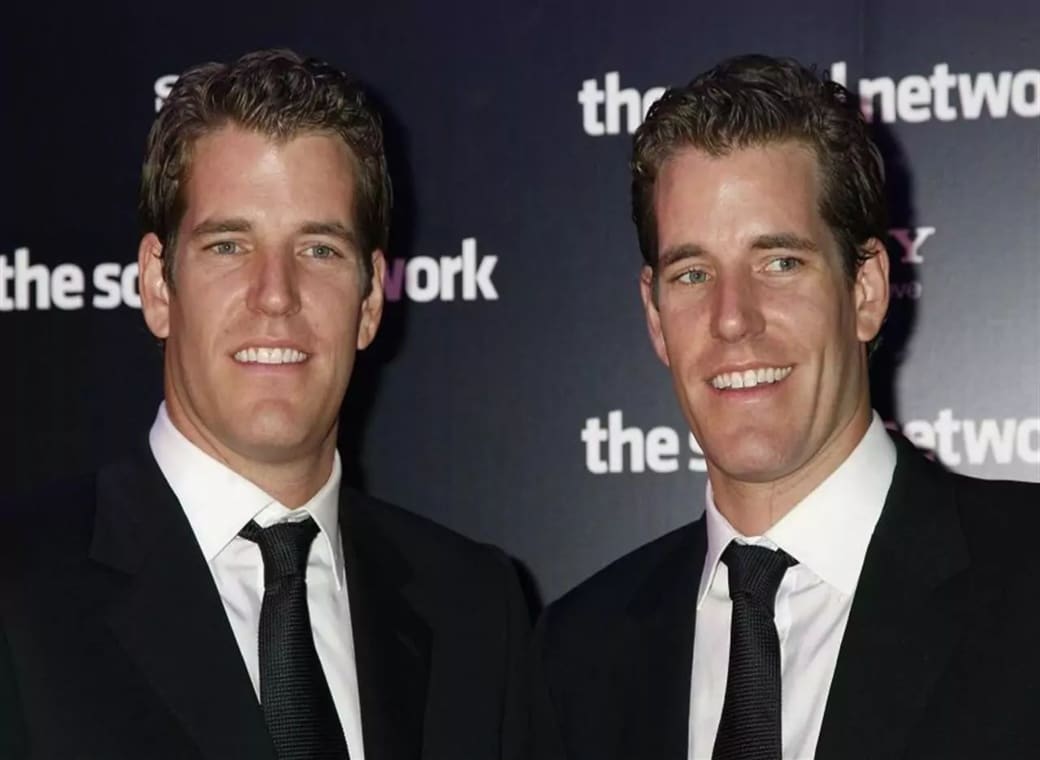

Gemini, the crypto exchange founded by Tyler and Cameron Winklevoss, has obtained approval as a Virtual Asset Services Provider (VASP) from the Autorite des marches financiers (AMF) in France.

This important development marks a fundamental milestone in Gemini’s European expansion strategy.

Summary

Crypto exchange Gemini expands into France

In an exclusive communication with CNBC, Gemini has revealed its upcoming plans to launch retail and institutional services in France.

The approval allows the company to expand its offering to French users in the coming weeks, after completing the final preparations.

Gillian Lynch, EU manager of Gemini, emphasized the importance of this regulatory approval in France, considering it a crucial moment in the broader efforts of the exchange’s European expansion.

Gemini’s expansion into France aligns with a broader trend among major American companies specializing in crypto, which are seeking opportunities in the European Union due to increased regulatory scrutiny in the United States, particularly from the Securities and Exchange Commission (SEC).

The move comes in the wake of regulatory challenges faced by Gemini and other US crypto entities, such as the SEC’s charges against Gemini and cryptocurrency lender Genesis for the sale of unregistered securities related to Gemini Earn, a high-yield savings product.

Gemini is actively contesting these accusations.

Gemini’s decision to establish its European headquarters in Ireland in May 2023 underscores its commitment to the European market.

This move reflects the strategic choices made by other major US cryptocurrency exchanges such as Coinbase, which has designated Ireland as its main regulatory hub within the EU.

The European regulatory landscape, as highlighted by Gemini leaders during a visit last year, shows both strong support for the sector and a pressing need for regulatory clarity.

Reference has been made to the EU regulation on crypto asset markets (MiCA), a reference regulation that allows crypto companies to use a license in an EU country as a passport to operate throughout the Union.

Gemini and European Union: a proactive approach to the regulatory landscape

Gemini’s proactive approach to expansion in the EU coincides with the broader context of the evolution of cryptocurrency regulations. In the United States, recent developments such as the SEC’s approval of bitcoin spot Exchange-Traded Funds (ETFs) indicate a gradual acceptance of certain elements of cryptocurrencies within traditional financial frameworks.

This move followed years of regulatory resistance from the SEC, motivated by fears of market manipulation in unregulated cryptocurrency markets.

Although the United States has not yet seen federal regulation of cryptocurrencies, the evolving landscape indicates a change in regulatory stance.

Several bills are currently under examination by the Chamber of Representatives, as evidence of a growing recognition of the importance of regulatory frameworks for the cryptocurrency sector.

The expansion of Gemini in France represents a strategic response to evolving regulatory dynamics, positioning the exchange to take advantage of opportunities offered by the European market.

Approval as a VASP in France allows Gemini to offer its complete suite of services to both retail and institutional clients, marking a significant step forward in the company’s mission to provide accessible and regulated cryptocurrency services globally.

Gemini customers in France will soon have access to a wide range of features, including the ability to trade over 70 cryptocurrencies through the Gemini website and mobile application.

In addition, users will be able to benefit from the advanced features offered by the ActiveTrader platform, for those seeking a more sophisticated trading experience.

Institutional clients, a crucial segment for Gemini, will have access to Gemini eOTC, the electronic over-the-counter trading solution.

This offer reflects Gemini’s commitment to providing tailored solutions for institutional investors seeking efficient and secure ways to enter the cryptocurrency market.

The European headquarters of the Gemini crypto exchange in Ireland

The choice of Ireland as the European headquarters for Gemini aligns with the broader trend of cryptocurrency companies choosing strategic locations within the EU.

The decision is not only a response to the regulatory landscape, but positions Gemini to capitalize on the advantages of MiCa in the crypto markets.

The regulatory framework established by MiCA allows companies like Gemini to operate seamlessly in all EU member states. Additionally, it streamlines the authorization process and promotes a more cohesive regulatory environment.

The transfer to Ireland echoes the decisions of other major US cryptocurrency exchanges, such as Coinbase, which have recognized the importance of establishing a strong regulatory presence in the EU.

These exchanges are strategically positioning themselves to navigate the evolving global regulatory landscape, providing users with a reliable and compliant platform.

The expansion of Gemini in Europe is emblematic. It shows the broader trend of cryptocurrency companies diversifying their geographic presence in response to regulatory challenges in their own countries.

The European regulatory framework, combined with initiatives such as MiCA, represents a unique opportunity for forward-thinking companies to establish themselves as leaders in the global cryptocurrency space.

Conclusions

As Gemini prepares to launch its services in France, the company remains actively engaged in addressing regulatory challenges in its domestic market, particularly the SEC’s allegations regarding Gemini Earn.

The outcome of these challenges will undoubtedly have implications for the broader cryptocurrency sector and for how regulatory bodies perceive and interact with cryptocurrency platforms.

In conclusion, the approval of Gemini as a VASP in France and its subsequent expansion into the European market represent a strategic move to navigate the evolving regulatory landscape.

With the continuous maturation of the cryptocurrency sector, proactive measures to comply with regulations and expand into new markets are becoming increasingly crucial for the success and long-term sustainability of major players like Gemini.