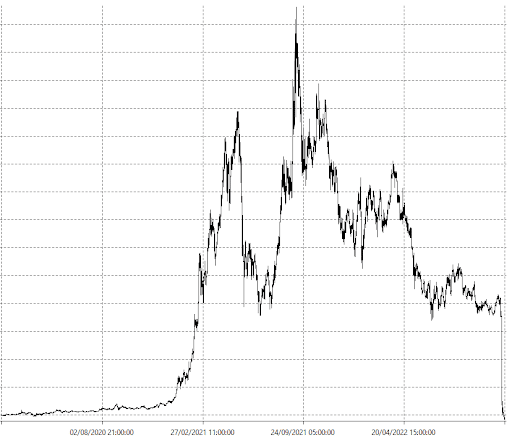

From the perspective of a systematic trader, it is interesting to understand how an automated strategy would have worked during this very turbulent. And more importantly, how this automated (long-only) strategy would have reacted to current conditions on the most observed token of recent months: FTT.

For those who had been ‘holders’ of FTT before the crash, the investment to date would be worth very little, almost zero. The initial investment would have been pulverized and little more than a few pennies would be left by now.

By trading systematically, this kind of epilogue could have been avoided. Provided you were trading these tokens through an exchange other than FTX. Sure, there would still most likely be losses by trading only long on an exchange that failed, however, there is still a big difference from seeing one’s entire initial investment vaporized.

The comparison between “Buy&Hold” and an automated trading strategy

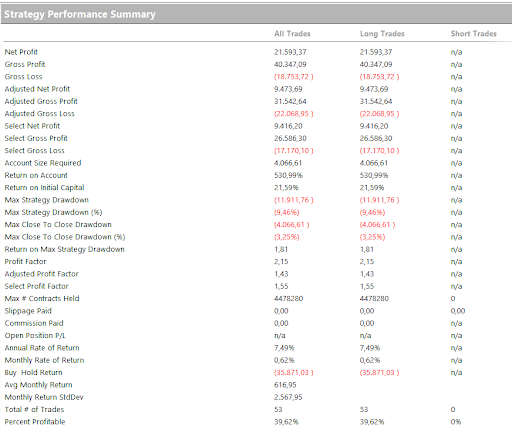

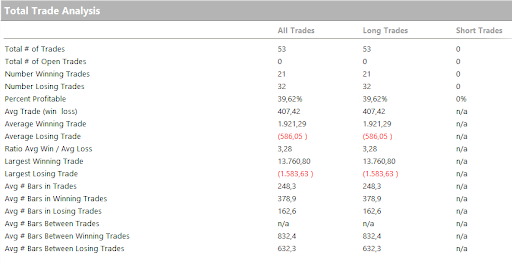

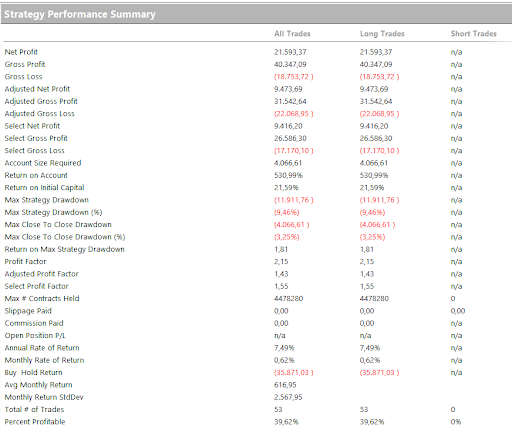

In this regard, an automated strategy that makes only long trades when the highest levels of the last 6 days or so is analyzed below. This is a classic ‘trend-following’ strategy, absolutely not too scrupulous as an entry filter, which is shown for the purpose of giving an understanding of the underlying mechanisms of an automated strategy and how it differs from a conventional strategy such as ‘buy&hold’.

The strategy will close its positions on the opposite side of a hypothetical price channel, that is, on the lowest level of the last 6 days. More precisely, the price channel will be formed by the highest level of the last 150 hours (150/24 hours=6.25 days), and conversely, the lower side will be formed by the lowest level of the last 150 hours.

In this way, although the strategy does not contain any stop loss, it will still be protected in case of sudden market crashes.

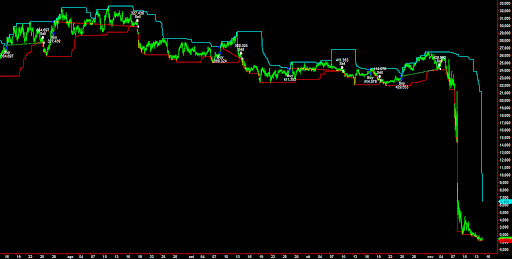

Figure 1 shows an example of the assumed price channel on the underlying FTT and some example entry patterns.

In the subsequent figures, it can be seen early on that although the price of the token collapsed sharply from $25 to $2 in just a few days (with a 92% drawdown), the strategy analyzed would contain the damage. This is because, by entering and exiting a trade, risk is assumed to be mitigated or otherwise limited only to certain times of the day. Even if the strategy had operated during the collapse, the position would have been closed with a more limited loss.

The fixed size used for the backtest is $10,000 per trade, so there is a constant size throughout the duration of the backtest, which begins in 2020 and ends in December 2022.

Conclusions: results and comments on the tests performed

Unfortunate cases happen regardless of the strategy used. This is to say that even with an automated strategy one could find oneself in the market at the wrong time. But certainly, the use of a stop loss or at any rate a condition to exit the trade as a result of too large downward movements limits the risk per se, and by a lot, because in any case, one could immediately cut the profit or loss of the open trade. In contrast, generally buy-and-hold strategies work without stop losses or other exit conditions, and it is the investor who must be vigilant about his or her positions.

However, the risk that could be called systemic remains alive, indeed very much alive, that is, the risk inherent in the market, in this case FTT, which could put the investor in the position of not being able to close a position in a market that is not properly liquid (e.g., during a crash). In any case, it would still be faster to get executed automatically than to have to liquidate a position that was previously staked.

Moreover, the trading system that is more “stupid” than the human brain, would have smelled the danger and avoided taking a position during the collapse, or at any rate shortly thereafter would have tried to close the position at a loss on the lower price channel.

Of course, situations such as these should be avoided as much as possible, even with trading systems, so as not to be put in the position of trading in an illiquid and extremely volatile market.

Unfortunately, these ‘black swans’ could happen to everyone, even in the future, and unfortunately, these are events that are as unpredictable as they are violent and sudden. In any case, the invitation is always to keep your eyes open and to stay as far away as possible from fraudulent brokers.

Until next time!