After the SEC sued Binance citing 13 different wrongdoings, including the commingling of customer funds with CZ funds, users rushed to withdraw their crypto from the exchange.

Nevertheless, the rush to the counters does not seem to scare off Binance, which has faced similar situations before and enjoys the highest asset balance among its competitors.

Let’s analyze the situation together

Summary

The SEC lawsuit against Binance and the wave of withdrawals

On 5 June, the Securities and Exchange Commission sued cryptocurrency exchange Binance for violating US securities laws.

The federal agency came down hard on it, citing as many as 13 different misdemeanors in the US District Court for the District of Columbia, including serious allegations of deception of investors and opaque management of its financial statements.

Immediately, many of the exchange’s customers rushed to withdraw their assets, fearing a repeat of the November 2022 nightmare involving FTX.

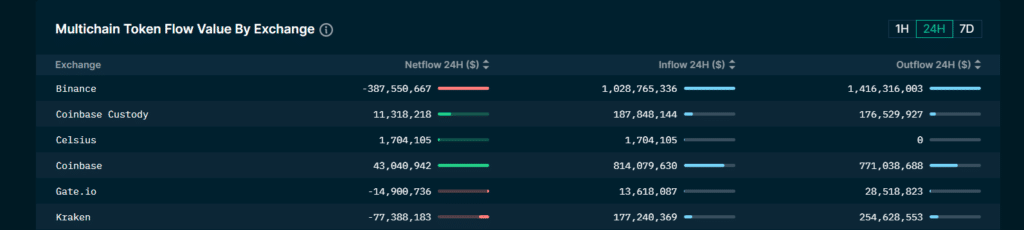

In detail, the first 24 hours since the SEC’s lawsuit was announced were the busiest and saw a total of $3 billion in cryptocurrency outflows, according to Nansen‘s data.

In total, the netflow, or the difference between cash inflows and outflows, amounted to about $1.4 billion in the negative.

At the moment the situation seems to have subsided slightly, with a decrease in the trend of withdrawals in recent hours.

This is because the FUD against the exchange has been debunked on Twitter by both Binance representatives and many active users on social media.

Notably, the last 24 hours have seen less violent outflows, with a negative netflow of $387 million. Most of the movements have occurred on the Ethereum blockchain.

In the last 7 days, the data speak of a negative netflow of $1.6 billion, of which again the vast majority comes from transactions conducted on Ethereum.

The situation for Binance.com appears to be under control

The stampede triggered by the SEC’s lawsuit against Binance, and the FUD that spread rapidly in the hours that followed, does not appear to seriously threaten the exchange’s fortunes.

In fact, the platform run by its CEO Changpeng Zhao, who is also being sued by the federal agency, has faced similar situations to this one before, with far greater user withdrawals.

For example, taking data from DefiLlama, we can see how on 30 January 2023 there was a negative cash flow of as much as $4.28 billion, while on 14 December 2022 there was another major capital outflow of $4.26 billion.

Compared to these two events, the outflow of the past few days does not seem to be particularly severe.

If we then take a look at the total balance sheet held by the exchange, we realize that the net outflow of the past 7 days amounts to “only” 2.8% of all that Binance currently manages.

This is still a considerable sum, but not alarming to the point that we should speak of a bankruptcy in progress.

In detail, Binance still has total assets of $57.796 billion, of which 28.18% is on the Ethereum chain, 27.96% on the Tron chain, and 27.27% on Bitcoin.

The token allocation of the exchange shows that most of the funds (more than 50%) are allocated in USDT and BTC, 12% are in ETH, while about 10% are split in BNB and BUSD.

The world’s largest exchange in terms of trading volume and reputation is not in danger, at least from a financial and liquidity flow perspective.

The real danger seems to be more toward Binance.US, which just in the last few hours has been forced to delist about 100 trading pairs from its markets because certain cryptocurrencies have been deemed “securities” by the SEC.

Binance.US has never registered these “financial products,” for which there is a special regulation dated 1933, so it is not allowed to sell them to US residents.

A separate discussion applies to Binance.com, which is headquartered in the Cayman Islands, so it has more protection against the imposition of US courts.

In this regard, false rumors were circulating these days about some US judge forcing Binance to transfer its assets to Binance.US to be permanently frozen.

This is not true.

We remain eagerly awaiting updates regarding this court case, which seems to have taken on a decidedly more political backdrop, in which the interests of investors are increasingly being undermined, despite the fact that this should be the ultimate goal of the SEC.