According to the latest sources, it seems that market maker Jane Street Capital, among others, has decided to permanently distance itself from the United States due to the regulatory uncertainty in the crypto sector that has been going on for far too long.

In particular, Jane Street Capital, the famous trading company also known as Jane Street, has stopped all cryptocurrency trading in the US. Let’s see what is going on in detail.

Summary

Jane Street Capital pulls out of crypto trading

Unfortunately, more and more players and companies in the blockchain industry are voluntarily going into exile from the US. This is due to financial regulators and the overall regulatory uncertainty surrounding cryptocurrencies, factors that have even prompted cryptocurrency exchange Coinbase to look elsewhere.

Now, even market maker Jane Street Capital, as well as Jump Crypto, have preferred to distance themselves from a certain type of uncertain and damaging regulation in the US.

As we know, market makers continuously quote buy and sell prices to improve the liquidity of crypto exchanges. They are therefore essential for the fluidity of the exchanges, in particular to avoid excessive price gaps.

Despite this, two days ago Bloomberg broke the news that market makers Jane Street and Jump Crypto had decided to withdraw from cryptocurrency trading in the US. As expected, it is the regulatory uncertainty surrounding crypto in the US that is driving this decision.

Pressure from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) continues to have a negative impact.

What will be the consequences for exchanges after the market makers’ departure?

In any case, according to sources quoted by Bloomberg, Jane Street Capital and Jump Crypto are not yet “completely abandoning” the crypto sector.

As for Jump Crypto, which is part of the Jump Trading group, there is still a desire to “develop internationally” in the sector.

Of course, the departure of these market makers is not without risk for cryptocurrency exchanges.

If we take the case of FTX, for example, we see that another factor in its rapid decline, in addition to poor management, was precisely a liquidity crisis.

The news is also being commented on by the crypto Twitter community, where many have expressed a wide range of concerns.

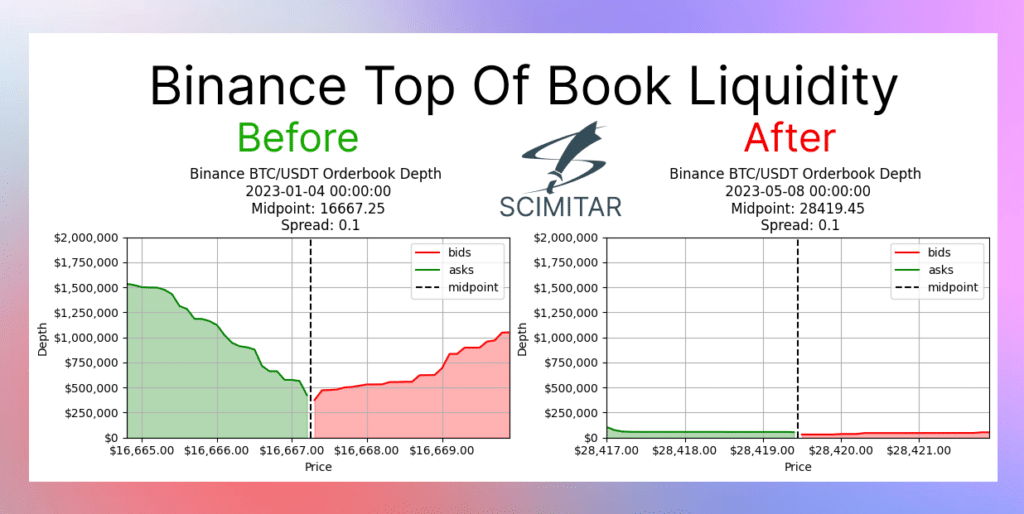

One of the most common was about the exchange’s order books, which are feared to be significantly depleted without the help of Jane Street Capital.

Unfortunately, giants such as Binance could also suffer significantly. One Twitter account in particular estimated trading on Binance with and without market makers, as can be seen:

In conclusion, the withdrawal of market makers such as Jane Street Capital severely weakens the industry and increases risks for consumers.

Crypto regulation is ‘Operation Choke Point 2.0’, says Cardano founder

Some time ago, Cardano founder Charles Hoskinson commented on the new regulatory actions in the US and elsewhere.

Specifically, he called their every move “Operation Choke Point 2.0”, i.e. a war against cryptocurrencies and Bitcoin.

Unsurprisingly, Charles Hoskinson , had already denounced several anti-crypto abuses brought to light by Cooper & Kirk in a video published on 29 March 2023, in which he states:

“Cooper & Kirk have meticulously documented what is happening against cryptocurrencies and what is happening is unconstitutional. This is an abuse of regulation. Regulators strip the US Congress of its power and embezzle it”.

Joe Biden‘s offensive against cryptocurrencies, backed by the financial regulators he has appointed, therefore seems obvious to all. Specifically, there are several points that support the thesis that the US is waging a real war on crypto.

For example, the fact that banking regulators have issued an informal memo warning banks of the “risks” of taking on crypto assets as clients.

Not least, the fact that banks feel pressured to refuse to take on new crypto-related clients and to remove existing clients from the industry. Then there are the arbitrary closures of banks serving cryptocurrencies, as in the case of Signature Bank.

Therefore, these and other factors mentioned above lead one to believe that the US and others have no intention of helping the blockchain industry to become more integrated with the traditional one, but only push for its total exclusion.