This new article will examine, and test on Ethereum, one of the most widely used indicators in trading for trend following type strategies: ADX.

This indicator, whose acronym stands for “Average Directional Movement Index,” is used to measure the strength of a trend.

If the indicator tends toward low values then the trend will be almost absent, but if the ADX takes high values then the underlying trend will be more significant.

Summary

Trading: the study of the ADX on Ethereum

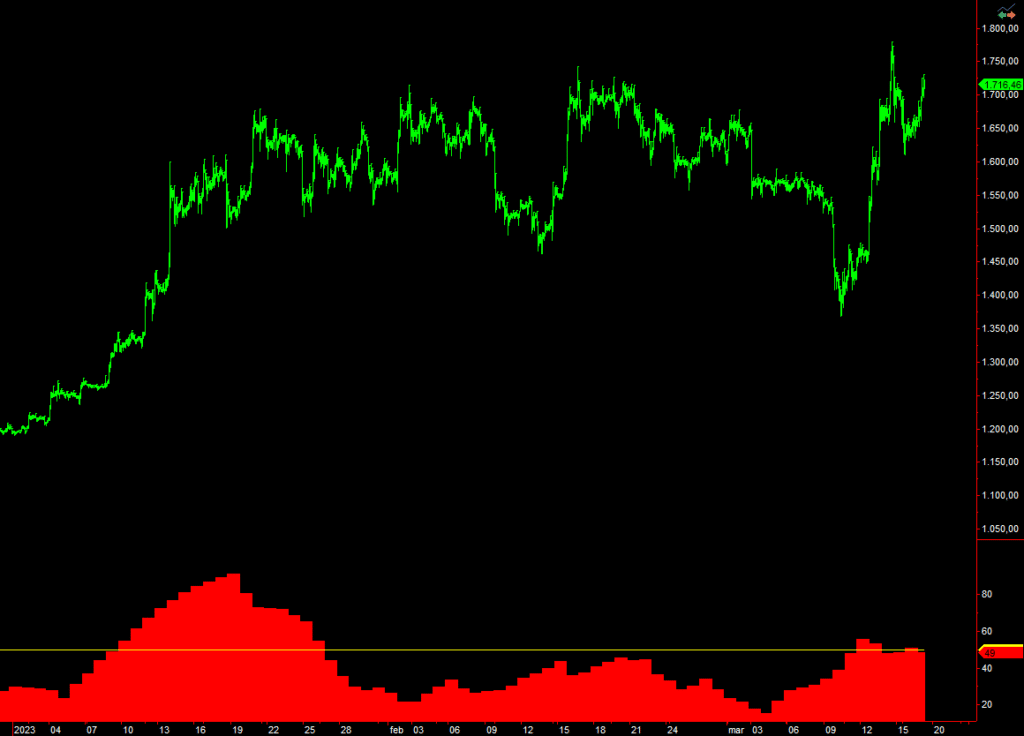

An example of how ADX is used on an Ethereum chart can be seen in Figure 1. The indicator ranging from 0 to 100 is calculated over the last 5 days, and as can be seen in the initial part of the chart, in the presence of extended and explicit trends, the indicator takes values above the average threshold line of 50.

During the up-trend that occurred on Ethereum in early 2023 it was seen how the ADX went from a value of 20 to highs of over 90.

The crypto market does spend a lot of time in a trend, whether bullish or bearish, and it is therefore very likely to see very high ADX values as in the case just described.

An important distinction is also made by the fact that ADX tends to rise in both up-trend and down-trend situations. In sideways market situations, or where the trend is absent, the ADX will be at lower values, or at least generally contained between 0 and 50.

Having made these due clarifications, the question remains as to how the information retrieved from the indicator can be used in a trading strategy. What would seem most logical, simply by looking at the chart, would be to avoid trend-following trades in very extended trend phases with the ADX on very high values.

This is because when the market movement is already quite extensive and the ADX is marking high levels, continuing trend-following may not bear the desired fruit.

How to use ADX in trading: a test on Ethereum

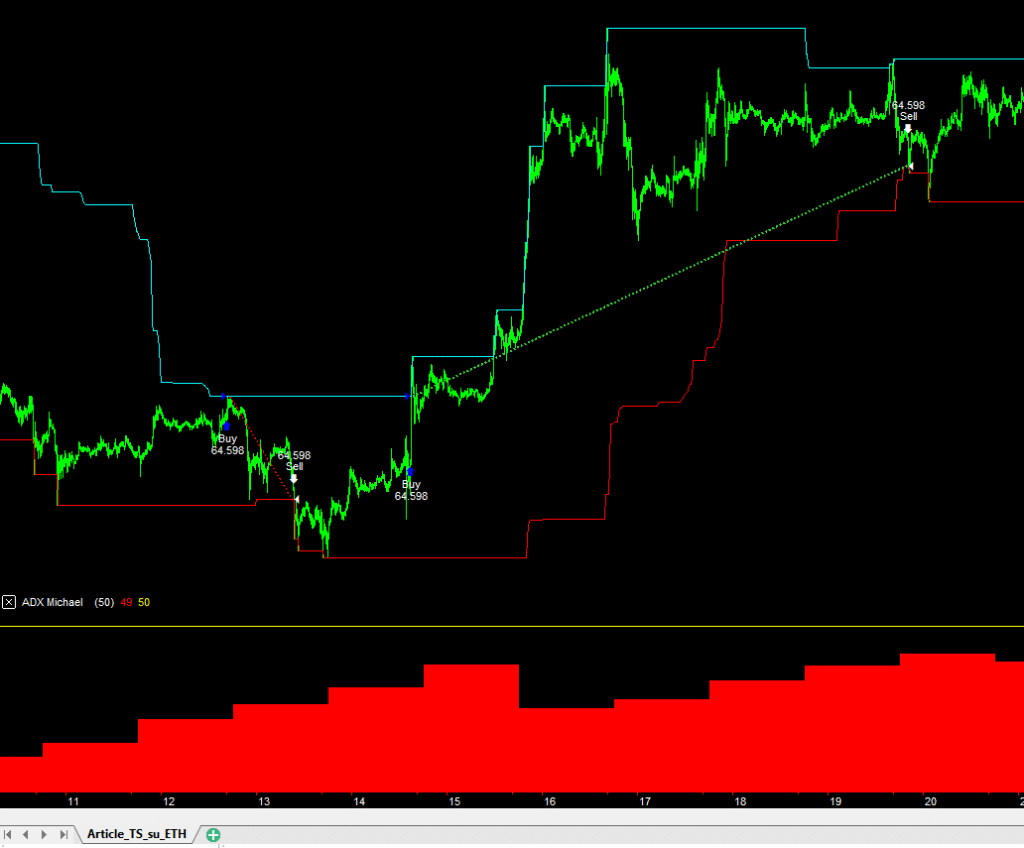

We therefore proceed to build a strategy (entry example visible in Figure 2) that makes only long trades on the Ethereum spot market.

The time frame used is 15 minutes, and the highest high of the last 200 bars will be used as the entry level, while the lowest low of the last 200 bars will be used as a kind of trailing stop for long trades.

This trigger (or entry level) is calculated through what is generally called the Price Channel (or also Donchian Channel) a very useful indicator for setting up trend-following strategies.

For exits, on the other hand, the strategy provides a stop loss, that is, a level on which to set the maximum loss, equal to 5% of the value of the position taken ($10,000), and that is $500.

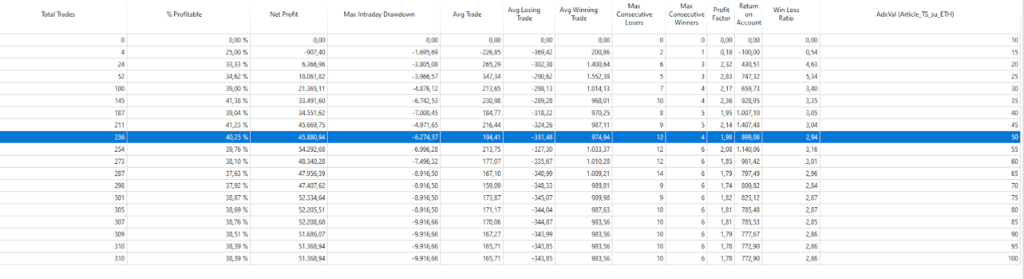

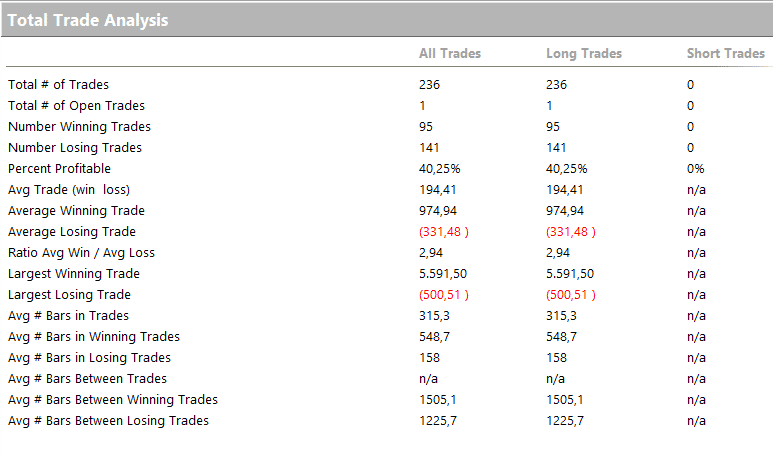

Figure 3 shows the results of optimizing the ADX values applied to the strategy just described. The results range from 5 to 100, and the condition included in the code requires that we operate only when ADX is below a certain threshold. In fact, as the ADX value decreases, the condition becomes more and more stringent, and this is evidenced by the number of trades, which decreases as the ADX values decrease.

What emerges from these results is that already at the base, the strategy makes excellent trades. In fact, with ADX values below 100,95,90 and generally high (and therefore low) values, the strategy achieves excellent results. As one moves toward more significant ADX values, one notices that the average trade, or average profit per trade, increases and the relative drawdown decreases. Between 30 and 60 one could isolate the most interesting cases, but the point that provides the most certainty is 50.

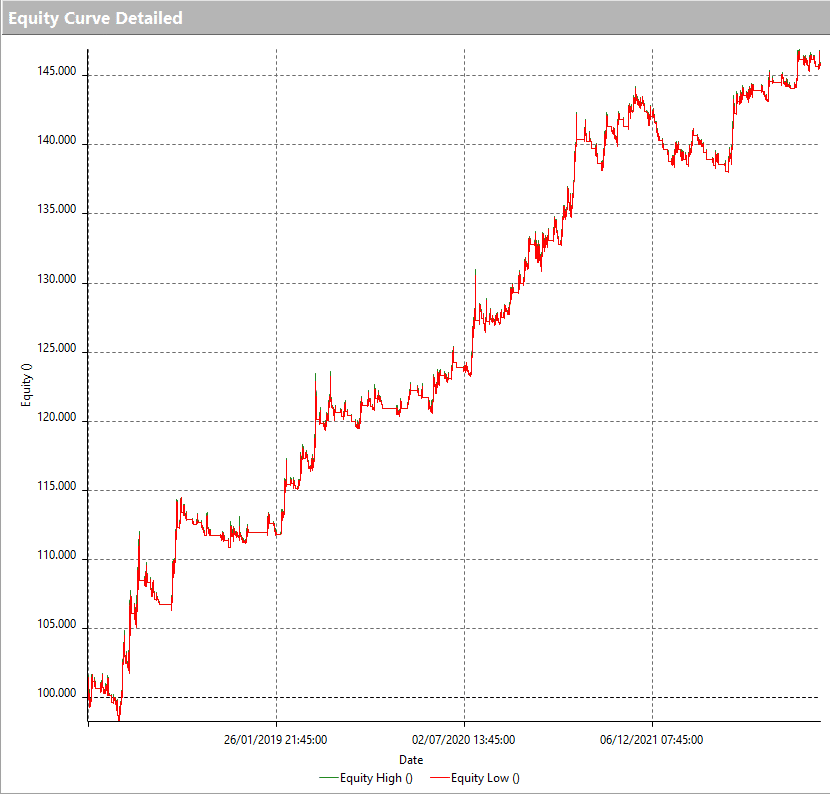

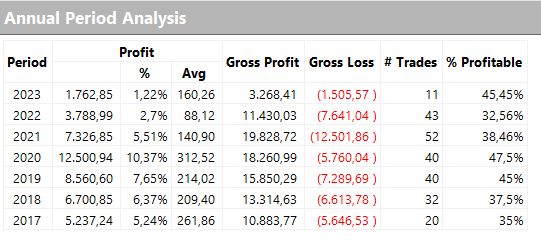

By setting this value, the strategy takes on a very positive profit curve, visible in Figure 4, and also the average trade, as observed in the optimization, reaches $194, about 2% of the value of the position taken. Certainly a very capacious value and potentially able to cover the costs of trading in this market.

Hence a very good result, with 2022 positive as well, which is certainly another point of merit of this strategy compared to a more simple “buy-and-hold” given the strong shocks made by this market in the year in question. Even in the current year, 2023, in the face of a rebound in the underlying, the strategy was also able to tweak and improve on its previous all-time highs.

Conclusions

In conclusion, it can be said that the quality of trades has thus improved as a result of the addition of the indicator and that ADX is certainly a filter to remember when trend-following.

Ethereum, more so than other cryptocurrencies, has also proven to be a pliant market, capable of reacting well to different types of filters and conditions, and as mentioned, ADX has also been able to demonstrate that it can distinguish trend phases from lateral phases with good success.

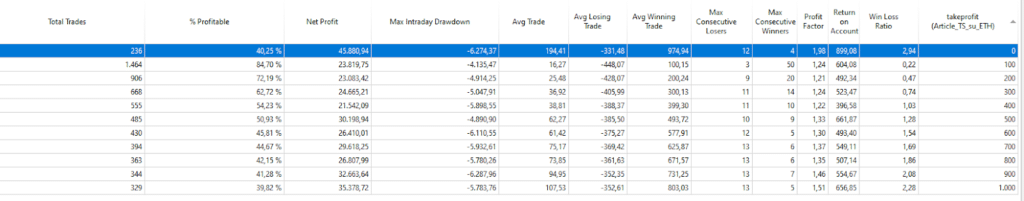

The strategy at this point in development could be further refined, for example by limiting the number of days in the market or inserting other conditions to reduce the final number of trades. Adding a take profit, on the other hand, results as a limitation to the system, which working in a notoriously volatile and explosive market would end up cutting into profits too soon (Figure 7).

Until next time!

Andrea Unger