A previous article examined a strategy on Ethereum (ETH) based on the calculation of ADX, an indicator whose acronym stands for “Average Directional Movement Index” and is used to measure the strength of a trend.

If the indicator tends toward low values then the trend will be almost absent, if the ADX takes high values then the underlying trend will be more significant.

Summary

Backtest of the ADX trading system on Bitcoin, MATIC and BNB

Since this trading strategy was providing interesting results on ETH, the decision was made to test the same logic also on other cryptocurrencies. Specifically, the strategy involved long-only entries, with ADX less than 50 on the highest highs of the last 200 bars (at 15 minutes).

Exits were on the lowest lows of the last 200 bars, as well as possibly at stop loss (5% of the position’s value), or after a maximum of 5 days in the market.

How might this logic work on other cryptocurrencies?

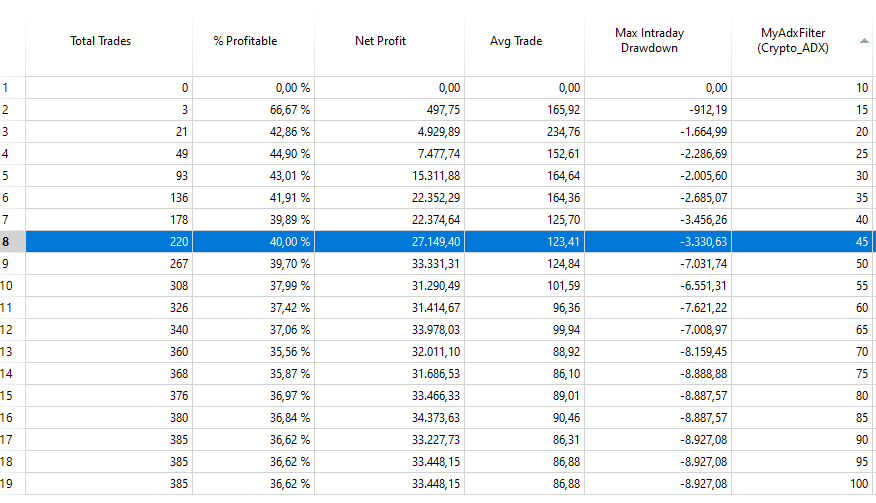

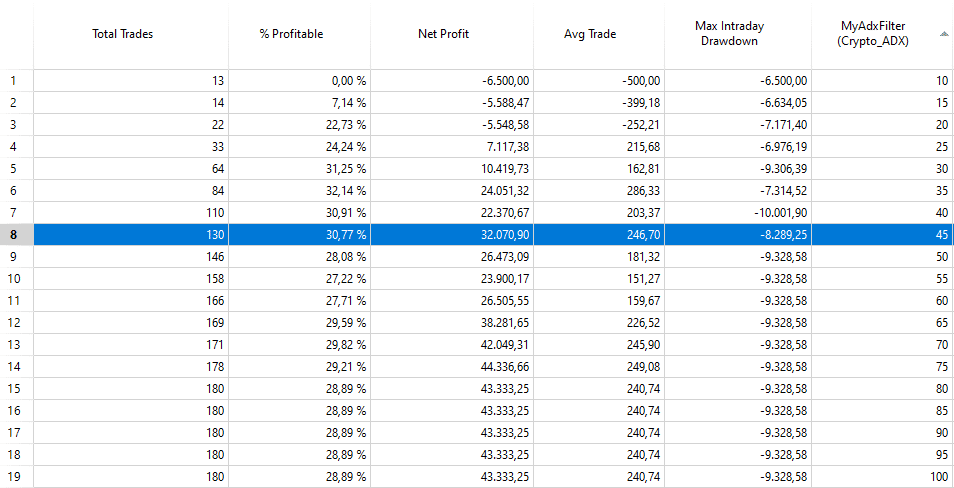

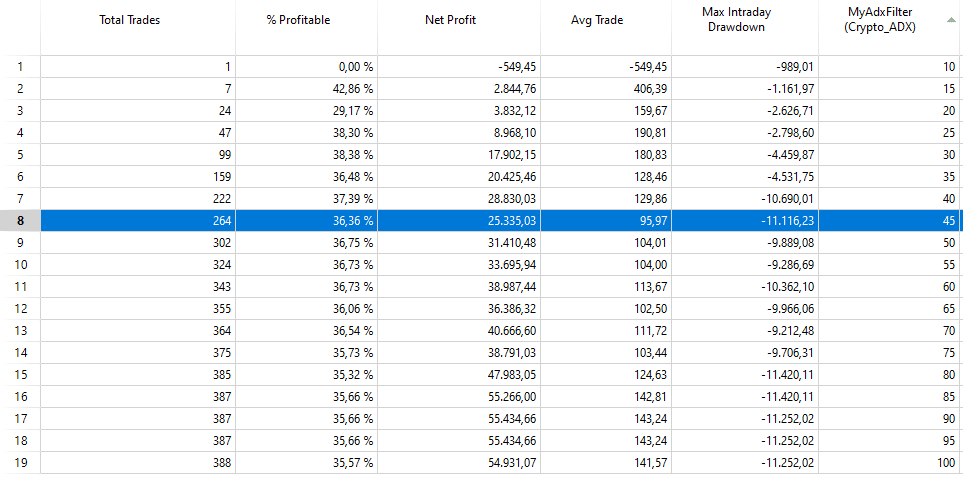

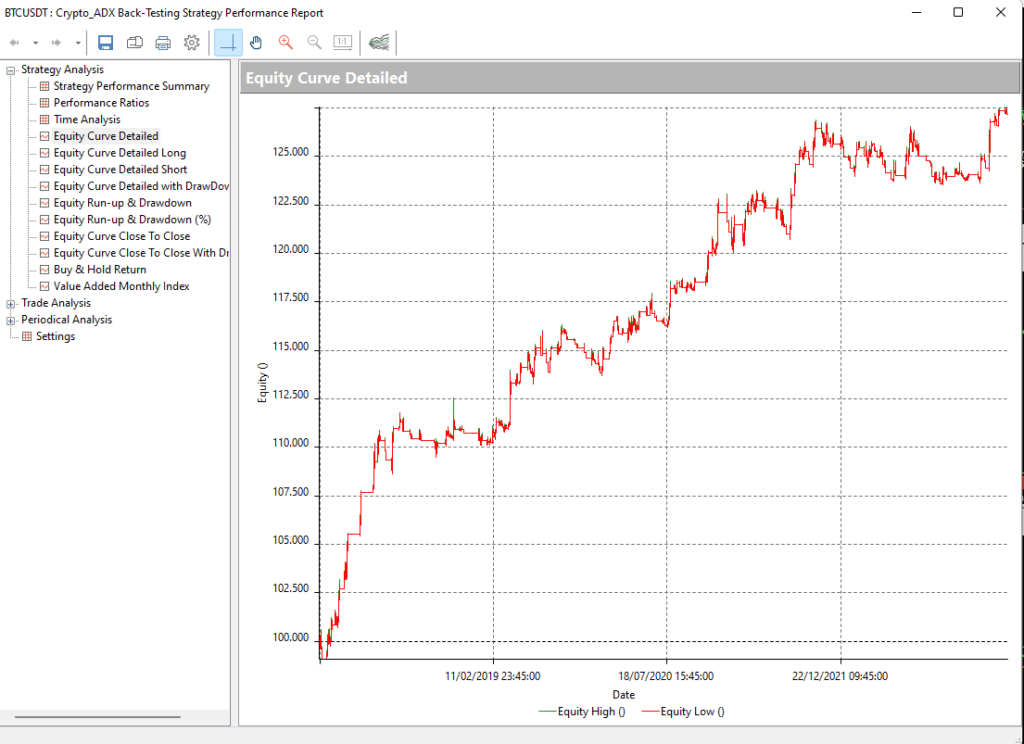

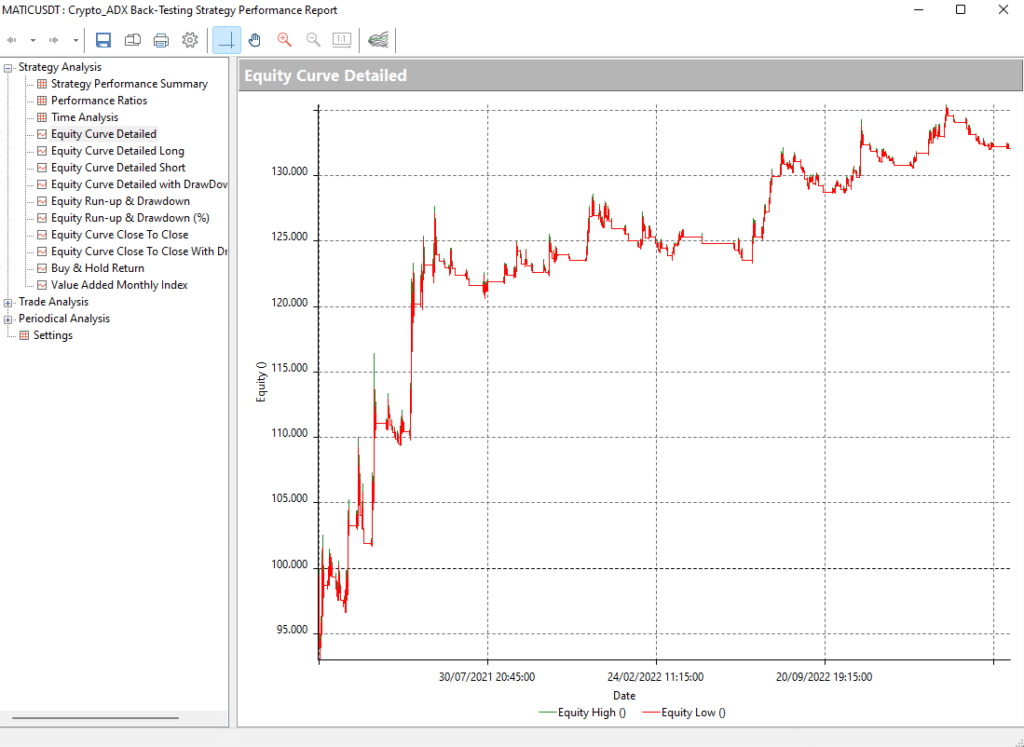

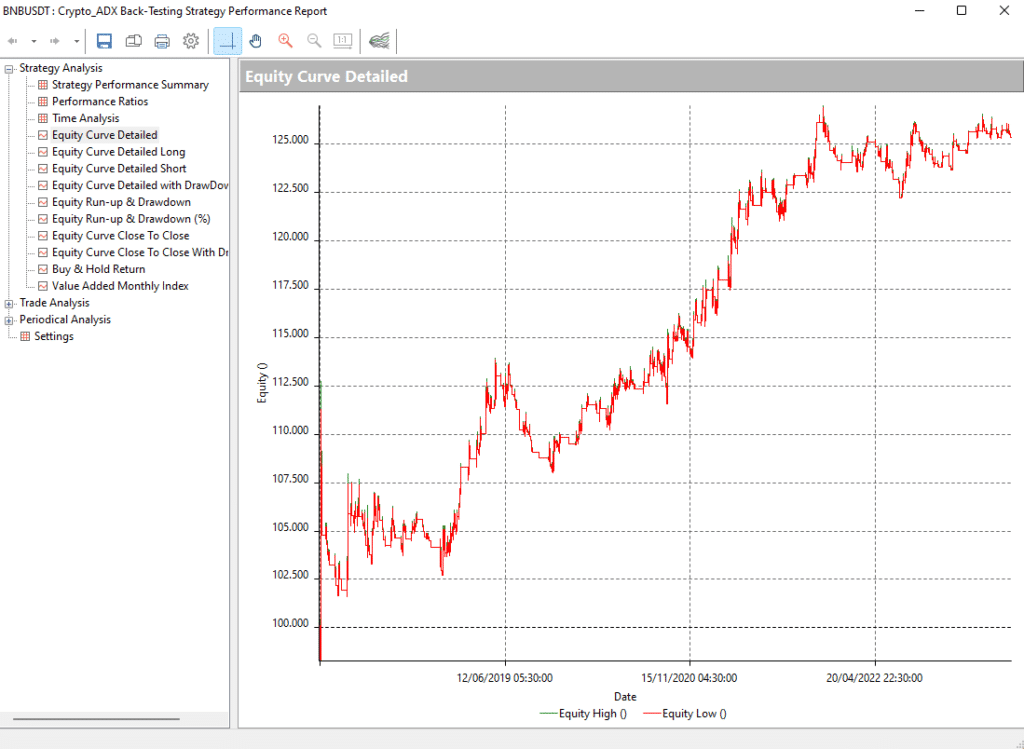

Testing the trading system on Bitcoin (BTC), MATIC, and BNB shows from the outset some continuity from the results obtained on ETH.

We chose to use ADX values below 45 (slightly more stringent than the ETH strategy) for these crypto assets because it provides the best results (Figures 2-3-4) in overall terms. The profit goes down as the ADX values go down, but the average trade goes up (except on BNB on which other ADX values seem to work), consequently the drawdown goes down as the ADX filter becomes more stringent.

This is certainly an indication of the good filtering job done by the indicator, as the quality of the average trade has increased.

The position is always fixed and is equivalent to $10,000 in monetary value. The average trades that are obtained are undoubtedly capacious enough to trade in the real market.

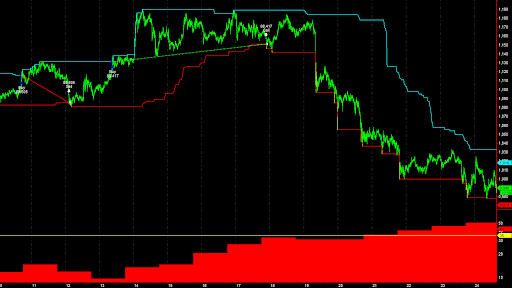

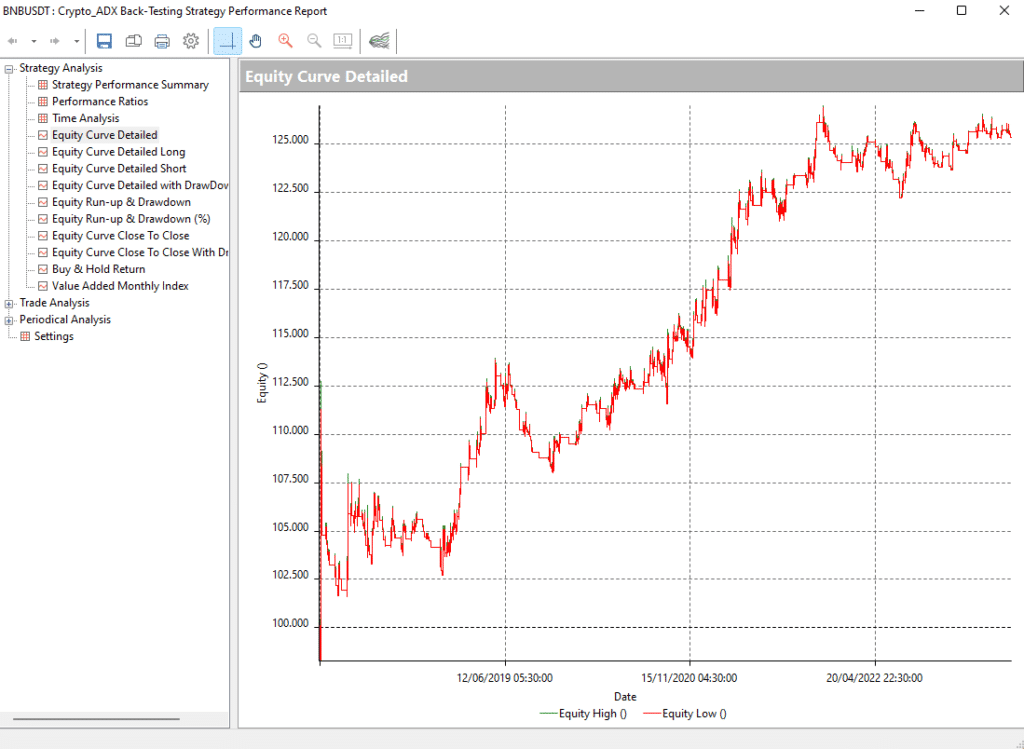

In the next figures (5-6-7), it can be seen that the individual curves are also appreciable. ADX seems to be able to provide interesting results even in younger and newer markets such as cryptocurrencies.

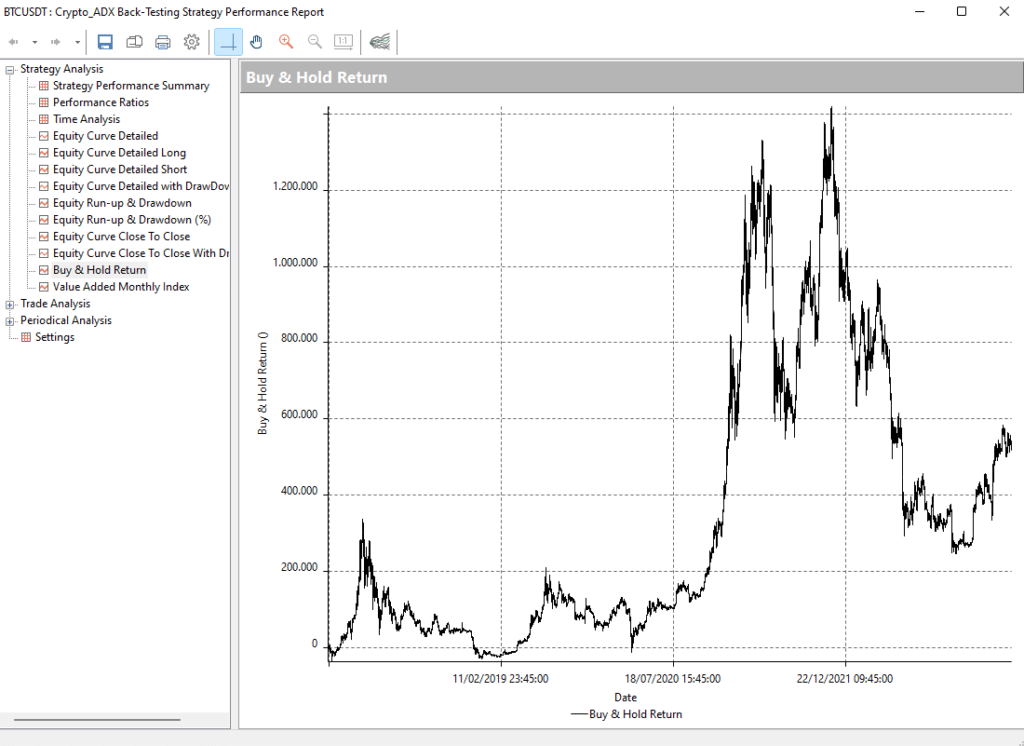

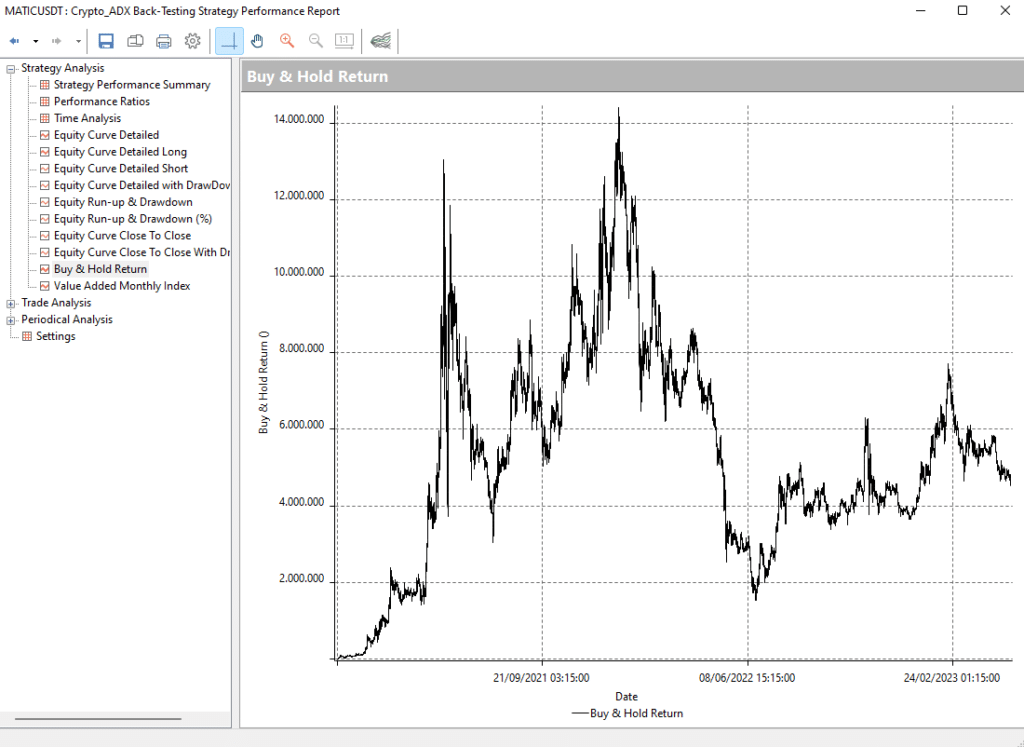

Also interesting to see is the comparison between the simple buy&hold of these products and the strategy just used.

Conclusions on the ADX trading system on Bitcoin, MATIC, and BNB

What immediately jumps out is that in the most recent part of the backtest, or more generally in the last year and a half, the strategy has performed better than the simple buy&hold of the instrument.

In fact, while the overall profit of the strategy is lower than that of the buy&hold, there are no sharp drawdowns like those recorded by the markets between the beginning of 2022 and the end of the same year.

The automated strategy, with the help of ADX, was able to skim those market phases where it was not convenient to enter and take long positions.

Even on Bitcoin – a market that is certainly more prone to the development of automatic strategies since it is the oldest among crypto assets – the equity peaks of this strategy have recently been reached, in the face of the conspicuous rebound that the same market made in the early months of 2023.

In this case as well, the automated strategy was able on the one hand to contain risk and on the other hand to update historical highs more frequently than the classic buy-and-hold approach.

Until next time!

Andrea Unger