Often, when analyzing the evolution of projects like Bitcoin or Ethereum, we focus on the price performance of their native cryptocurrencies, namely BTC and ETH.

However, this way we actually analyze only one side of the coin, completely neglecting the other. The fact is that price analysis on the one hand allows one to understand what is happening in the short term, but on the other hand, it is only by analyzing the on-chain fundamentals that one can understand the evolution over the long term.

Summary

The growth of Bitcoin and Ethereum addresses despite the price

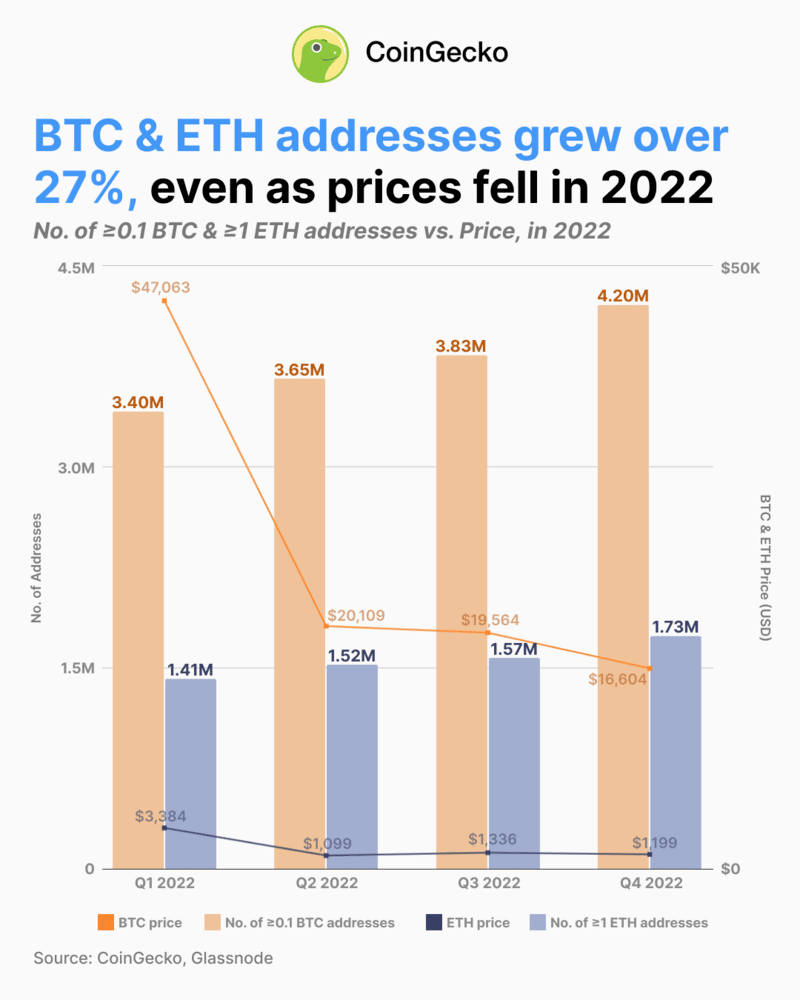

This dichotomy emerges clearly and overbearingly when comparing what happened in 2022 simultaneously with the price of Bitcoin and Ethereum, on the one hand, and the number of addresses holding BTC and ETH, on the other.

In fact, recent research by CoinGecko reveals that while BTC and ETH lost more than half of their market value, the number of Bitcoin and Ethereum addresses with at least $1,000 grew steadily instead.

Dynamics that develop over the long term, such as precisely the growth in the number of addresses, follow a much more constant and dilated trend than prices. These latter, as is well known, follow much shorter duration trends and, above all, very nerve-wracking.

CoinGecko’s research contains a chart that gives a very good idea of this contrast.

Bitcoin (BTC)

Beginning with Bitcoin, one immediately notices how over the four quarters of 2022 the orange line of price has been pretty much steadily declining. Indeed, between $47,000 in the first quarter and $16,600 in the fourth, the decline was 65%.

What’s more, it was not even a steady decline, as it occurred specifically due to three major collapses, including two in the second quarter (Terra and Celsius), and one in the fourth (FTX).

Nevertheless, during the same period, the number of Bitcoin addresses on which at least 0.1 BTC was reported to be held steadily increased, so much so that by the end of the year it was +23% higher than at the beginning of 2022.

Ethereum (ETH)

It is no coincidence that something very similar happened to Ethereum.

The price has fallen from $3,300 to below $1,200, excluding momentary spikes, with a 64% drop. At the same time, however, the number of on-chain addresses with at least 1 ETH increased by 21%.

The fact that this increase was slightly less than that of Bitcoin may be due to the fact that BTC is probably believed to be a store of value by slightly more people than those who believe that ETH is as well.

It is worth noting, however, that with the move to PoS, ETH has become a currency with deflationary supply, at least for now, so the distance separating it from BTC in this context has narrowed a great deal lately.

The accumulation phase in relation to the price of Bitcoin and Ethereum

According to CoinGecko’s report, by Lim Yu Qian, the dynamics just described could be explained by assuming that crypto investors have taken advantage of low prices to accumulate or hold. This would be a sign of confidence in the future of the industry.

Moreover, the increase in addresses would also indicate the entry of more participants, or greater adoption of cryptocurrencies, into this market.

In fact, during last year’s bear market, and particularly at times of the greatest price declines, there were clear signs that whales were accumulating.

It is possible that on the one hand there were those who, in fear, sold out as quickly as possible, settling for selling at bargain prices, while on the other hand there were those who did not let their emotions get the best of them and rationally thought that perhaps such low prices were a tempting opportunity to accumulate.

So there should have been a huge transfer of funds from the more emotional investors and speculators, usually the less experienced ones with less capital to invest, to the more rational and experienced investors and speculators, usually with large amounts of capital to manage wisely and sensibly.

If things had happened exactly this way, one could easily explain the increase in addresses with at least 0.1 BTC or 1 ETH. It would therefore have been on the one hand a phase of unloading, due to fear, and on the other hand a phase of accumulation due to reasoning that considers risk a danger but also an opportunity.

In fact, CoinGecko’s own report points out that the greatest growth in the number of these addresses occurred in the fourth quarter, which is the period when Bitcoin in particular hit its lowest price levels in 2022.

Although there were no certainties, it was possible to imagine that at some point the descent would stop, and when the collapse due to the FTX bankruptcy came to a halt with a -26% it was possible to imagine that the bottom was near.

For example, the implosion of the Terra/Luna ecosystem in May caused the price of Bitcoin to collapse by 35%, while the failure of Celsius in June caused it to collapse by a further 43%.

Given that FTX played a far greater role within the Bitcoin ecosystem than did Terra (which had very little to do with Bitcoin) and Celsius (which had far fewer users than FTX), that -26% had a vague appearance of only half a collapse, so much so that many at that point were expecting a drop to $10,000, $12,000, or at least $14,000.

In other words, some analyzed the situation well and interpreted it as a possible buying opportunity, while many instead simply panicked and sold.