The rapid rise of the cryptocurrency industry in recent years has brought with it a host of exciting possibilities. Still, it has also exposed many infrastructure problems hindering its growth.

From issues with scalability and security to concerns around regulatory compliance and adoption, a range of challenges must be addressed if cryptocurrencies are to realize their full potential.

As the crypto industry continues to grow and gain mainstream adoption, addressing these infrastructure problems will be crucial for its long-term success.

The problems of the traditional banking system

Bitcoin and the blockchain were created by Satoshi Nakamoto in 2008 to address the problems of the fiat currency and the need for trust when it comes to saving money in banks.

After more than 15 years, the banking industry issues stay the same: it is too expensive, not connected to Web3 which is the future, the processes are slow, and there is a need for trust.

How the blockchain and Stasis can solve those problems

Regularly Joe doesn’t know a lot about banks. It’s about time to climb the learning curve! Are you aware of the risks associated with the fractional banking system?

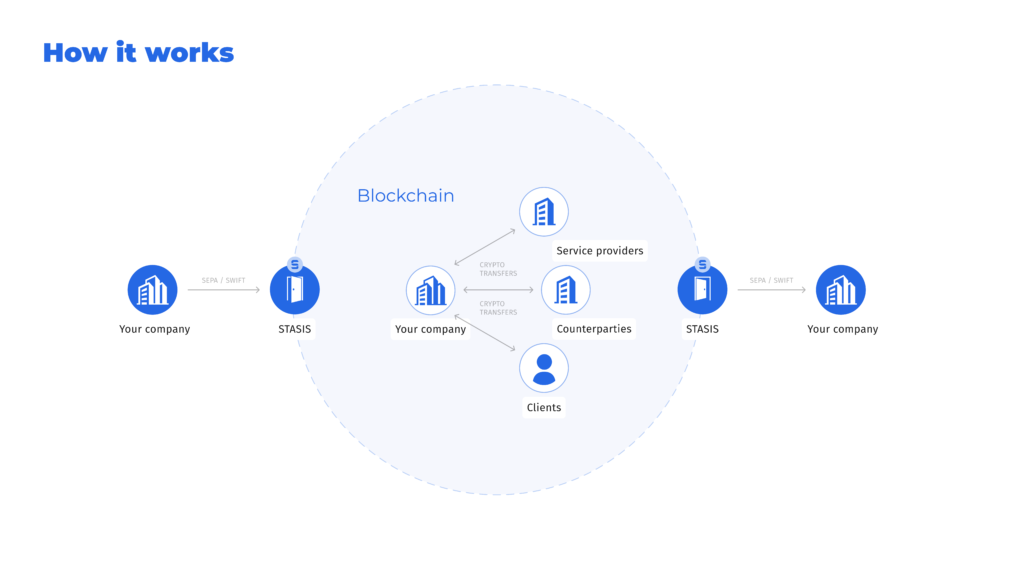

So now, let’s explore how distributed ledger technology can help make these issues go away. The blockchain indeed solves all the problems above mentioned regarding the traditional finance system and that’s why our EUR stablecoin is of course based on blockchain technology.

This way you are the real owner of your money, especially if you use a non-custodial wallet, the system is faster and accessible any time, cheaper and there is no need to trust anyone.

The uncomfortable truth is, the fractional banking system has many risks. The so-called “solid institutions” can’t withstand the turmoils of today as the last few recent examples show. Credit Suisse had a 167 years-long history. Silicon Valley Bank operated for 40 years. In the end, both institutions collapsed in just 2 days.

STASIS does not have such risks as the company keeps funds in collateral euro stored in the Central Bank.

The whole setup created by STASIS might seem intricate at first glance, but the magic behind the gears actually works!