All the latest and important crypto news regarding the current trend of the Cardano (ADA), Akira (AKR) and Pi (PI) cryptocurrencies.

Summary

Price analysis of the Cardano (ADA), Pi (PI) and Akira (AKR) crypto assets

Cardano traders are most likely expecting a bullish week. Pi (PI), on the other hand, awaits its future market entry, while Akira (AKR) is the memecoin on which the investor is actively contributing.

Bullish week for Cardano (ADA)? The crypto could perform better than PI and AKR

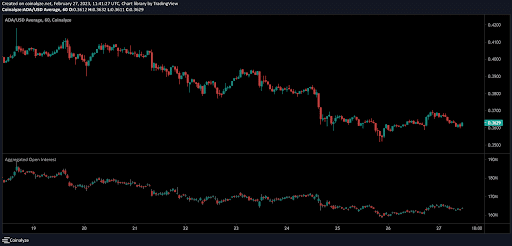

Let’s start from last Sunday, when Cardano (ADA) was trading at $0.411. Over the past week, however, the price of ADA has dropped 12.2% to being traded at $0.361.

Therefore the market structure was bearish in the lower time frames.

With Bitcoin headed further down the charts, it looked like ADA bulls could face further losses. However, price action showed that Cardano (ADA) buyers were presented with a buying opportunity on the token.

At first glance, the four-hour and one-hour market structures were bearish: they formed decreasing highs and lows over the past week, thus forming a bearish channel. The RSI was at 32.9, showing strong downward momentum.

The OBV has also been trending downward for the past three days, signifying huge selling pressure during the downtrend. At the same time, this was a new test of the H4 bullish order block that ADA made during the rally earlier this month.

$0.345-$0.36 is a region where bulls can begin to reverse prices. During the previous rally from this order block, the upward movement was quick and the pullback slow. The $0.354 level has also been a support level since mid-January.

Therefore, despite the evidence of indicators, it was likely that ADA would recover and push toward $0.41 in the coming week. However, a drop below $0.345 would invalidate this idea.

In any case, Coinalyze’s one-hour chart showed that Open Interest has fallen along with price over the past three days. ADA also fell below $0.37 during this period.

Therefore, the conclusion was that long positions were discouraged and the market had a bearish sentiment in the short term. On the other hand, spot CVD reached a higher low and started to rise in recent days, indicating demand in the market.

The liquidation charts also showed that some long positions were liquidated on 24 February. Within two hours, longs worth $1 million were liquidated when Cardano fell from $0.38 to $0.365 on 24 February.

Pi crypto: when will there be market entry? All the details

As we know, Pi Network is a new crypto mining project that allows mobile users to mine Pi coins without draining the device’s battery.

Pi’s blockchain protects not only economic transactions through a mobile meritocracy system, but also a complete Web 3.0 experience where community developers can create decentralized blockchain applications (dApps) for millions of users.

The project has evolved over the years with tremendous community interest and is now in the final stages of transitioning to the public mainnet. It has been particularly active recently because of a couple of price-related news stories: in fact, by all accounts, the Pi coin has been listed on Huobi, although the team for now does not seem to confirm its official status.

In addition, Wrapped Pi (WPI), the Pi bridge utility token, also went live on the BNB chain in January 2023, as a planned bridge between the Pi network and the BNB chain. In any case, the launch date of Pi Network Mainnet has become a hot topic again.

The Pi Core team confirmed in its 2022 year-end update that Pi Network is at a vital stage in the development of the closed Mainnet leading up to the launch of the open Mainnet.

The team is still focusing on completing KYC and further technology improvements before opening the mainnet to the public, but currently has no set timeline for this transition.

Therefore, the question arises whether all the Pi coin listings so far are just scams as transacting Pi through an exchange is prohibited during the Enclosed Mainnet period.

This question has caused confusion within the Pi Network community and has prompted the team to respond to what is happening.

According to a statement from the Pi Core team, all of these listings so far have been conducted independently of the team, which were not approved and were not in line with network policies. The team is calling for the removal of the coin from these exchanges and warning users not to engage in trading at this time.

In any case, we see that the price of PI is on the rise this week. The price has risen 2.26% in the last 24 hours, but in the last hour it has decreased 0.12%. The current price is €44.16 per PI. The price of Pi is 85.91% lower than the all-time high of €313.38. The current outstanding bid is 0 PI.

Focus on the performance of AkiraToken (AKR)

AkiraToken (AKR) is a decentralized financial payment network that rebuilds the traditional payment stack on the blockchain. It uses a basket of fiat-anchored stablecoins, algorithmically stabilized by its AKR reserve currency, to facilitate programmable payments and the development of an open financial infrastructure.

As of December 2020, the network transacted about $299 billion worth of transactions for more than 2 million users.

Despite this activity, both AKR’s price and trading volume in the past 24 hours are $0.

It has a circulating supply of 1,000,000,000 AKR coins and a total supply of 1,000,000,000 ACR.

Akira aspires to establish a decentralized project in which the investor actively contributes to the project.

In fact, each investor can vote and create ideas that can improve the ecosystem and has the opportunity to develop the project with other contributors. Akira is an ERC20 memecoin with 100% liquidity locked in. The contract has been waived and is available for anyone to review.

Akira was created with its holders in mind. From conception, the token itself was designed to protect its investors and help them grow their holdings in comfort.

1% of all transactions are distributed to holders to keep investors ambitious. 9% of all transactions are distributed to marketing funds and the development team, to keep the project active.