What is the crypto market sentiment today and how is the trend of the most prestigious crypto assets: Bitcoin and Ethereum?

Below are all the details about it.

Summary

Trend of Bitcoin and Ethereum today: bullish market?

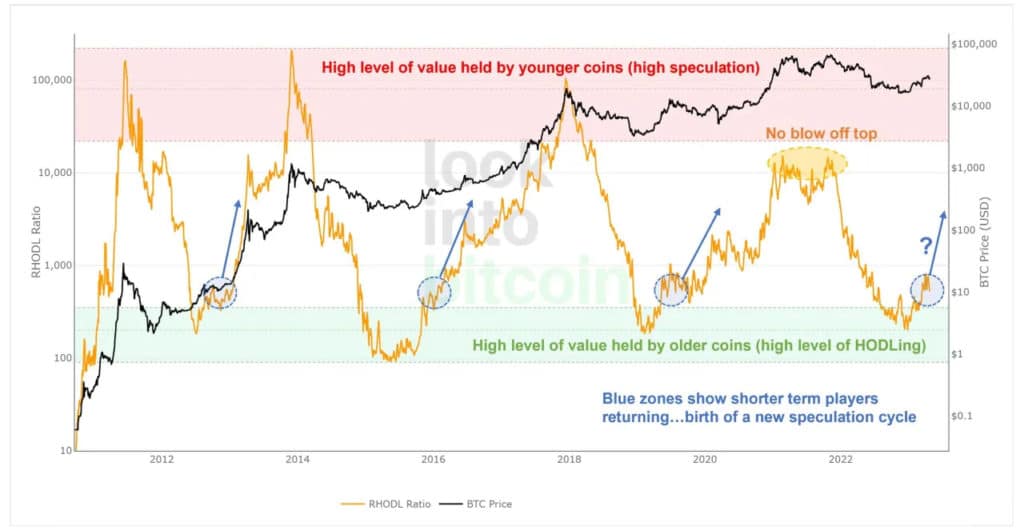

Based on the latest data, we see that one on-chain metric is showing bullish market signals despite the fact that Bitcoin prices are falling at the moment. Specifically, the on-chain indicator RHODL is in a similar position to the start of the last two major bullish Bitcoin markets.

Moreover, the indicator, which was created by Philip Swift in 2020, uses a ratio of Realized Value HODL Waves. Yesterday, Swift said that when he created the indicator, one thing that had struck him was the way it had shown the formation of a new bullish run.

The analyst added that this was the moment when the value of the most recent coin ratio started to increase. Finally, Swift stated:

“This is where we are right now. Don’t panic about small price pullbacks. Zoom out.”

As for the performance of Ethereum, we see that its price has been rising since early 2023. The digital asset is currently trading at $1,813.68, a 51% increase from its price at the beginning of the year.

However, one wonders whether with the bearish market around the corner ETH will be able to cross the $4,000 threshold. It is worth mentioning that $4000 is used as a benchmark because Ethereum was able to reach such heights in the last bull run.

In fact, the cryptocurrency reached an all-time high price of $4,891.70 in November 2021. However, less than a year later, Ethereum was hit hard by the cryptocurrency winter.

In any case, as the price of ETH has been recovering sharply since the beginning of 2023, experts believe that when the market fully recovers, Ethereum will reach the $4,000 mark and even continue to beat its previous ATH.

Focus on the price of Bitcoin (BTC): will it return to $24,000?

Regarding the trend and price of Bitcoin, we see that in late February it emerged from the accumulation zone, which could signal the emergence of a new speculation zone.

In addition, Bitcoin has crossed several long-term on-chain indicators in recent months and remained above them. Specifically, it crossed the 200-week moving average in mid-March and is still above it, suggesting a change in long-term trend.

The 200wma is currently at $25.818, according to data from Woo Charts. In addition, Bitcoin’s realized price is only $19.914. This is the value of all BTC in circulation at the price they last moved.

However, Bitcoin market sentiment is currently neutral as the cryptocurrency correction continues. BTC’s fear and greed index has dropped to 50 as bulls and bears fight for supremacy.

The same index reached a local high of 69 last month when BTC surpassed $30,000 for the first time in nearly a year. Hence, BTC prices are currently consolidating around the $27,000 range.

This means that the crypto par excellence has not moved much since the weekend, but has lost 5.3% in the past two weeks. In addition, the asset has lost 12% since its high in 2023 in mid-April. Analysts have suggested that it could return to $24,000 during this correction, as buying pressure seems to have evaporated.

Trend of Ethereum today: Coinbase suspends ETH staking rewards

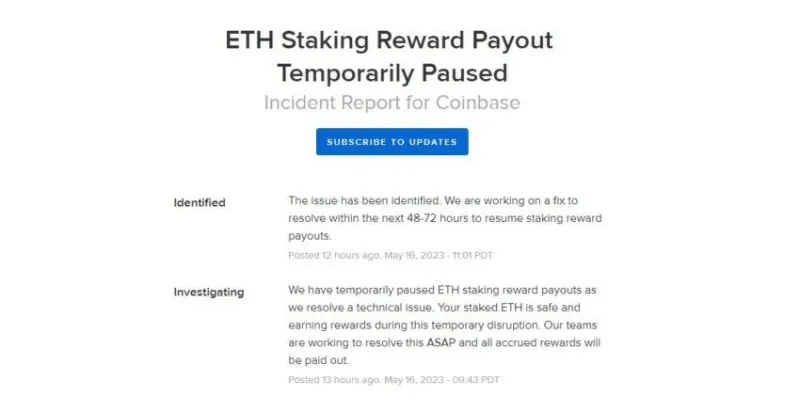

Crypto exchange Coinbase has temporarily suspended reward payments for its ETH staking service due to a technical complication, adding that it will take three days to resolve the issue.

However, the exchange assured users that it is still accumulating rewards and will establish their payment once the problem is resolved, which is expected in the next 48-72 hours.

As we know, Ethereum staking is in high demand and well-known, as Coinbase, and others, allows users to deposit their ETH and earn staking rewards, the rate of which is currently 6%.

The advantage of Coinbase’s Ethereum staking service, which has led to its growing popularity, is the fact that it does not require a minimum of 32 ETH to start staking.

It is also worth noting that the discontinuation of the staking service has nothing to do with the US Securities and Exchange Commission’s (SEC) actions against ETH staking, unlike what happened to Kraken.

In any case, ETH rewards were stuck on Coinbase last week because its systems did not support ETH addresses from external validators. The crypto community took to social media channels for clarification on the matter, with a large number of withdrawals stuck in the queue.

Coinabse also introduced the Coinbase Wrapped Staked ETH utility token (cbETH), which is a 1:1 representation of ETH in stakes. This token allows holders to use it as collateral in the DeFi market.

Finally, we see that Coinbase is also seeing an increase in ETH inflows as a result of increased staking rewards. This is mainly due to memecoins taking over the Ethereum network, such as PEPE, which has clogged the network and is driving up gas rates.