This article will address the topic of the performance of crypto assets in 2022 from a systematic point of view. This is certainly a somewhat uncomfortable topic given the performance of the sector in the past year, but it can help to understand how to move within this market.

Specifically, some of the most capitalized cryptocurrencies will be considered, including BTC, ETH, BNB, XRP, including several altcoins.

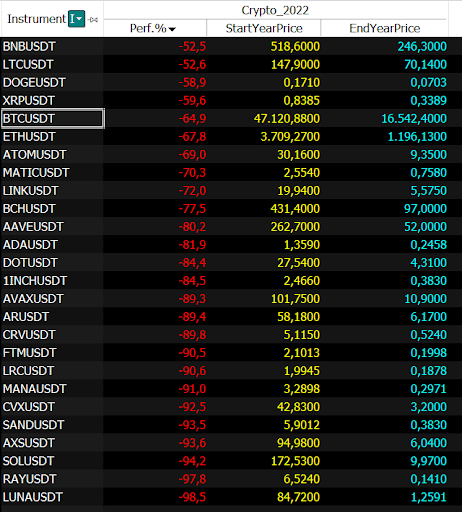

In Figure 1 we can see in the ‘Perf. %’ column how the 2022 performance, for the assets under consideration, was disastrous almost as a whole. All the cryptocurrencies considered saw very severe losses, ranging from -52.5% to -98.5%.

The best was BNB, which despite the criticism and stresses to which the “crypto exchange” sector has been subjected following the FTX affair, posts a negative return of 52%, resulting from the opening of the year 2022 that occurred at $518.6 and ended at $246.3.

Scrolling down this list there’s also BTC, which scores -64.9%, DOGE -58.9%, ETH at -67.8% and MATIC -70.3%.

But there are also those who have done worse, such as for example LUNA (-98.5%), whose affair is sadly known to all users of the Terra ecosystem, and with her the whole DeFi sector including among others AAVE (-80.2%), FTM (-90.5%), AVAX (-89.3%) and CRV (-89.8%) who have suffered losses of more than 80%.

Even the Metaverse sector, which was much talked about in the previous year, ended the year as badly as it could have: SAND (-93.5%), MANA (-91%) and AXS (-93.6%) posted even worse returns than other sectors, reaching losses of more than 90%.

A review of the performance of the crypto sector in 2022

As mentioned, 2022 was disappointing in that it saw heavy losses almost across the entire sector. It certainly left an indelible mark on all investors. It will not be easy to regain confidence right away, but as has happened in the past with Bitcoin (and the crypto sector in general) things can change in a short period of time.

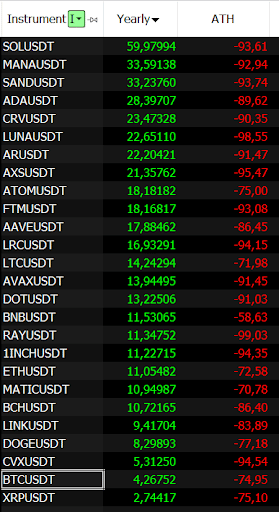

In fact, proceeding with the analysis, Figure 2 shows how despite the fact that the current year has just begun, there are many cryptocurrencies that are attempting a recovery, such as SOL (+59.9% in the first days of 2023), MANA (+33.5%) and SAND (33.2%), although they are still a long way from what are the ‘All time highs’ i.e., the absolute highs recorded by the market. Bitcoin in particular has seen a slight rise in the early days of 2023, but the distance from all-time highs still amounts to a whopping -74.95%.

In short, there is still a long way to go, though we may soon see a new halving of Bitcoin, which is usually preceded by a rebound in Bitcoin that is accompanied by the entire crypto sector.

The comparison with traditional markets, visible in Figure 3, also highlights how Bitcoin, and the entire crypto world, are still very volatile markets that require study, dedication, and proper risk management before they can be fully understood.

In particular, QQQ, the ETF that invests in the 100 most capitalized technology stocks in the United States of America, scores a -34% in 2022, as does SPY (ETF on S&P500), which scores a more dignified -20.5%.

Nothing compared to the performance of Bitcoin or other cryptocurrencies, which coming from a strong rally have posted somewhat worse returns than the traditional markets.

However, the strong correlation that linked markets such as the Nasdaq and the S&P500 to the crypto sector in 2022 remains in the public eye. A sector that was initially considered stand-alone, but which has shown a clear link to traditional finance, particularly with the restrictive policy of central banks.

We end this overview with TLT, which is an ETF that invests in US bonds with maturities over 20 years, posting a resounding -29.35%.

Thus, the only markets that have been exempt from the 2022 drubbing are USO (an ETF that invests in oil) and GLD (an ETF that invests in gold), which mark +22.2% and +1.26%, respectively.

While we wait to see what surprises 2023 will bring, we warmly urge you to use extreme caution in the markets to avoid overexposures that could seriously affect the overall performance of the portfolio, especially before the markets show clear signs of a restart.

Until next time and happy 2023 to all!