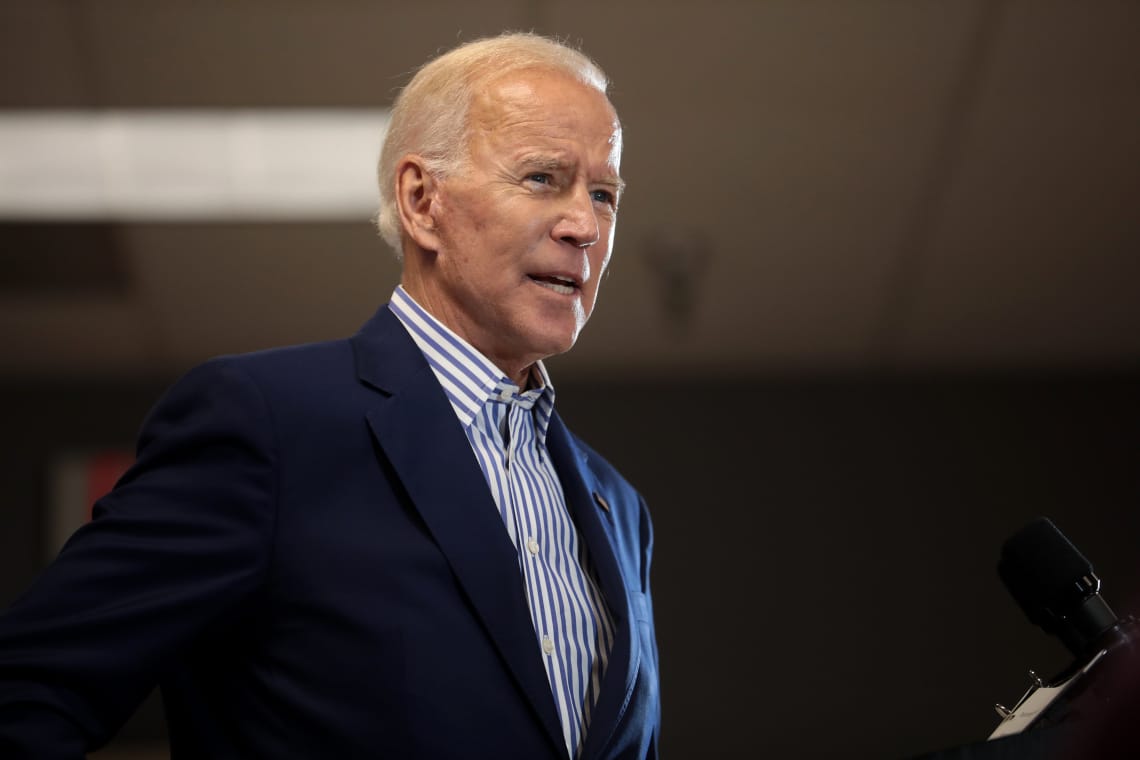

President Biden’s 2024 federal budget proposal has drawn criticism from the mining industry for including a provision to tax up to 30% of the electricity costs incurred by miners of bitcoin and other cryptocurrencies.

The White House has stated that the tax is aimed at curbing environmental and economic concerns, as the energy consumption required to mine cryptocurrencies such as bitcoin is significant.

Summary

30% tax on Bitcoin mining: Biden’s proposal for the 2024 federal budget

The proposed tax would mainly affect bitcoin miners, as other major cryptocurrency networks use Proof-of-Stake (PoS) rather than Proof-of-Work (PoW) consensus algorithms.

PoW algorithms require miners to solve complex mathematical problems to validate transactions on the network, which consumes significant energy.

The environmental impact of bitcoin mining has long been a concern for environmentalists: some estimates suggest that the energy required to mine bitcoin is greater than the electricity consumption of entire countries such as Argentina or Sweden.

This has led to calls for the cryptocurrency industry to adopt more energy-efficient consensus algorithms, such as PoS.

In addition to environmental concerns, there are also economic concerns associated with the energy consumption of Bitcoin mining.

High electricity consumption can strain local power grids, leading to higher costs for consumers and, in some cases, blackouts.

US President Biden’s proposal is seen as a way to address these concerns. By taxing the energy used to mine cryptocurrencies, the government hopes to encourage miners to adopt more energy-efficient practices and technologies.

Revenue from the tax could also be used to fund research into alternative energy sources and to mitigate the economic impact of Bitcoin mining on local power grids.

Bitcoin mining: proposal draws criticism despite ecological purpose

However, critics of the tax proposal argue that it could lead to an exodus of cryptocurrency miners from the US.

With many countries offering more favourable tax regimes for cryptocurrency miners, such as lower electricity costs or even tax breaks, it is feared that the tax could make the US less competitive in the global cryptocurrency industry.

Some supporters of the tax argue that it could actually benefit the US in the long run by encouraging innovation in energy-efficient crypto mining technologies.

By making it more expensive to mine cryptocurrencies using energy-intensive PoW algorithms, the tax could encourage the development of new, more efficient technologies such as PoS.

Despite the controversy surrounding the tax proposal, it is important to note that it is only a proposal at this stage. It will need to be approved by Congress before it can be implemented, and there is likely to be considerable debate and lobbying on both sides of the argument.

It is also worth noting that the proposed tax would only apply to cryptocurrency miners, not individual cryptocurrency investors or traders.

This means that the tax would only affect a relatively small subset of the overall cryptocurrency sector, although it is worth noting that bitcoin mining is still a significant part of the industry.

President Biden’s proposed tax on electricity costs for cryptocurrency miners is a controversial move that aims to address the environmental and economic concerns associated with bitcoin mining.

While there are concerns that the tax could lead to an exodus of crypto miners from the US, it is possible that it could encourage innovation in energy-efficient crypto mining technologies.

The proposal is still in its early stages, and it remains to be seen how it will be received by Congress and the cryptocurrency industry in general.

One potential outcome of the proposed tax on cryptocurrency miners’ electricity costs is that it could lead to a change in the cryptocurrency mining landscape, with more miners adopting energy-efficient PoS algorithms or moving their operations overseas to avoid taxation.

Many US states have already introduced their own mining regulations

However, it is worth noting that some US states have already taken steps to encourage energy-efficient cryptocurrency mining.

For example, the state of Kentucky has introduced tax incentives for cryptocurrency miners who use renewable energy sources, and the state of Texas is known for its abundant renewable energy resources, which have attracted cryptocurrency miners looking for low-cost, sustainable energy.

In addition, some crypto mining companies have already begun to adopt more energy-efficient technologies in response to environmental concerns.

For example, Bitmain, one of the world’s largest cryptocurrency mining companies, has developed a water-cooled mining facility that is significantly more energy efficient than traditional air-cooled facilities.

The proposed tax on electricity costs for cryptocurrency miners is just one of several measures proposed by the Biden administration to regulate the cryptocurrency industry.

Other proposed measures include increased reporting requirements for cryptocurrency transactions and increased oversight of cryptocurrency exchanges and custodians.

These proposals have been met with mixed reactions from the cryptocurrency industry, with some arguing that increased regulation is necessary to prevent fraud and protect consumers, while others argue that it could stifle innovation and growth in the sector.

Overall, the proposal for a tax on electricity costs for cryptocurrency miners is a controversial issue that highlights the tension between environmental and economic concerns associated with Bitcoin mining.

While it is still unclear how the proposal will be received by Congress and the crypto industry in general, it is clear that the debate over the environmental impact of Bitcoin mining is far from over.

As the cryptocurrency industry continues to grow and evolve, it will be important for policymakers to balance the need for innovation and economic growth with the need for sustainability and environmental responsibility.

Only by striking the right balance can we ensure that the benefits of the cryptocurrency industry are realised without causing undue damage to the planet and its inhabitants.